Get the free HELPFUL TAX TIPS FROM OPM - Office of Personnel Management - gao

Show details

GAO United States General Accounting Washington. D.C. 20548 General Government Division 1 Office I B282340 May 3,1999, The Honorable AMO Houghton Chairman, Subcommittee on Oversight Committee on Ways

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your helpful tax tips from form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your helpful tax tips from form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit helpful tax tips from online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit helpful tax tips from. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out helpful tax tips from

How to fill out helpful tax tips from:

01

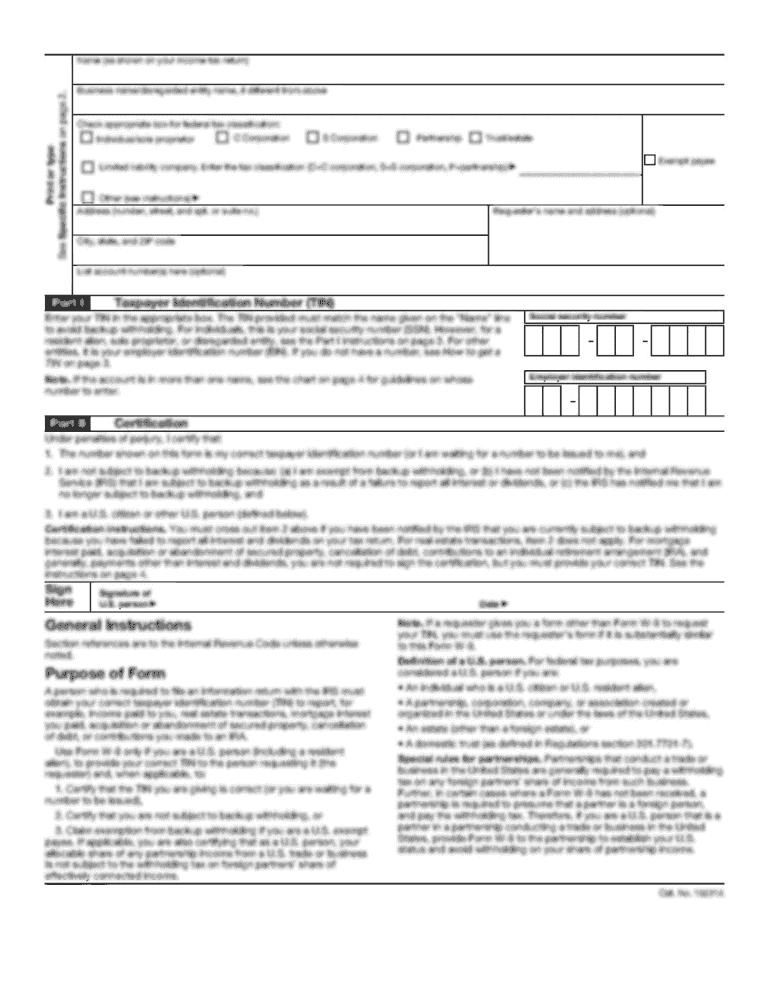

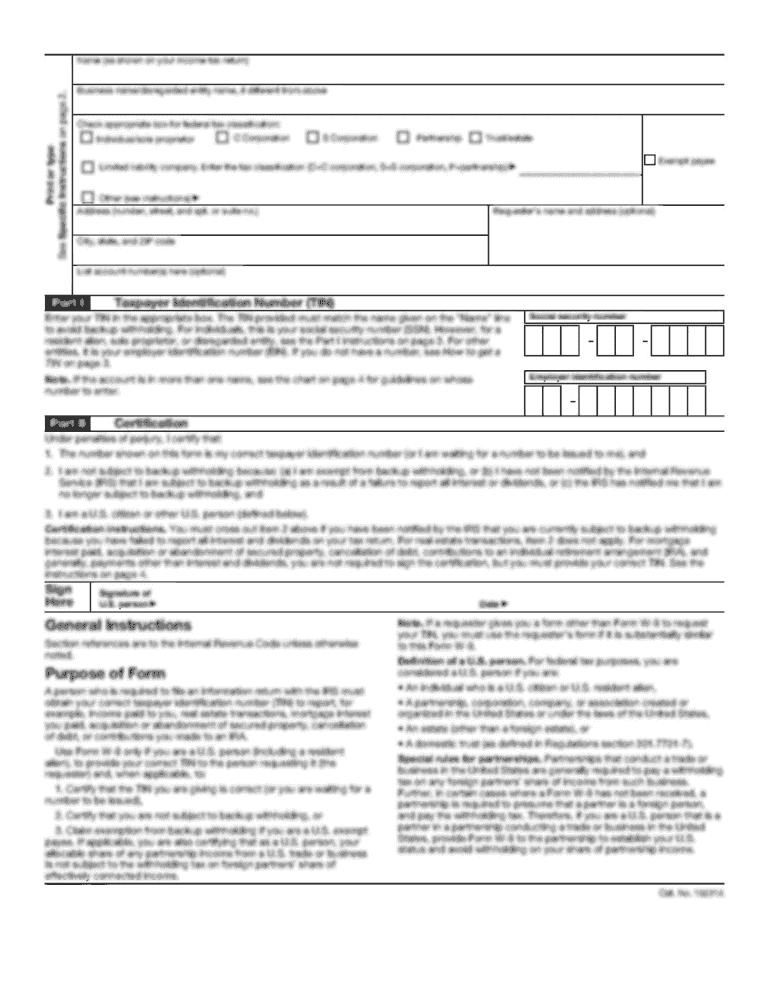

Gather all necessary documents: Before starting to fill out tax forms, make sure you have all the essential documents, such as W-2s, 1099s, and receipts for deductions, organized and easily accessible.

02

Understand the different forms: Familiarize yourself with the different tax forms you might need to fill out, such as the 1040, Schedule C, or Schedule A. Each form serves a specific purpose, so understanding which ones are applicable to your situation will help you fill them out correctly.

03

Double-check your personal information: Ensure that your personal details, such as your name, address, and social security number, are accurately filled out on the forms. Any mistakes can result in delays or complications with your tax return.

04

Accurately report your income: Take the time to accurately report all sources of income, including wages, self-employment earnings, and investment profits. Use the appropriate sections on the tax forms to provide this information.

05

Claim eligible deductions and credits: Familiarize yourself with deductions and credits that you might be eligible for, such as education expenses, home office deductions, or dependent care credits. Ensure that you understand the specific criteria and guidelines for claiming these deductions and credits.

06

Organize records for itemized deductions: If you plan to itemize deductions, make sure you have proper records and receipts to support your claims. Common itemized deductions include mortgage interest, medical expenses, and charitable contributions.

07

Review for accuracy and completeness: Once you have filled out all the necessary forms, review them carefully for accuracy and completeness. Missing or incorrect information can lead to potential penalties or delays in processing your return.

Who needs helpful tax tips from?

01

Individuals with limited knowledge of tax rules and regulations: Tax codes can be complex and confusing, so individuals who are not well-versed in tax rules can benefit from helpful tax tips to ensure they fill out their tax forms accurately.

