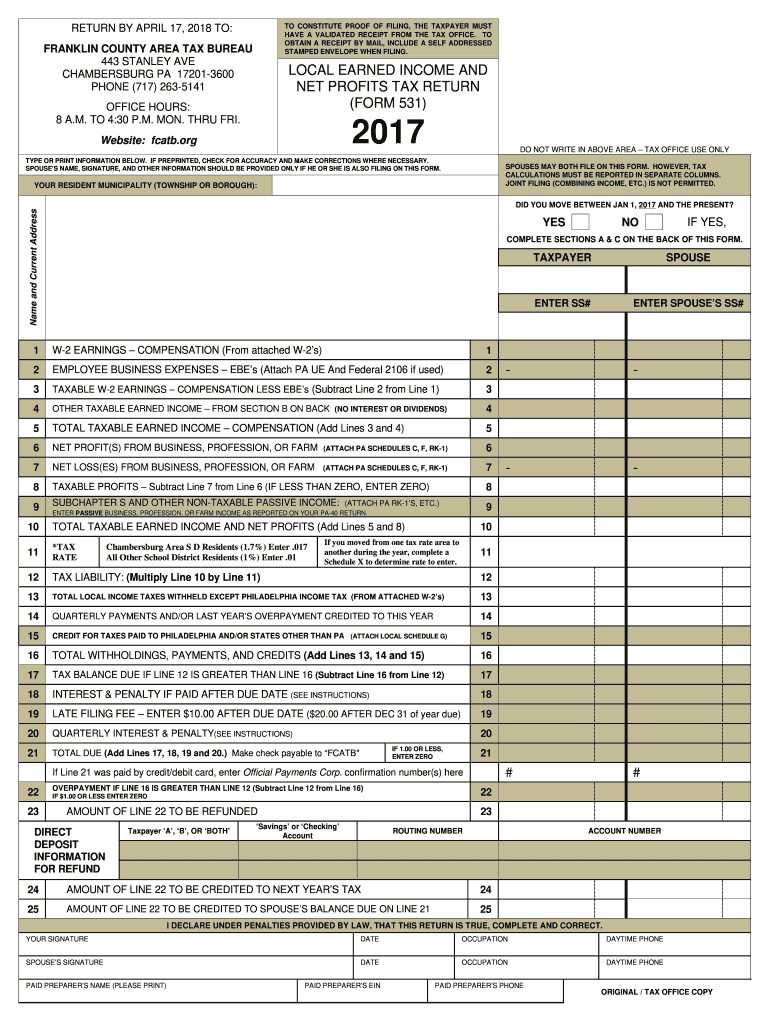

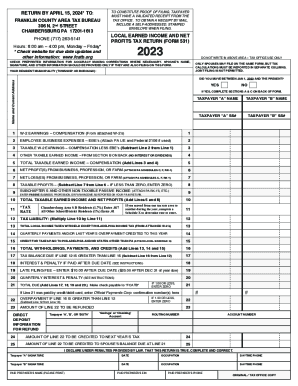

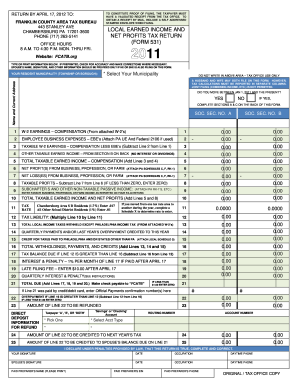

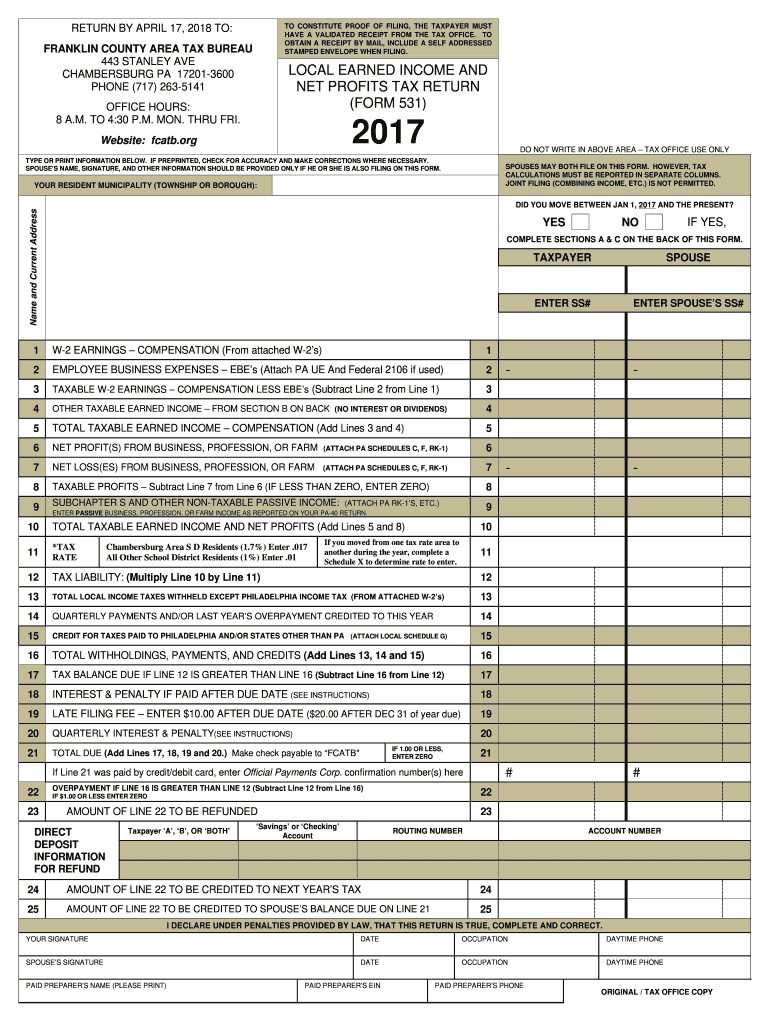

PA FCATB 531 - Franklin County 2017 free printable template

Get, Create, Make and Sign PA FCATB 531 - Franklin County

Editing PA FCATB 531 - Franklin County online

Uncompromising security for your PDF editing and eSignature needs

PA FCATB 531 - Franklin County Form Versions

How to fill out PA FCATB 531 - Franklin County

How to fill out PA FCATB 531 - Franklin County

Who needs PA FCATB 531 - Franklin County?

Instructions and Help about PA FCATB 531 - Franklin County

Things could be changing in one of the region's most affordable places to own a home the Franklin County Board of Supervisors will soon vote on two proposed tax increases 10 News reporter Rachel Lucas explains why the county says it needs the money after continued debate the Franklin County Board of Supervisors now has 2 weeks to decide if they will raise real estate and property taxes board supervisor chair Kline Breaker says the increase is necessary to pay for county projects like the development of the Business Park improving much-needed broadband services funding for fire and rescue squads as well as the Sheriff's Department to increase school safety without a tax increase he says so what happened the Board of Supervisors will consider adding a seven cents on real estate taxes per 100 of assessed value as well as a 17 cent increase on personal property taxes currently Franklin County residents pay much lower in real estate taxes than surrounding counties if the increase is passed it will still be lower than half of the surrounding counties Breaker told 10 news today in a phone interview that the Board of Supervisors could still decide to increase taxes by a much lower margin, but that means that someone isn't getting funded next year the final vote happens on May 29th in Franklin County I'm Rachel Lucas 10 News working for you

People Also Ask about

How do I pay local taxes in PA?

What is a form 37 on Ohio tax return?

What form is used to file Ohio locality taxes due?

What is the local tax rate for Franklin County PA?

Does Ohio have locality taxes?

Does Franklin Ohio have a city income tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send PA FCATB 531 - Franklin County to be eSigned by others?

How do I edit PA FCATB 531 - Franklin County in Chrome?

How do I complete PA FCATB 531 - Franklin County on an iOS device?

What is PA FCATB 531 - Franklin County?

Who is required to file PA FCATB 531 - Franklin County?

How to fill out PA FCATB 531 - Franklin County?

What is the purpose of PA FCATB 531 - Franklin County?

What information must be reported on PA FCATB 531 - Franklin County?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.