PA FCATB 531 - Franklin County 2015 free printable template

Show details

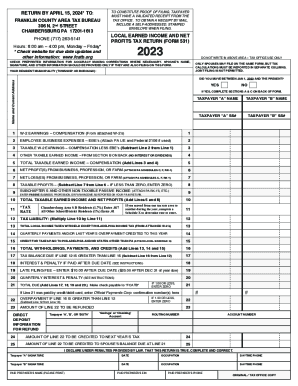

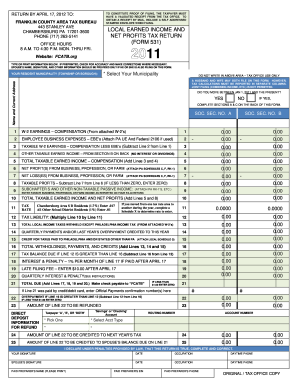

M. TO 4 30 P. M. MON. THRU FRI. Website fcatb. org DO NOT WRITE IN ABOVE AREA TAX OFFICE USE ONLY TYPE OR PRINT INFORMATION BELOW. IF PREPRINTED CHECK FOR ACCURACY AND MAKE CORRECTIONS WHERE NECESSARY. Make check payable to FCATB IF 1. 00 OR LESS ENTER ZERO If Line 21 was paid by credit/debit card enter Official Payments Corp. confirmation number s here OVERPAYMENT IF LINE 16 IS GREATER THAN LINE 12 Subtract Line 12 from Line 16 AMOUNT OF LINE 22 TO BE REFUNDED DIRECT DEPOSIT INFORMATION FOR...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA FCATB 531 - Franklin County

Edit your PA FCATB 531 - Franklin County form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA FCATB 531 - Franklin County form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA FCATB 531 - Franklin County online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit PA FCATB 531 - Franklin County. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA FCATB 531 - Franklin County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA FCATB 531 - Franklin County

How to fill out PA FCATB 531 - Franklin County

01

Obtain the PA FCATB 531 form from the Franklin County website or designated office.

02

Read the instructions carefully to understand the required information.

03

Fill out your personal information in the designated sections, including name, address, and contact details.

04

Provide any necessary background information as requested on the form.

05

Attach any required documentation that supports your application.

06

Review the completed form for accuracy and completeness.

07

Submit the form to the appropriate Franklin County office by the specified deadline.

Who needs PA FCATB 531 - Franklin County?

01

Individuals applying for assistance or services provided by Franklin County.

02

Residents of Franklin County seeking to access certain programs or benefits.

03

Clients needing assistance with legal or financial matters that require the form.

Instructions and Help about PA FCATB 531 - Franklin County

Fill

form

: Try Risk Free

People Also Ask about

Does Chester County PA have a local income tax?

Resident rate 2.75% of gross wages. Non-resident rate 2.00% of gross wages. All residents are required to file a FINAL if the residents taxes are being withheld by the employer.

What is the local tax rate for Franklin County PA?

The minimum combined 2023 sales tax rate for Franklin County, Pennsylvania is 6%. This is the total of state and county sales tax rates. The Pennsylvania state sales tax rate is currently 6%.

How do I file my local taxes in Pennsylvania?

File Your Local Earned Income Tax Return Online Access e-file. Provide the required information (e.g., your wages, local tax withholding and where you lived during the year). Schedule your payment to arrive on or before the due date.

What is the earned income tax in Franklin County PA?

The Earned Income Tax (EIT) is a 1% tax levied on the earned income and net profits of Franklin Park residents. The tax is collected by Keystone Collection Group and then distributed equally between the Borough and North Allegheny School District.

What is the income tax in Chambersburg PA?

The earned income and net profits tax charges 1.7% on residents earned income like wages, salaries or compensation for work. Unearned income - such as interest, dividends, pensions and Social Security - are exempt from this tax.

What is the income tax rate in Chambersburg PA?

The earned income and net profits tax charges 1.7% on residents earned income like wages, salaries or compensation for work. Unearned income - such as interest, dividends, pensions and Social Security - are exempt from this tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send PA FCATB 531 - Franklin County to be eSigned by others?

To distribute your PA FCATB 531 - Franklin County, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the PA FCATB 531 - Franklin County electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your PA FCATB 531 - Franklin County in seconds.

How do I edit PA FCATB 531 - Franklin County straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing PA FCATB 531 - Franklin County.

What is PA FCATB 531 - Franklin County?

PA FCATB 531 is a form used for property tax assessment appeals in Franklin County, Pennsylvania.

Who is required to file PA FCATB 531 - Franklin County?

Property owners who believe their property has been overvalued for tax purposes are required to file PA FCATB 531.

How to fill out PA FCATB 531 - Franklin County?

To fill out PA FCATB 531, property owners must provide their personal information, property details, and reason for the appeal, along with any supporting documentation.

What is the purpose of PA FCATB 531 - Franklin County?

The purpose of PA FCATB 531 is to allow property owners to appeal their property tax assessments if they believe the assessed value is inaccurate.

What information must be reported on PA FCATB 531 - Franklin County?

The form must include the property owner's name, address, property description, current assessed value, and the requested value, along with any evidence supporting the appeal.

Fill out your PA FCATB 531 - Franklin County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA FCATB 531 - Franklin County is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.