Get the free EVIDENCE OF PROPERTY INSURANCE - NH.gov

Show details

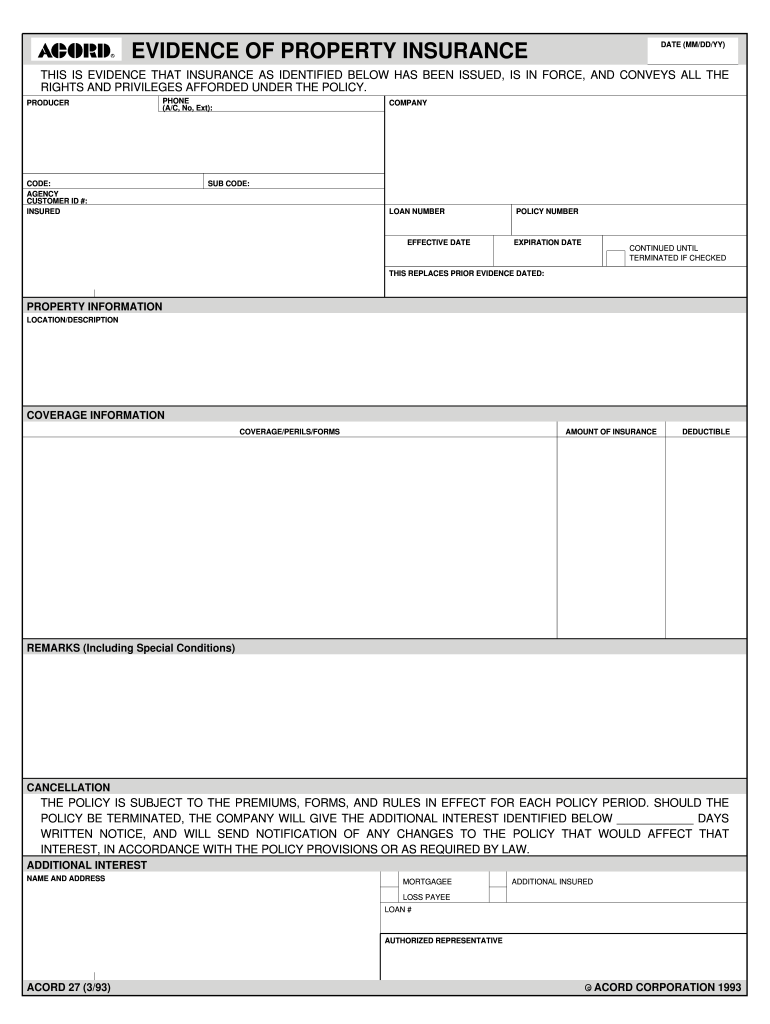

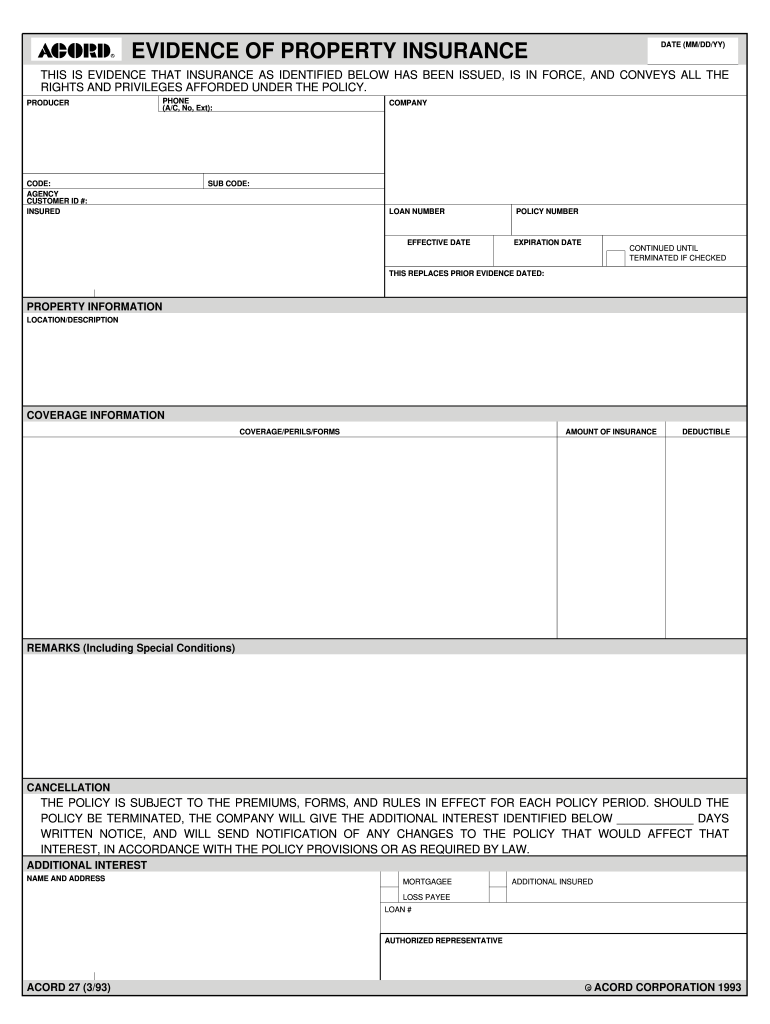

ADDITIONAL INSURED. MORTGAGEE. REMARKS (Including Special Conditions). EVIDENCE OF PROPERTY INSURANCE. DATE (MM/DD/YYY) ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign evidence of property insurance

Edit your evidence of property insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your evidence of property insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit evidence of property insurance online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit evidence of property insurance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out evidence of property insurance

How to fill out evidence of property insurance?

