Get the free 760 Flat Form 09 06 12.indd - Virginia Department of Taxation - tax virginia

Show details

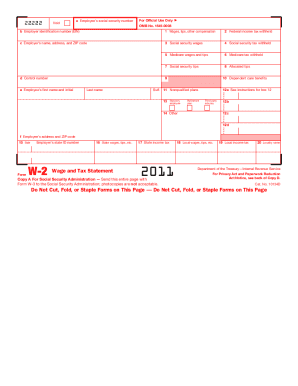

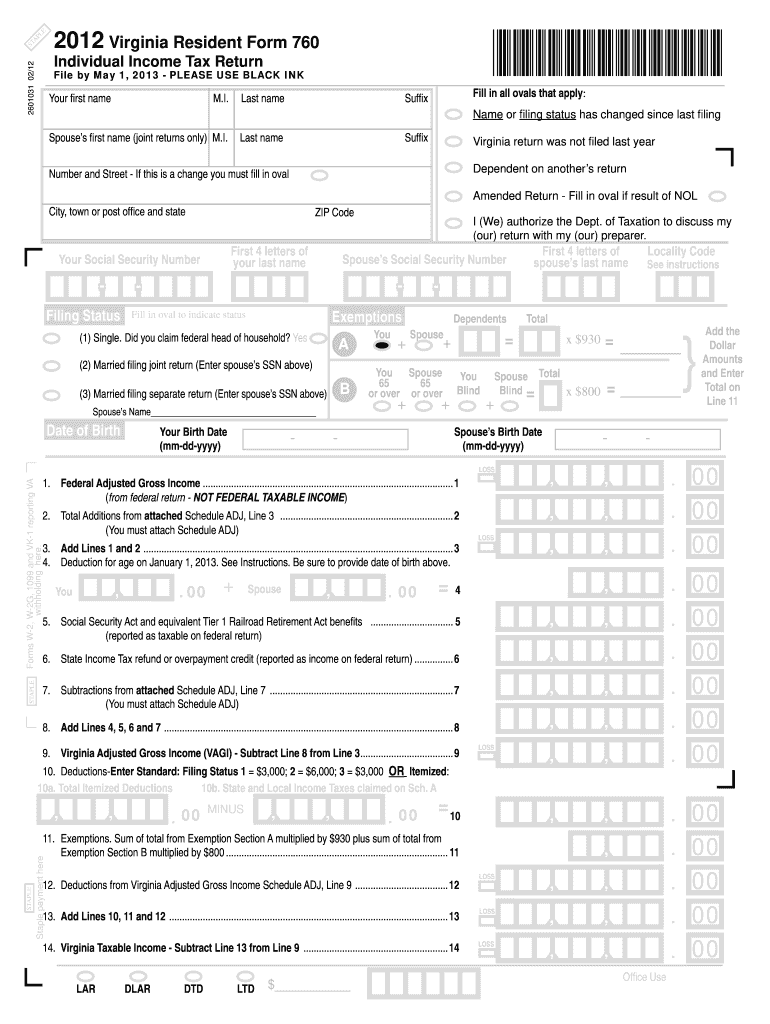

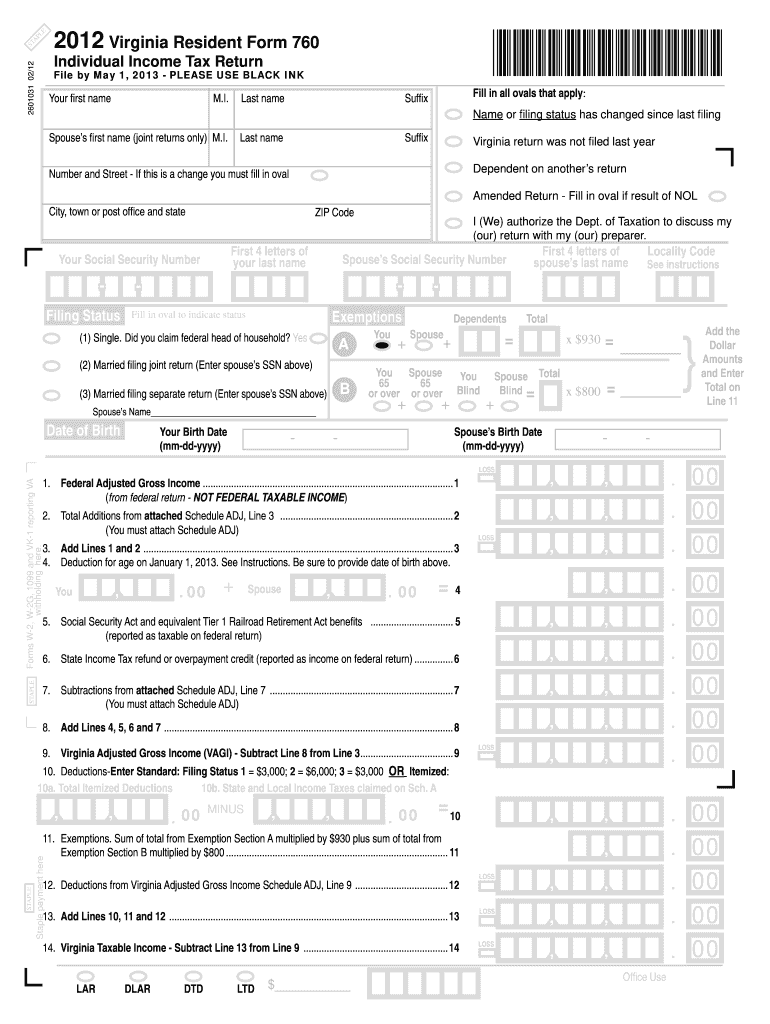

PL E ST A 2012 Virginia Resident Form 760 2601031 02/12 Individual Income Tax Return File by May 1 2013 - PLEASE USE BLACK INK Your rst name M. I. Last name Fill in all ovals that apply Suf x Name or ling status has changed since last ling Spouse s rst name joint returns only M. I. Virginia return was not led last year Dependent on another s return Number and Street - If this is a change you must ll in oval Amended Return - Fill in oval if result of NOL City town or post of ce and...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 760 flat form 09 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 760 flat form 09 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 760 flat form 09 online

Follow the steps below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 760 flat form 09. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

How to fill out 760 flat form 09

To fill out the 760 flat form 09, follow these steps:

01

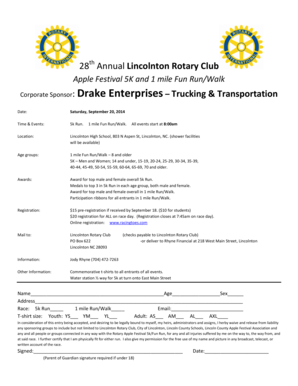

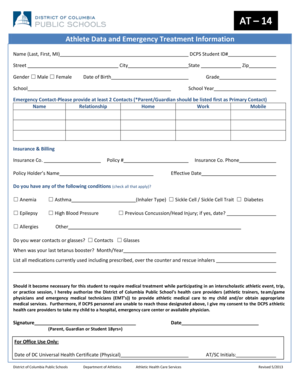

Gather the necessary information: Collect all the required details such as your personal information, income sources, deductions, and any applicable tax credits. This may include documents like W-2 forms, 1099 forms, and receipts.

02

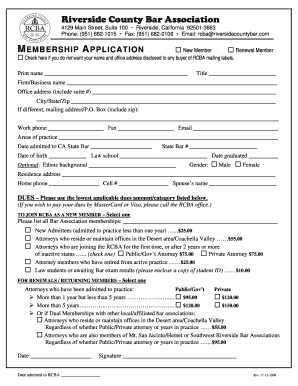

Start with the personal information section: Fill in your name, social security number, address, and other relevant details as required by the form.

03

Report your income: List all your income sources, including wages, salaries, dividends, and any other taxable income. Be sure to include all relevant documentation and accurately report each amount.

04

Deductions and credits: Determine if you qualify for any deductions or credits and report them in the appropriate sections of the form. This may include deductions for student loan interest, self-employment expenses, or child tax credits. Review the instructions accompanying the form to ensure you are claiming the correct deductions and credits.

05

Calculate your tax liability: Use the information provided on the form to determine your tax liability. Follow the instructions on the form or consult a tax professional if you need assistance with the calculations.

06

Sign and date the form: Once you have completed all the necessary sections, sign and date the form to attest to the accuracy of the information provided.

