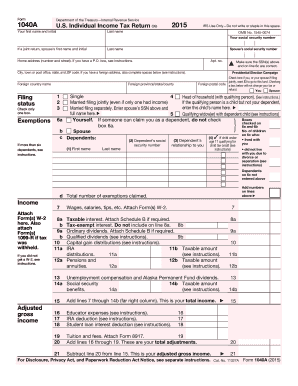

AR DFA AR1000F 2015 free printable template

Show details

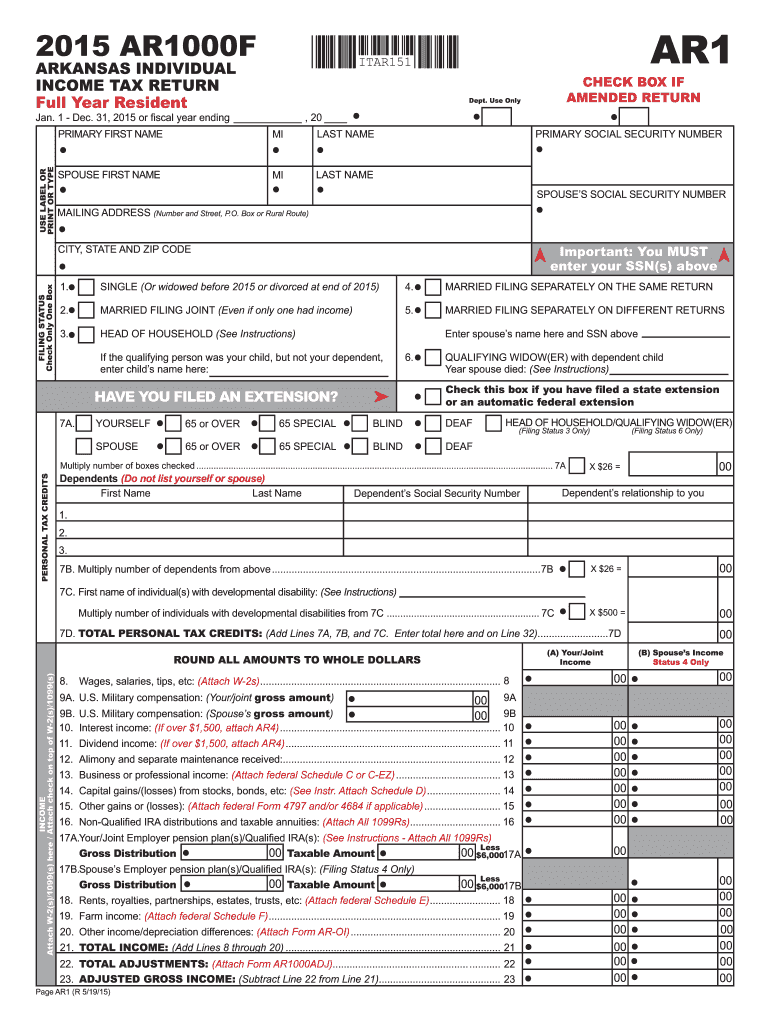

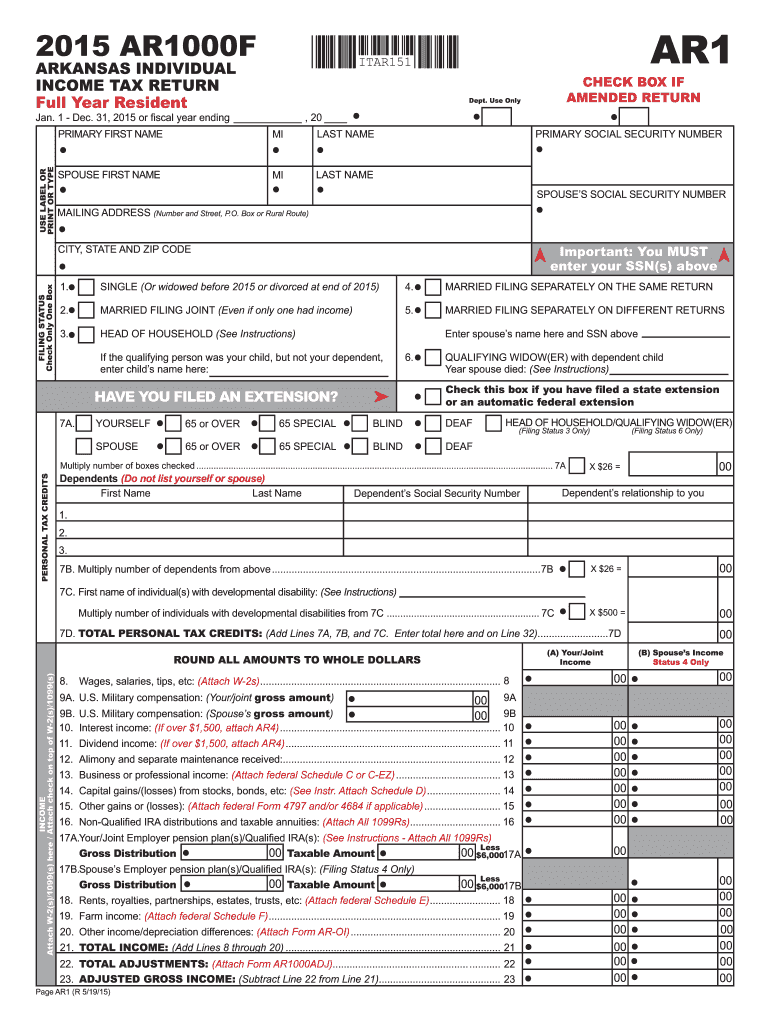

19 20. Other income/depreciation differences Attach Form AR-OI. 20 21. TOTAL INCOME Add Lines 8 through 20. 21 22. TOTAL ADJUSTMENTS Attach Form AR1000ADJ. 22 23. -867 5266 1 20 Subtract Line 22 from Line 21. 23 Page AR1 R 5/19/15 Primary SSN - - A TAX COMPUTATION 25. Select tax table See Instructions Line 25 LOW INCOME Table 5 8/ 5 Table PAYMENTS If you qualify for the Low Income Tax Table enter zero 0 on Line 25A. If Line 35 is greater than Line 31 enter 0. 36 Arkansas income tax withheld...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR DFA AR1000F

Edit your AR DFA AR1000F form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR DFA AR1000F form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AR DFA AR1000F online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AR DFA AR1000F. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR DFA AR1000F Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR DFA AR1000F

How to fill out AR DFA AR1000F

01

Gather all necessary documentation, including your income statements, deductions, and credits.

02

Start filling out the AR1000F form with your personal information, including name, address, and social security number.

03

Report your total income from all sources for the tax year in the appropriate section.

04

Identify and list any deductions you are eligible to take, such as standard deductions or itemized deductions.

05

Calculate your taxable income by subtracting deductions from total income.

06

Apply the tax rates to your taxable income to determine your total tax liability.

07

Check for any tax credits you may qualify for and apply them appropriately.

08

Review the completed form for accuracy and ensure all necessary signatures are included.

09

Submit the form electronically or by mail according to the instructions provided.

Who needs AR DFA AR1000F?

01

Residents of Arkansas who are required to file a state income tax return.

02

Individuals with taxable income from various sources including employment, investments, or business activities.

03

Taxpayers seeking to claim deductions and credits to reduce their tax liability.

Instructions and Help about AR DFA AR1000F

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay Arkansas income tax?

Just like the federal government, if you earn an income, you must pay income taxes in Arkansas. As a traditional W-2 employee, your Arkansas taxes will be drawn on each payroll automatically.

What is AR income tax?