01

Find the relevant form: Look for the specific form provided by your insurance company or the organization that requires proof of property insurance. This form may be available online or can be obtained from your insurance agent or company.

02

Provide personal information: Fill out your personal details accurately, including your full name, address, contact information, and any other required identification information. This step helps establish your ownership or liability on the property.

03

Describe the property: Provide a detailed description of the property that requires insurance. This typically includes the full address, property type (residential, commercial, etc.), size or square footage, and any unique characteristics or features.

04

Specify coverage details: Indicate the coverage amount and type of insurance you have obtained for the property. This includes listing the insurance company, policy number, effective dates, and any relevant endorsements or additional coverage options.

05

Attach supporting documents: If the evidence of property insurance form requires additional documentation, make sure to attach them as requested. These may include a copy of the insurance policy, a certificate of insurance, or any other relevant paperwork.

06

Review and sign: Carefully review all the information you have provided on the evidence of property insurance form. Double-check for accuracy and completeness. Once satisfied, sign and date the form, acknowledging that the information provided is true and accurate to the best of your knowledge.

Who needs evidence of property insurance?

01

Landlords: Landlords often require tenants to provide evidence of property insurance as part of their lease agreement. This helps protect the landlord's investment in the property and provides liability coverage for potential damages caused by the tenants.

02

Lenders: When purchasing a property with a mortgage, lenders usually require borrowers to provide evidence of property insurance. This protects the bank or financial institution's interest in the property, ensuring it is covered in case of damage or loss.

03

Homeowners: Homeowners may need evidence of property insurance to comply with local regulations or homeowner association requirements. It provides peace of mind knowing that their property is adequately protected against potential risks and damages.

04

Business owners: Business owners, especially those operating from commercial properties, often require evidence of property insurance to secure business licenses, contracts, or meet legal requirements. It safeguards the business assets, equipment, and premises, offering financial protection in the event of an unforeseen incident.

05

Property managers: Property management companies or professionals may need evidence of property insurance to ensure that the properties they oversee are adequately covered. This protects both the property owner and the property manager from potential liability claims.

Remember, the specific requirements for evidence of property insurance may vary depending on the jurisdiction, type of property, and the purpose for which it is needed. It is advisable to consult with your insurance agent or the requesting party for any specific instructions or additional information required.

Fill

form

: Try Risk Free

People Also Ask about

What is an 27 form used for?

The 27 form is more commonly knowns as the Evidence of Property Insurance. It is a single-page form used to provide proof of property coverage to another party who has interest in a residential property, commercial property and/or the contents of the property.

What is an evidence of property insurance?

For residential properties and small commercial properties, evidence of insurance is conveyed using an insurance form called 27. This form can also include mortgage information.

What is the difference between 28 and 27?

However, if the receiver of the form has a verifiable insurable interest in the policy, such as a mortgagee or lender, use form 27. When the property is insured under a large limit commercial lines policy and the lender requires specific detailed coverage information, use form 28.

What are statements made by an applicant for property insurance?

Representations are the statements made by the insured on the insurance application.

What is the form evidence of insurance?

The certificate serves as proof that a business has the type of insurance coverage to protect against against claims of: Property damage – If a vendor or sub-contractor you hired to do work for you causes damage to a client's property, you may have to pay for repairs.

What is an insurance 28?

The Association for Cooperative Operations Research and Development () created form insurance certificates, specifically an 28 (property) and an 25 (general liability). These certificates evidence your insurance coverage and can be requested from your insurance provider.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in evidence of property insurance?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your evidence of property insurance to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit evidence of property insurance in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your evidence of property insurance, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I complete evidence of property insurance on an Android device?

On Android, use the pdfFiller mobile app to finish your evidence of property insurance. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is evidence of property insurance?

Evidence of property insurance is a document proving that a property is covered by an insurance policy, detailing the types of coverage and the limits of insurance.

Who is required to file evidence of property insurance?

Property owners, landlords, and sometimes tenants are required to file evidence of property insurance, especially when requested by lenders, landlords, or other entities.

How to fill out evidence of property insurance?

To fill out evidence of property insurance, provide the name of the insured, the property address, the policy number, the effective dates of the policy, and details regarding the coverage provided.

What is the purpose of evidence of property insurance?

The purpose of evidence of property insurance is to verify that insurance coverage is in place to protect property against risks, and to meet contractual or legal obligations.

What information must be reported on evidence of property insurance?

Information that must be reported includes the name of the insured, the property address, the insurance company, the policy number, coverage limits, and the effective and expiration dates of the policy.

Fill out your evidence of property insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Evidence Of Property Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.