Get the free ey form a13

Show details

Ernst & Young IFRS Core Tools October 2011 International GAAP Disclosure Checklist Based on International Financial Reporting Standards in issue at 30 September 2011 Effective for entities with a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ey form a13 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ey form a13 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ey form a13 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ey gaap checklist form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

How to fill out ey form a13

How to fill out ey form a13:

01

Start by carefully reading the instructions provided on the form. Make sure you understand the purpose and requirements of filling out the form correctly.

02

Gather all the necessary information and documents that are required to complete the form. This may include personal details, financial information, or any supporting documentation.

03

Fill out the form accurately and legibly, using black or blue ink. Take your time to ensure that you provide all the required information, and double-check for any errors or omissions.

04

If there are any sections or questions that you are unsure about, seek clarification from the relevant authorities or consult a professional for guidance.

05

Review the completed form to make sure all information is accurate and complete. Ensure that you have signed and dated the form where required.

06

Make copies of the filled-out form for your records before submitting it. This will serve as a reference in case of any future inquiries or disputes.

07

Submit the form to the appropriate recipient as instructed. This may involve mailing it, hand-delivering it, or submitting it online through a designated portal or website.

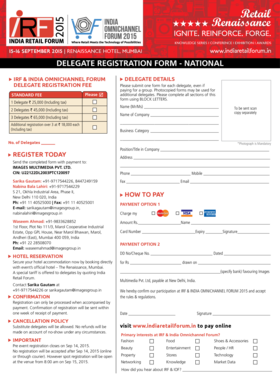

Who needs ey form a13:

01

Individuals who are required to report certain financial transactions or taxable activities to the tax authorities.

02

Businesses or organizations that need to provide financial information or disclose specific details for regulatory or compliance purposes.

03

Professionals or service providers who are obligated to report any relevant client or customer information for anti-money laundering or know-your-customer procedures.

04

Any entity or individual identified by the relevant authorities as being subject to the requirements of ey form a13.

Note: The specific criteria for who needs ey form a13 may vary depending on the jurisdiction and the purpose of the form. It is important to refer to the instructions or consult with a professional to determine if you are required to fill out this particular form.

Fill us gaap disclosure checklist : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file ey form a13?

The form A13 is specific to the Canadian Customs and is required to be filed by individuals or businesses who wish to export or transfer goods out of Canada temporarily. This includes items such as tools, equipment, or other goods that are intended to be used outside of Canada for a specific purpose or duration.

How to fill out ey form a13?

To properly fill out the EY Form A13, follow the steps below:

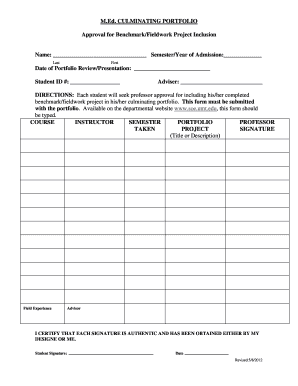

1. Start by providing your personal details at the top of the form, including your name, address, phone number, and email address.

2. Indicate your immigration category in Part A, such as immigrant, work permit holder, student, or other.

3. In Part B, fill in your passport details, including the passport number, date of issue, and expiration date.

4. Specify whether you are applying as a principal applicant or a family member of a principal applicant in Part C.

5. Part D requires you to provide information about your immigration history, such as if you have ever been denied a visa or removed from any country, including Canada.

6. In Part E, indicate whether you have any medical, psychological, or social conditions that may affect your stay in Canada.

7. Complete Part F by providing your employment history, including your current and previous occupations, employer names, start and end dates, and job descriptions.

8. If applicable, fill out Part G with your educational background, including the names of schools or institutions attended, dates of attendance, and degrees or certificates obtained.

9. In Part H, declare if you have ever been charged, convicted, or placed on probation for any criminal offense in any country.

10. Next, indicate your financial information in Part I, including your total monthly income, expenses, assets, and liabilities.

11. Provide details about any family members or dependents accompanying you to Canada in Part J, such as their names, ages, and relationship to you.

12. Sign and date the form at the bottom, confirming that all the information provided is true and accurate.

Remember to review your completed form thoroughly to ensure accuracy before submitting it.

What is the purpose of ey form a13?

The purpose of Form A13, also known as the "Application for Remand Order," is to request a remand order from a court. A remand order enables the Crown Prosecution Service (CPS) to detain a suspect for further investigation. This form is typically used in cases where the police require more time to gather evidence or complete their investigation before deciding whether to charge the suspect or release them.

What information must be reported on ey form a13?

Form A13 is used to report information on transactions and other activities of a foreign affiliate of a Canadian resident for tax purposes. The form is used to report details about the affiliate's financial activities to the Canada Revenue Agency (CRA). The specific information that must be reported on Form A13 includes:

1. Identification of the taxpayer: This includes the name, address, and taxpayer identification number of the Canadian resident who is filing the form.

2. Identification of the foreign affiliate: This includes the name, address, and taxpayer identification number of the foreign affiliate.

3. Jurisdiction of the foreign affiliate: This refers to the country or jurisdiction where the foreign affiliate operates.

4. Fiscal period: The fiscal period for which the report is being filed must be indicated.

5. Functional currency: The reporting currency used by the foreign affiliate.

6. Detailed financial information: This includes details about the foreign affiliate's income, expenses, assets, liabilities, and equity. The information may include balance sheet, income statement, statement of changes in equity, and cash flow statement.

7. Related party transactions: Any transactions between the Canadian resident and the foreign affiliate, as well as transactions between the foreign affiliate and other related parties, must be reported.

8. Transfer pricing information: If applicable, details about transfer pricing arrangements between the Canadian resident and the foreign affiliate should be disclosed.

9. Business activities: A description of the foreign affiliate's business activities is required.

10. Taxpayer certification: The taxpayer must sign and certify the form, confirming that the information provided is true, accurate, and complete.

It is important to note that the specific reporting requirements on Form A13 may vary depending on the circumstances and the nature of the foreign affiliate's activities. It is recommended to refer to the official instructions provided by the CRA for detailed guidance on completing the form accurately.

What is the penalty for the late filing of ey form a13?

The penalty for the late filing of an EY form A13 may vary depending on the jurisdiction and specific circumstances. However, generally, late filing of tax forms can result in penalties such as late filing fees, interest charges on the outstanding tax amount, and potential audit and compliance measures from the tax authorities. It is advisable to consult with a tax professional or refer to the specific regulations of the relevant taxing authority to determine the exact penalties for late filing of EY form A13.

How can I modify ey form a13 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your ey gaap checklist form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make edits in ey disclosure checklist without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing gaap compliance checklist and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my ey us gaap disclosure checklist 2021 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your ey disclosure checklist 2021 form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your ey form a13 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ey Disclosure Checklist is not the form you're looking for?Search for another form here.

Keywords relevant to ey disclosure checklist 2019 form

Related to ey gaap disclosure checklist 2021

If you believe that this page should be taken down, please follow our DMCA take down process

here

.