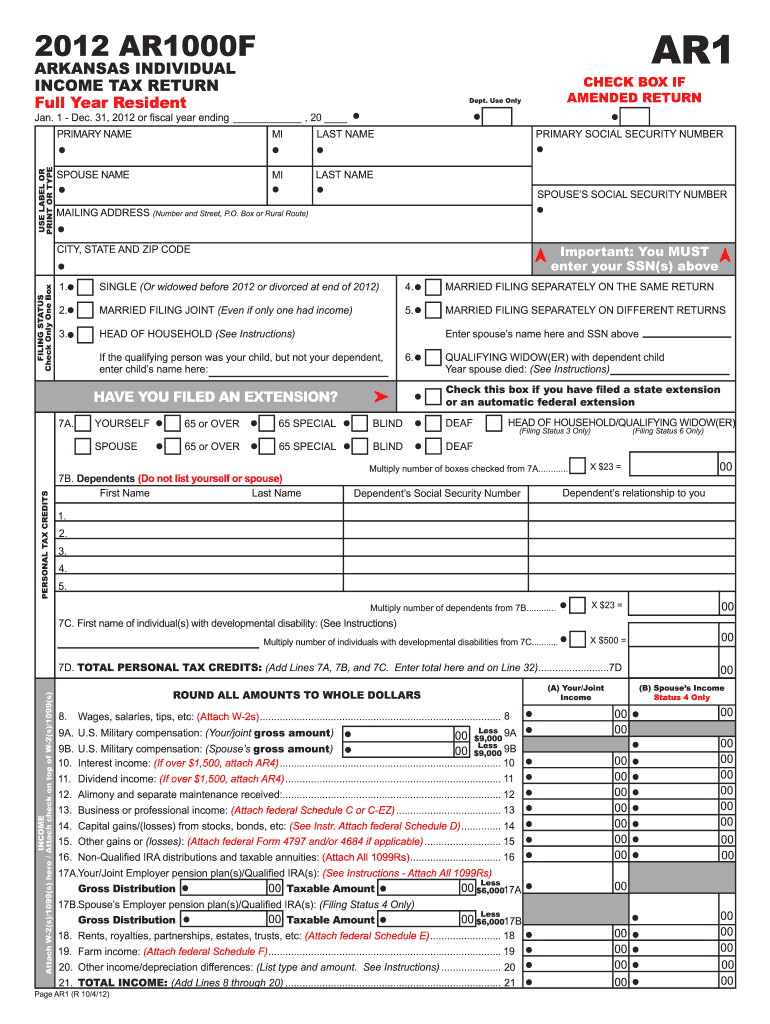

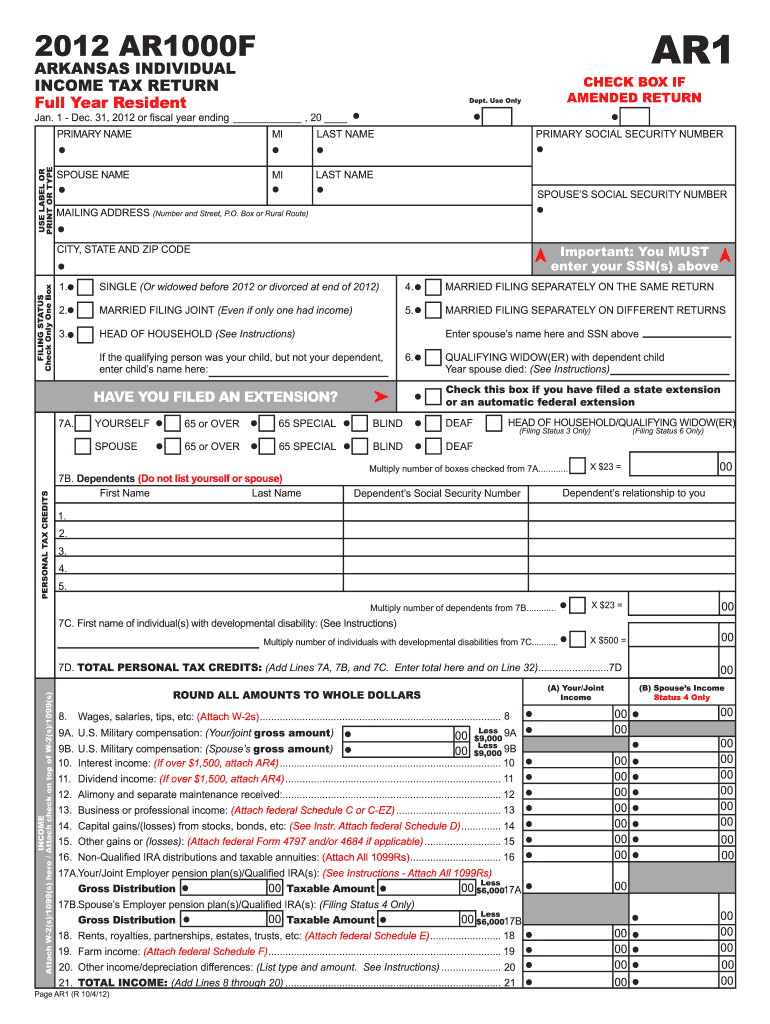

AR DFA AR1000F 2012 free printable template

Get, Create, Make and Sign AR DFA AR1000F

Editing AR DFA AR1000F online

Uncompromising security for your PDF editing and eSignature needs

AR DFA AR1000F Form Versions

How to fill out AR DFA AR1000F

How to fill out AR DFA AR1000F

Who needs AR DFA AR1000F?

Instructions and Help about AR DFA AR1000F

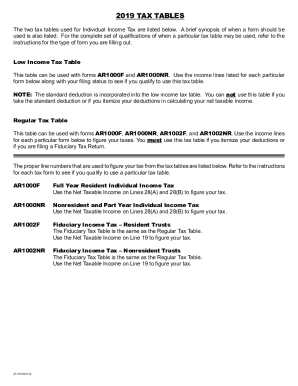

It's the tax helper back assisting you find printable tax forms in your particular state, and today we're going to go into Arkansas and look for ways to find free printable tax forms, so you avoid paying money for any booklets or any information you need from companies like Turbo Tax H&R Block Liberty anything like that so go to google.com and type in Arkansas printable tax forms hit enter and the first listing you're going to see is the DFA Arkansas gov page go ahead and click there and this is going to take you to the income tax forms now something that's important to remember is that most 2012 tax forms are not going to be updated, yet you're going to have to wait a little while but all 2011 tax forms are pretty much here, so I would suggest looking at some old tax forms before looking at the 2012 at the current time if you're looking at this video later on you're going to see all the tax forms updated as you can see in 2011 all these tax forms are here but in 2012 they're not that being said they're going to be up there as soon as we get closer to the tax season, but you're going to need one either the AR 1,000 CR one of the AR one thousand is likely what you'll need to go ahead and click the link there and as you're going to see there's a PDF file that will allow you to fill in all of this information so remember this is the 2011 you'll want to make sure this says 2012 before filling all this information out and sending it in if you fill all this information out and send it in with 2011 you're going to have problems, and you're going to confuse the state government stuff like that so later on under 2012 you will see all of these tax forms updated in here, and I would suggest clicking on those if you have any more questions you can just call you can use this contact us page or there's a frequently asked questions page also use those if you have any questions there's always the e-file system here as well so once again if you have any questions please feel free to comment below and please like the video on YouTube if you find it helpful

People Also Ask about

Does Arkansas have a state income tax form?

What is the Arkansas non resident withholding tax?

What is form AR1000RC5?

Where to find Arkansas tax forms?

What is form AR1000NR?

What is the AR1000F form?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit AR DFA AR1000F in Chrome?

How can I edit AR DFA AR1000F on a smartphone?

How do I fill out AR DFA AR1000F using my mobile device?

What is AR DFA AR1000F?

Who is required to file AR DFA AR1000F?

How to fill out AR DFA AR1000F?

What is the purpose of AR DFA AR1000F?

What information must be reported on AR DFA AR1000F?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.