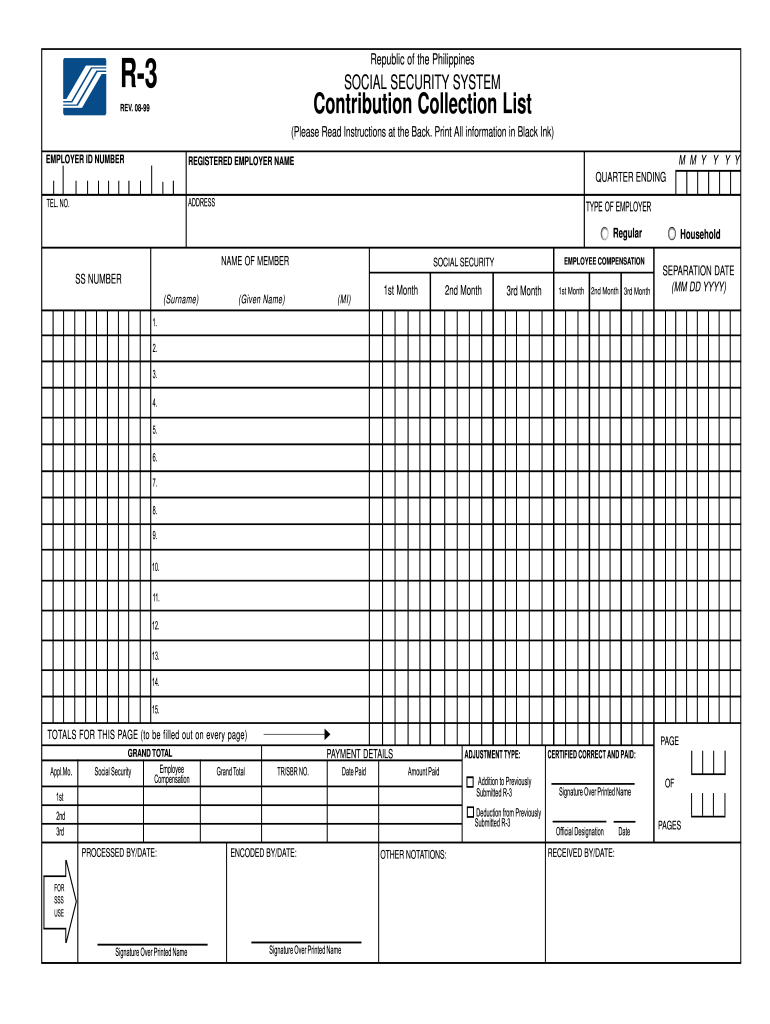

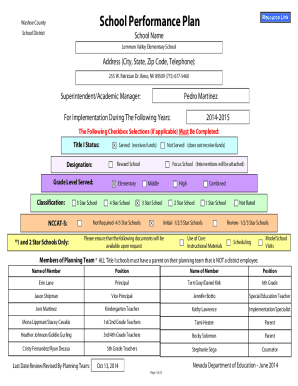

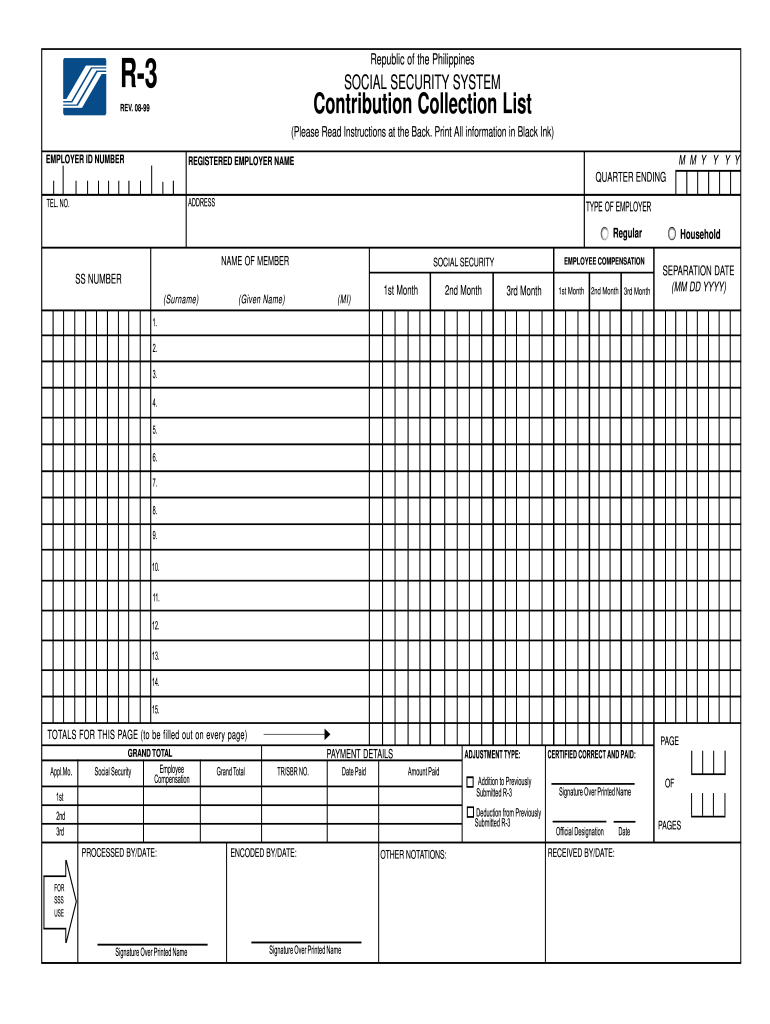

Get the free sss r3 form excel format

Get, Create, Make and Sign

How to edit sss r3 form excel format online

How to fill out sss r3 form excel

How to fill out sss r3 form excel:

Who needs sss r3 form excel:

Video instructions and help with filling out and completing sss r3 form excel format

Instructions and Help about sss loan collection list form excel

Music so okay guys and another day and another tutorial on my channel yeah Music, so Katakana anaconda NASA flocks YouTube channel was maddening reason I am rounding reason, and so we will go straight to the tutorial anyways okay I will show you guys how to download where to download the SSS file generator and how to troubleshoot it okay cause a few clients of mine having problem using this program from processors they encountered this when after downloading this bug when they run the program nothing happens, so I will show you guys how to troubleshoot it, but first we will show you where to download okay so here guys I will put the link where to download of course in SSS an official website, but I will look at the complete link so that it will direct you to the download page okay so now as you can see here you will click this download heart rate file generator yeah you pick a point, and you have to download this file okay, so it's done loading like but my god I have my clients also are complaining the file it takes time to download so looking again I have a download file of this program I will cancel my laptop to this computer okay just for a while it's a series I have one minute and then two minutes and then five minutes what the hell anyway I have a pile I'm going to transfer to my two this desktop and I will show you guys just a little okay guys already transferred the five here because I will not wait for my download with to take so long I'm going to close this anyways I just show you where to download okay I will put that in my link description the exact download page of this file okay, so I'm going to close this one anyways yeah canceled out no problem here oh my god okay our trip I'll just underscore CS dope that's the file okay, so I'm going to click this file in the click run Music and then yes of course you have to upset click accept and — destination folder you're going to take both of these ok it's on C Drive and XSS are three file generator folders that's the folder name so big installed ok it's already installed in our system so box on unlocking guys so click this PC shortcut whether I am using Windows 10 on my desktop so click drugs attention guys eaten I am guys SSS particle generator so open this file and then you have to click this installs a free fall generic on a kick the ball topically and you no problem at all you need a go pinyin program so again out double click again ax so Literal gun that's the problem or a few clients of mine while running this SSS file generator okay so when they click this double click this file Demo bus line you come on top and then the exit and then Alana, so I was going to show you guys and how to troubleshoot this one the problem here is we haven't installed Java and your system already have installed Java, but it's not updated, so it's a solution and guys you have to download the Java from program and the official website or even on show I was going to post it on the link description below come...

Fill sss loan collection report excel format : Try Risk Free

People Also Ask about sss r3 form excel format

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your sss r3 form excel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.