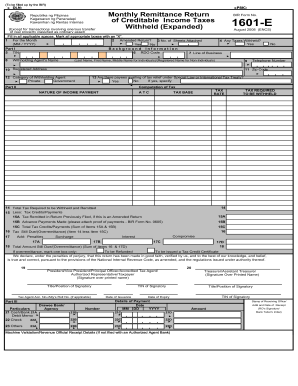

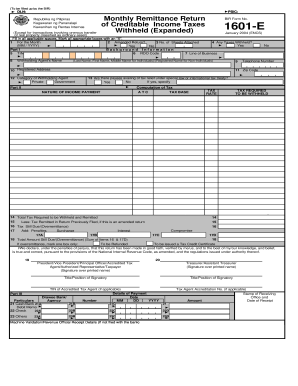

Who Must File BIR Form 1601-E?

BIR Form 1601-E is called the Monthly Remittance Return of Creditable Income Taxes Withheld. It is an expanded version. It was designed by the Bureau of Internal Revenue. Furthermore, it must be completed and submitted by all withholding agents who may be either individual or non-individual. Submit it in triplicate.

What is BIR Form 1601-E for?

BIR Form 1601-E is created for deducting and withholding taxes on income payments that are subject to creditable or expanded withholding taxes.

When is BIR Form 1601-E Due?

This document must be submitted on the 10th day of the month following the one in which you have made withholding except for the taxes that were withheld for December. The taxes withheld in December must be reported on or before January 15th of the next year. If an applicant fails to report on time, get ready to pay a penalty. The penalty rates are indicated on the back of the form.

Is BIR Form 1601-E Accompanied by Other Forms?

You do not have to attach any other additional documents to this tax form.

What Information do I Include in BIR Form 1601-E?

The following information must be provided in the form:

-

Month of payment;

-

Taxpayer identification number;

-

Line of business;

-

DO code;

-

Agent’s name and category;

-

Registered address;

-

Nature of income payment;

-

Tax base and rate;

-

Details of payment.

Where do I Send BIR Form 1601-E?

When the form is fully completed, you must send it to the Revenue District Office (Authorized Agent Bank). Make sure all lines are filled out properly.