AR DFA AR1000F 2016 free printable template

Show details

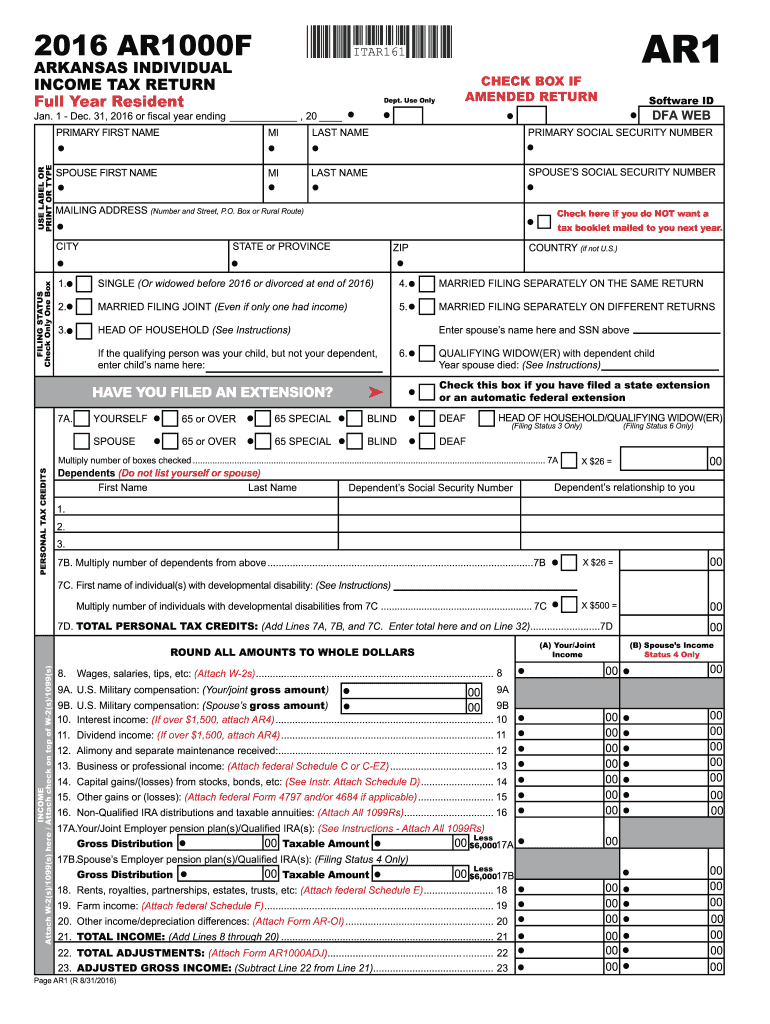

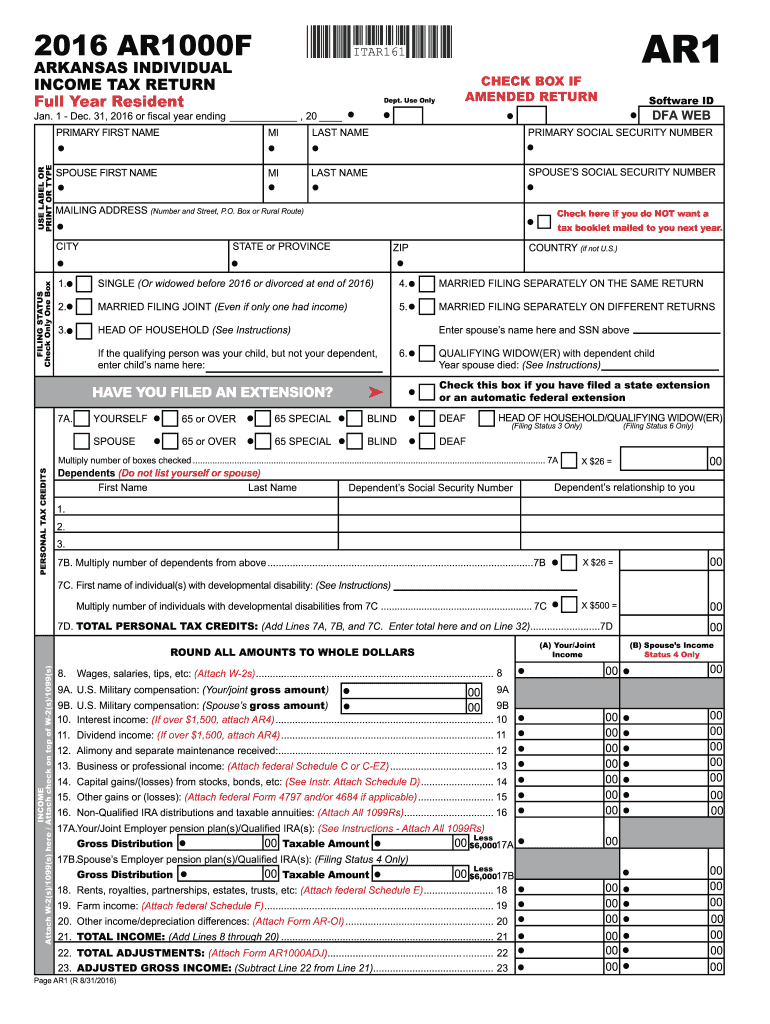

19 20. Other income/depreciation differences Attach Form AR-OI. 20 21. 727 / 1 20 Add Lines 8 through 20. 21 22. 727 / -8670 176 Attach Form AR1000ADJ. 22 23. -867 5266 1 20 Subtract Line 22 from Line 21. 23 Page AR1 R 8/31/2016 Primary SSN - - A PAYMENTS TAX COMPUTATION 25. 36 Arkansas income tax withheld Attach state copies of W-2 and/or 1099R Form s. 37 Estimated tax paid or credit brought forward from 2015. TOTAL DUE 50C 50A. UEP Attach Form AR2210 or AR2210A. If required enter exception...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ar1000f 2016 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ar1000f 2016 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ar1000f 2019 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ar1000f form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

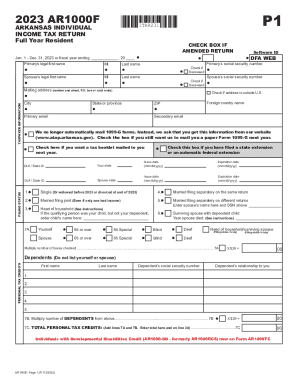

AR DFA AR1000F Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ar1000f 2016 form

How to fill out ar1000f 2019?

01

Gather all necessary financial information, such as income statements, W-2 forms, and any other relevant documents.

02

Review the instructions provided with the ar1000f 2019 form to ensure you understand the requirements and any specific sections that may be applicable to you.

03

Begin by entering your personal information, including your name, address, and social security number, at the top of the form.

04

Proceed to fill out the income section, reporting all sources of income for the tax year. This may include wages, self-employment income, rental income, and other taxable earnings.

05

Deduct any adjustments to income that you are eligible for, such as contributions to a traditional IRA or student loan interest paid.

06

Calculate your total federal adjusted gross income and transfer this amount to the appropriate section on the form.

07

Move on to the deductions section, where you can claim any allowable deductions, such as mortgage interest, state and local taxes, and medical expenses.

08

After calculating your total deductions, subtract this amount from your adjusted gross income to arrive at your taxable income.

09

Determine your tax liability based on the tax rate schedule provided in the instructions. This will depend on your filing status and taxable income.

10

If you had any taxes withheld throughout the year, report this amount in the Payments section of the form. If applicable, claim any refundable tax credits you are eligible for.

11

Finally, make sure to sign and date the form before submitting it.

Who needs ar1000f 2019?

01

Individuals who are residents of Arkansas for tax purposes during the tax year.

02

Individuals who have earned income from Arkansas sources, even if they are not residents of the state.

03

Individuals who have a filing requirement due to other factors, such as significant income from self-employment or rental properties in Arkansas.

