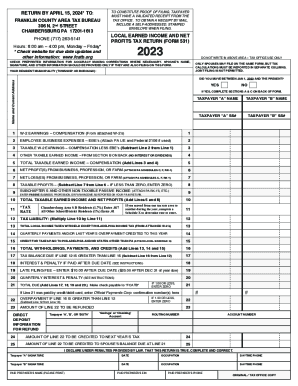

PA FCATB 531 - Franklin County 2013 free printable template

Show details

TO CONSTITUTE PROOF OF FILING, THE TAXPAYER MUST HAVE A VALIDATED RECEIPT FROM THE TAX OFFICE. TO OBTAIN A RECEIPT BY MAIL, INCLUDE A SELF ADDRESSED STAMPED ENVELOPE WHEN FILING. RETURN BY APRIL 15,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA FCATB 531 - Franklin County

Edit your PA FCATB 531 - Franklin County form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA FCATB 531 - Franklin County form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA FCATB 531 - Franklin County online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit PA FCATB 531 - Franklin County. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA FCATB 531 - Franklin County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA FCATB 531 - Franklin County

How to fill out PA FCATB 531 - Franklin County

01

Obtain a copy of the PA FCATB 531 form from the Franklin County website or office.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Fill out the personal information section, including your name, address, and contact information.

04

Provide details about your income, including employment information and any additional sources of income.

05

Complete any relevant sections related to your financial situation, such as assets and liabilities.

06

Double-check all entries for accuracy and ensure all required fields are completed.

07

Sign and date the form at the designated area.

08

Submit the completed form to the appropriate Franklin County office as outlined in the instructions.

Who needs PA FCATB 531 - Franklin County?

01

Individuals or families residing in Franklin County who are applying for financial assistance or seeking support services.

02

People who need to report changes in their financial situation for benefits eligibility.

03

Residents who are applying for housing assistance or similar programs through local agencies.

Instructions and Help about PA FCATB 531 - Franklin County

Fill

form

: Try Risk Free

People Also Ask about

Do I have to declare tips Canada?

In Canada, the amount that workers earn in tips and gratuities is considered income that they must declare when they file their tax and benefit returns.

Who has to file a partnership tax return?

You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Are tips under $20 a month taxable?

Employees who receive tips of less than $20 in a calendar month aren't required to report their tips to you but must report these amounts as income on their tax returns and pay taxes, if any.

Does a partnership need to file a tax return Canada?

A partnership by itself does not pay income tax on its operating results and does not file an annual income tax return. Instead, each partner includes a share of the partnership income or loss on a personal, corporate, or trust income tax return.

Who has to file a partnership information return?

Who has to file a partnership information return? Under subsection 229(1) of the regulations, all partnerships that carry on business in Canada or are Canadian partnerships or specified investment flow‑through (SIFT) partnerships must file a partnership information return.

How do you prove tips?

Pay stubs, bank statements, a recent tax return, a letter from your employer on company letterhead stating how much you were paid, or a combination of these might be used to demonstrate your income.

Do I have to report my tips to the IRS?

Reporting tips on individual income tax return Any tips that the employee didn't report to the employer must be reported separately on Form 4137, Social Security and Medicare Tax on Unreported Tip Income, to include as additional wages with their tax return.

Do partnerships have to file?

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

What is IRS Section 531?

Accumulated Earnings Tax (IRC 531) The purpose of the accumulated earnings tax is to prevent a corporation from accumulating its earnings and profits beyond the reasonable needs of the business for the purpose of avoiding income taxes on its stockholders.

What is a 531 form?

IRS Publication 531 is a document that explains how taxable tips are to be reported to the government. Employees must pay federal income tax on all tips and Social Security and Medicare tax on most tips, regardless of how the tips are received.

When must a partnership file its return?

The partnership tax return is generally due by the 15th day of the third month following the end of the tax year. See the Instructions for Form 1065, U.S. Return of Partnership Income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my PA FCATB 531 - Franklin County directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign PA FCATB 531 - Franklin County and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get PA FCATB 531 - Franklin County?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the PA FCATB 531 - Franklin County in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How can I fill out PA FCATB 531 - Franklin County on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your PA FCATB 531 - Franklin County by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is PA FCATB 531 - Franklin County?

PA FCATB 531 - Franklin County is a specific form used in Franklin County, Pennsylvania for property assessment appeals.

Who is required to file PA FCATB 531 - Franklin County?

Property owners who disagree with their property assessment values are required to file PA FCATB 531 - Franklin County.

How to fill out PA FCATB 531 - Franklin County?

To fill out PA FCATB 531, provide personal and property information, explain the reason for the appeal, and submit supporting documentation if necessary.

What is the purpose of PA FCATB 531 - Franklin County?

The purpose of PA FCATB 531 is to formally appeal property assessments in order to potentially lower the assessed value for tax purposes.

What information must be reported on PA FCATB 531 - Franklin County?

Information that must be reported includes the property owner's name, property address, assessment details, and the basis for the appeal.

Fill out your PA FCATB 531 - Franklin County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA FCATB 531 - Franklin County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.