02

Self-employed individuals and small business owners: Self-employed individuals and small business owners often have unique tax considerations and deductions they can claim. Helpful tax tips can guide them in understanding their specific tax obligations and maximizing their deductions.

03

Individuals with complex financial situations: Those with complex financial situations, such as multiple streams of income, investments, or rental properties, may require additional guidance to navigate their tax forms accurately.

04

First-time or inexperienced taxpayers: Individuals who are filing their taxes for the first time or have limited experience may find helpful tax tips beneficial to ensure they complete their tax forms correctly and claim all eligible deductions.

05

Individuals undergoing significant life changes: Major life events, such as getting married, having a child, or buying a home, can impact an individual's tax situation. Helpful tax tips can assist individuals in understanding how these changes affect their tax obligations and potential deductions.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is helpful tax tips from?

Helpful tax tips typically come from financial experts, accountants, or tax professionals.

Who is required to file helpful tax tips from?

Anyone who earns income, whether through employment or other means, may benefit from filing helpful tax tips.

How to fill out helpful tax tips from?

To fill out helpful tax tips, individuals should gather all relevant financial documents and follow the instructions provided on the form.

What is the purpose of helpful tax tips from?

The purpose of helpful tax tips is to provide guidance on how to maximize deductions and credits, and minimize tax liability.

What information must be reported on helpful tax tips from?

Information such as income, expenses, deductions, and credits must be reported on helpful tax tips.

When is the deadline to file helpful tax tips from in 2023?

The deadline to file helpful tax tips in 2023 is typically April 15th, unless an extension is requested.

What is the penalty for the late filing of helpful tax tips from?

The penalty for late filing of helpful tax tips can vary depending on the amount owed, but may include interest charges and additional fees.

Can I sign the helpful tax tips from electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your helpful tax tips from in seconds.

How can I edit helpful tax tips from on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing helpful tax tips from.

Can I edit helpful tax tips from on an Android device?

You can edit, sign, and distribute helpful tax tips from on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your helpful tax tips from online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.