Get the free W-2 and 1099 price list - Civic Systems

Show details

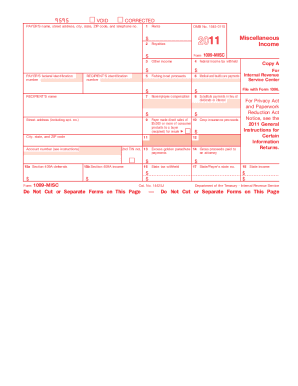

QUICK REFERENCE GUIDE for 2011-2012 1099 Information Returns Table of Contents What's New? Section 1 I 1099 Information Reporting 1 WHAT IS A 1099..........................................................................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your w-2 and 1099 price form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w-2 and 1099 price form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit w-2 and 1099 price online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit w-2 and 1099 price. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out w-2 and 1099 price

How to fill out w-2 and 1099 forms:

01

Gather necessary information: To fill out a w-2 form, you will need to have the employee's Social Security number, address, and earnings information. For a 1099 form, you will need the contractor's taxpayer identification number (TIN) or Social Security number, address, and payment details.

02

Obtain the correct forms: W-2 forms can be obtained from the Internal Revenue Service (IRS) or your payroll provider. 1099 forms can be obtained from the IRS or office supply stores. You can also use online platforms that provide electronic filing services.

03

Fill out employee or contractor information: On the w-2 form, you will enter the employee's personal information and their earnings for the year. On the 1099 form, you will enter the contractor's personal information and the total amount you paid them during the year.

04

Calculate taxes and deductions: Based on the earnings provided, you will need to calculate the applicable taxes and deductions. This includes federal income tax, Social Security tax, Medicare tax, and any other withholdings.

05

Complete the employer's section: On the w-2 form, you will need to provide your employer identification number (EIN) and other relevant details. On the 1099 form, you will enter your information as the payer.

06

Distribute copies: Once you have filled out the forms correctly, you will need to distribute copies to the employee or contractor, as well as send copies to the IRS.

Who needs w-2 and 1099 forms?

01

W-2 forms: Any employer who pays wages to an employee needs to provide a w-2 form. This includes businesses, organizations, and individuals who have employees working for them. W-2 forms are used to report an employee's wages and taxes withheld.

02

1099 forms: Any individual or business who pays non-employee compensation needs to provide a 1099 form. This includes individuals who hire independent contractors, freelancers, or self-employed individuals. 1099 forms are used to report income paid to contractors and freelancers, who are responsible for their own taxes.

In summary, filling out w-2 and 1099 forms requires gathering necessary information, obtaining the correct forms, entering employee or contractor details, calculating taxes and deductions, completing the employer's section, and distributing copies. W-2 forms are required by employers who have employees, while 1099 forms are required by individuals or businesses who pay non-employee compensation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is w-2 and 1099 price?

Both the W-2 and 1099 forms are used to report income to the IRS for tax purposes.

Who is required to file w-2 and 1099 price?

Employers are required to file W-2 forms for employees, while businesses must file 1099 forms for independent contractors.

How to fill out w-2 and 1099 price?

You can fill out W-2 and 1099 forms manually or by using software like QuickBooks or online tax services.

What is the purpose of w-2 and 1099 price?

The purpose of W-2 and 1099 forms is to report income earned by employees and independent contractors to the IRS.

What information must be reported on w-2 and 1099 price?

Both forms require information such as name, address, Social Security number, and total wages earned during the tax year.

When is the deadline to file w-2 and 1099 price in 2023?

The deadline to file W-2 and 1099 forms in 2023 is January 31st.

What is the penalty for the late filing of w-2 and 1099 price?

The penalty for late filing of W-2 and 1099 forms can vary, but can be up to $100 per form if not filed within 30 days of the deadline.

How do I edit w-2 and 1099 price online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your w-2 and 1099 price to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the w-2 and 1099 price electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your w-2 and 1099 price and you'll be done in minutes.

How do I fill out w-2 and 1099 price using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign w-2 and 1099 price and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your w-2 and 1099 price online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.