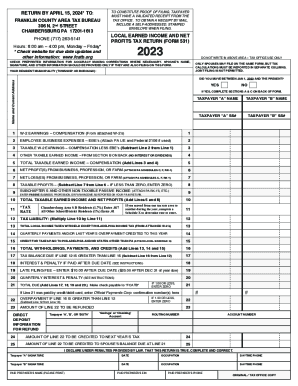

PA FCATB 531 - Franklin County 2022 free printable template

Show details

55 and one showing wages of 18 500. 73. On form 531 Line 1 you would enter 23 501. 5 000. 55 18 500. Place the last 4 digits of your social security number s on your check along with the notation Form 531 - Tax Year 20xx. See the back of Form 531 for a list of the MEMBER MUNICIPALITIES. Failure to file a return may subject you to a 500 fine. Form 531 Local Earned Income and Net Profits Tax Return has two reporting columns so that spouses may file on one return and still keep their incomes...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA FCATB 531 - Franklin County

Edit your PA FCATB 531 - Franklin County form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA FCATB 531 - Franklin County form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA FCATB 531 - Franklin County online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PA FCATB 531 - Franklin County. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA FCATB 531 - Franklin County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA FCATB 531 - Franklin County

How to fill out PA FCATB 531 - Franklin County

01

Obtain the PA FCATB 531 form from the Franklin County website or local office.

02

Read the instructions carefully to understand the information required.

03

Fill out your personal information at the top of the form, including your name, address, and contact details.

04

Complete the section regarding your financial information, including income, expenses, and any relevant assets.

05

Provide information about your household composition, including names and relationships of individuals residing in the household.

06

Sign and date the form at the bottom to certify the accuracy of the information provided.

07

Submit the completed form to the appropriate Franklin County office as instructed.

Who needs PA FCATB 531 - Franklin County?

01

Individuals or families in Franklin County seeking assistance with financial applications.

02

Residents of Franklin County applying for benefits or services related to housing or social support.

03

People who need to declare their financial status for programs offered by local government agencies.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to declare tips Canada?

In Canada, the amount that workers earn in tips and gratuities is considered income that they must declare when they file their tax and benefit returns.

Who has to file a partnership tax return?

You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Are tips under $20 a month taxable?

Employees who receive tips of less than $20 in a calendar month aren't required to report their tips to you but must report these amounts as income on their tax returns and pay taxes, if any.

Does a partnership need to file a tax return Canada?

A partnership by itself does not pay income tax on its operating results and does not file an annual income tax return. Instead, each partner includes a share of the partnership income or loss on a personal, corporate, or trust income tax return.

Who has to file a partnership information return?

Who has to file a partnership information return? Under subsection 229(1) of the regulations, all partnerships that carry on business in Canada or are Canadian partnerships or specified investment flow‑through (SIFT) partnerships must file a partnership information return.

How do you prove tips?

Pay stubs, bank statements, a recent tax return, a letter from your employer on company letterhead stating how much you were paid, or a combination of these might be used to demonstrate your income.

Do I have to report my tips to the IRS?

Reporting tips on individual income tax return Any tips that the employee didn't report to the employer must be reported separately on Form 4137, Social Security and Medicare Tax on Unreported Tip Income, to include as additional wages with their tax return.

Do partnerships have to file?

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

What is IRS Section 531?

Accumulated Earnings Tax (IRC 531) The purpose of the accumulated earnings tax is to prevent a corporation from accumulating its earnings and profits beyond the reasonable needs of the business for the purpose of avoiding income taxes on its stockholders.

What is a 531 form?

IRS Publication 531 is a document that explains how taxable tips are to be reported to the government. Employees must pay federal income tax on all tips and Social Security and Medicare tax on most tips, regardless of how the tips are received.

When must a partnership file its return?

The partnership tax return is generally due by the 15th day of the third month following the end of the tax year. See the Instructions for Form 1065, U.S. Return of Partnership Income.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my PA FCATB 531 - Franklin County in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your PA FCATB 531 - Franklin County as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send PA FCATB 531 - Franklin County for eSignature?

When your PA FCATB 531 - Franklin County is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I fill out PA FCATB 531 - Franklin County using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign PA FCATB 531 - Franklin County and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is PA FCATB 531 - Franklin County?

PA FCATB 531 is a form used in Franklin County, Pennsylvania, for the purpose of property tax assessment appeals. It allows property owners to formally challenge the assessed value of their property.

Who is required to file PA FCATB 531 - Franklin County?

Property owners in Franklin County who disagree with the assessed value of their property as determined by the county assessment office are required to file PA FCATB 531.

How to fill out PA FCATB 531 - Franklin County?

To fill out PA FCATB 531, property owners should provide their personal information, detailed property information, the reason for the appeal, and any supporting documentation that substantiates their claim regarding the assessed value.

What is the purpose of PA FCATB 531 - Franklin County?

The purpose of PA FCATB 531 is to provide a legal avenue for property owners in Franklin County to appeal their property assessments to potentially lower their property taxes.

What information must be reported on PA FCATB 531 - Franklin County?

The information that must be reported on PA FCATB 531 includes the property owner's name, property address, the current assessed value, and the proposed value, along with a statement explaining the basis for the appeal.

Fill out your PA FCATB 531 - Franklin County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA FCATB 531 - Franklin County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.