Anyone who meets the specific criteria for filing taxes and has income that is subject to taxes may need to complete the 760 flat form 09. The form is commonly used by individuals or households who do not qualify for a simpler tax form, such as the 1040EZ. It is important to review the tax filing requirements set by the relevant tax authority to determine if you need to file using this form.

Fill form : Try Risk Free

People Also Ask about 760 flat form 09

What is a 760 Virginia return?

What is a VA 760 form?

What does return is amended return mean?

What is Virginia tax return type 763?

What is 760 760PY 763?

What is a 760 760PY or 763 Virginia return?

What do you attach to VA 760?

What is the 760IP automatic extension payment?

What do I need to attach to my Virginia tax return?

How do I assemble my tax return?

What is VA tax form 760?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 760 flat form 09?

760 flat form 09 is a specific tax form used for reporting income and expenses for certain individuals or businesses.

Who is required to file 760 flat form 09?

Individuals or businesses meeting certain criteria, such as earning a certain amount of income or having certain types of expenses, are required to file 760 flat form 09.

How to fill out 760 flat form 09?

To fill out 760 flat form 09, you will need to provide information about your income, expenses, and any deductions or credits you may be eligible for.

What is the purpose of 760 flat form 09?

The purpose of 760 flat form 09 is to accurately report financial information to the relevant tax authority.

What information must be reported on 760 flat form 09?

On 760 flat form 09, you must report details such as income sources, expenses, deductions, and tax credits.

When is the deadline to file 760 flat form 09 in 2023?

The deadline to file 760 flat form 09 in 2023 is typically April 15th, but it may vary depending on the specific tax year.

What is the penalty for the late filing of 760 flat form 09?

The penalty for late filing of 760 flat form 09 can vary depending on the jurisdiction, but it may include fines or interest charges on any unpaid taxes.

How do I modify my 760 flat form 09 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your 760 flat form 09 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit 760 flat form 09 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your 760 flat form 09 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How can I fill out 760 flat form 09 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your 760 flat form 09, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your 760 flat form 09 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.