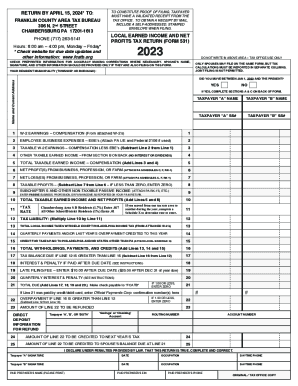

PA FCATB 531 - Franklin County 2012 free printable template

Show details

FRANKLIN COUNTY AREA TAX BUREAU 443 STANLEY AVE CHAMBERSBURG PA 17201-3600 717 263-5141 Website fcatb. This balance due must be paid in full when filing your return. Make checks payable to FCATB Franklin County Area Tax Bureau. LINE 15 If you were legally liable for and paid taxes on net profits and/or compensation to Philadelphia or any state other than Pennsylvania and the same net profits and/or compensation is also taxable on your local Franklin County Area Tax Bureau resident return you...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA FCATB 531 - Franklin County

Edit your PA FCATB 531 - Franklin County form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA FCATB 531 - Franklin County form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA FCATB 531 - Franklin County online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PA FCATB 531 - Franklin County. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA FCATB 531 - Franklin County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA FCATB 531 - Franklin County

How to fill out PA FCATB 531 - Franklin County

01

Obtain a copy of the PA FCATB 531 form from the Franklin County website or local government office.

02

Begin by filling out the personal information section, including your name, address, and contact information.

03

Provide any relevant case numbers or identifiers as required in the designated fields.

04

Clearly state the purpose of the form in the appropriate section.

05

Attach any necessary supporting documents that may be required based on the purpose stated.

06

Review the form for any errors or omissions before signing.

07

Sign and date the form at the bottom where indicated.

08

Submit the completed form to the appropriate office, either in person or through the specified mailing address.

Who needs PA FCATB 531 - Franklin County?

01

Individuals residing in Franklin County who need to file a petition or request related to legal or governmental matters.

02

Residents seeking to formalize requests concerning property or zoning issues.

03

Anyone needing to provide information for a court proceeding or administrative task specific to Franklin County.

Instructions and Help about PA FCATB 531 - Franklin County

Fill

form

: Try Risk Free

People Also Ask about

Do I have to declare tips Canada?

In Canada, the amount that workers earn in tips and gratuities is considered income that they must declare when they file their tax and benefit returns.

Who has to file a partnership tax return?

You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Are tips under $20 a month taxable?

Employees who receive tips of less than $20 in a calendar month aren't required to report their tips to you but must report these amounts as income on their tax returns and pay taxes, if any.

Does a partnership need to file a tax return Canada?

A partnership by itself does not pay income tax on its operating results and does not file an annual income tax return. Instead, each partner includes a share of the partnership income or loss on a personal, corporate, or trust income tax return.

Who has to file a partnership information return?

Who has to file a partnership information return? Under subsection 229(1) of the regulations, all partnerships that carry on business in Canada or are Canadian partnerships or specified investment flow‑through (SIFT) partnerships must file a partnership information return.

How do you prove tips?

Pay stubs, bank statements, a recent tax return, a letter from your employer on company letterhead stating how much you were paid, or a combination of these might be used to demonstrate your income.

Do I have to report my tips to the IRS?

Reporting tips on individual income tax return Any tips that the employee didn't report to the employer must be reported separately on Form 4137, Social Security and Medicare Tax on Unreported Tip Income, to include as additional wages with their tax return.

Do partnerships have to file?

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

What is IRS Section 531?

Accumulated Earnings Tax (IRC 531) The purpose of the accumulated earnings tax is to prevent a corporation from accumulating its earnings and profits beyond the reasonable needs of the business for the purpose of avoiding income taxes on its stockholders.

What is a 531 form?

IRS Publication 531 is a document that explains how taxable tips are to be reported to the government. Employees must pay federal income tax on all tips and Social Security and Medicare tax on most tips, regardless of how the tips are received.

When must a partnership file its return?

The partnership tax return is generally due by the 15th day of the third month following the end of the tax year. See the Instructions for Form 1065, U.S. Return of Partnership Income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my PA FCATB 531 - Franklin County in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign PA FCATB 531 - Franklin County and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete PA FCATB 531 - Franklin County online?

With pdfFiller, you may easily complete and sign PA FCATB 531 - Franklin County online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I edit PA FCATB 531 - Franklin County on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing PA FCATB 531 - Franklin County, you can start right away.

What is PA FCATB 531 - Franklin County?

PA FCATB 531 is a form used for property tax assessment appeals in Franklin County, Pennsylvania.

Who is required to file PA FCATB 531 - Franklin County?

Property owners who believe their property has been improperly assessed for tax purposes are required to file PA FCATB 531.

How to fill out PA FCATB 531 - Franklin County?

To fill out PA FCATB 531, provide personal information, property details, reasons for the appeal, and supporting evidence regarding the property assessment.

What is the purpose of PA FCATB 531 - Franklin County?

The purpose of PA FCATB 531 is to allow property owners to appeal their property tax assessments if they believe the assessed value is inaccurate.

What information must be reported on PA FCATB 531 - Franklin County?

Information required includes the owner's name, property address, assessment details, and reasons for the appeal along with any supporting documentation.

Fill out your PA FCATB 531 - Franklin County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA FCATB 531 - Franklin County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.