Arkansas Tax Rates, Collections, and Burdens Arkansas has a graduated individual income tax, with rates ranging from 2.00 percent to 4.90 percent. Arkansas also has a 1.0 to 5.30 percent corporate income tax rate.

What is AR8453 OL?

SPECIAL INFORMATION. If you choose to file your State of Arkansas tax return by using one of the online web providers, you are required to complete the AR8453-OL. You must keep the completed and signed AR8453-OL along with your tax return and any W-2's and/or 1099's.

Where to find Arkansas tax forms?

State Tax Forms In Person: Arkansas Revenue Office, 206 Southwest Drive, Jonesboro, AR. Phone: Arkansas Revenue Office, 870-932-2716 (Jonesboro) 1-800-882-9275 (Little Rock) Email: Individual.Income@rev.state.ar.us.

What does accelerated income tax mean?

Tax acceleration refers to taking a tax deduction when an expense is incurred rather than when paid in a subsequent period.

What is form AR1000RC5?

The AR1000RC5 form is used by families to receive a $500 tax credit for individuals with developmental disabilities. It is submitted with your state income taxes.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in AR DFA AR1000F?

With pdfFiller, it's easy to make changes. Open your AR DFA AR1000F in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete AR DFA AR1000F on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your AR DFA AR1000F, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I complete AR DFA AR1000F on an Android device?

Use the pdfFiller Android app to finish your AR DFA AR1000F and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is AR DFA AR1000F?

AR DFA AR1000F is a tax form used by taxpayers in Arkansas to report specific income and deductions to the state government.

Who is required to file AR DFA AR1000F?

Individuals or entities that have taxable income sourced from Arkansas are required to file the AR DFA AR1000F.

How to fill out AR DFA AR1000F?

To fill out AR DFA AR1000F, you must provide your personal information, report your income, calculate deductions, and adhere to the instructions provided by the Arkansas Department of Finance and Administration.

What is the purpose of AR DFA AR1000F?

The purpose of AR DFA AR1000F is to collect information on the taxable income and allow the state to assess and collect state income taxes from residents and non-residents earning income in Arkansas.

What information must be reported on AR DFA AR1000F?

The information that must be reported on AR DFA AR1000F includes personal identification details, total income, allowable deductions, and calculation of tax liability.

Fill out your AR DFA AR1000F online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR DFA ar1000f is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.