04

Anyone who wants to claim deductions, credits, or exemptions specific to Arkansas tax laws.

05

Those who need to reconcile any state income tax liabilities with their corresponding federal tax liabilities.

Video instructions and help with filling out and completing ar1000f 2019

Instructions and Help about arkansas tax forms

Fill forms : Try Risk Free

People Also Ask about ar1000f 2019

Where to get Arkansas tax forms?

What is a AR1000F tax form?

Is Arkansas eliminating state income tax?

How do I fill out a 2019 tax return?

What is the AR1000F form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ar1000f?

AR1000F is a line of GPS tracking devices produced by Queclink, a leading supplier of advanced telematics and wireless communication solutions. The AR1000F series is designed for various applications, including asset tracking, personal tracking, and fleet management. These devices offer real-time location tracking, geofencing, remote control capabilities, and other features to enable effective monitoring and management of assets or individuals.

Who is required to file ar1000f?

Individuals who are full-year residents of Arkansas are required to file Form AR1000F.

What is the purpose of ar1000f?

AR1000F is a specific form used for individual income tax filing in the United States. It is used by individuals who are residents of Arkansas to report their income, deductions, and tax liability for a particular tax year. The purpose of AR1000F is to accurately calculate the amount of tax owed or refund due to the taxpayer based on their income and other relevant financial information. Filing this form with the Arkansas Department of Finance and Administration enables taxpayers to fulfill their tax obligations and comply with the state's tax laws.

What is the penalty for the late filing of ar1000f?

The penalty for late filing of AR1000F, which is the individual income tax return form for Arkansas residents, is 5% of the tax due per month, up to a maximum of 25% of the tax due. Additionally, interest will accrue on any unpaid tax at a rate of 1% per month.

How to fill out ar1000f?

To properly fill out form AR1000F, follow these steps:

1. Section A - Personal Information:

- Enter your name, SSN, spouse's name and SSN (if applicable), and residency status.

2. Section B - Filing Status:

- Indicate your filing status (Single, Married Filing Jointly, Head of Household, etc.).

3. Section C - Dependents:

- Enter the names, SSNs, and relationship of your dependents.

4. Section D - Income:

- Report your income from various sources, such as wages, self-employment, interest, dividends, etc.

- Calculate the total income and transfer it to Line 5.

5. Section E - Deductions:

- Report any deductions you qualify for, such as federal income tax, retirement contributions, etc.

- Calculate the total deductions and transfer it to Line 20.

6. Section F - Tax and Credits:

- Calculate your tax liability using the tax rate tables provided.

- Enter any tax credits you are eligible for, subtracting them from your tax liability.

- Transfer the final tax amount to Line 26.

7. Section G - Payments and Refund:

- Enter any payments made, including withholdings from your salary or estimated tax payments.

- Calculate the refund or amount owed by subtracting Line 29 from Line 27.

8. Section H - Consent, Signatures, and Declaration:

- Sign and date the form, affirming that the information provided is accurate to the best of your knowledge.

9. Section I - Nonrefundable Contributions:

- Skip this section unless you have made any nonrefundable contributions.

10. Attachments:

- Include any necessary attachments such as W-2 forms, 1099 forms, or additional schedules.

Review the completed form AR1000F for accuracy and ensure that all necessary information is provided.

What information must be reported on ar1000f?

The AR1000F form is used to report Arkansas individual income tax return. The information that must be reported on this form includes:

1. Personal Information: This includes your name, Social Security number, filing status, and address.

2. Income: You must report all taxable income earned during the tax year, including wages, salaries, tips, interest, dividends, rental income, pension/retirement income, and any other sources of income.

3. Adjustments to Income: This section includes deductions that you can claim, such as contributions to retirement accounts, health savings accounts, self-employment tax deductions, alimony paid, and certain other deductions.

4. Arkansas Tax Withheld: You need to report the total amount of Arkansas income tax withheld from your wages or other sources of income.

5. Non-resident Income: If you are a non-resident of Arkansas but earned income from Arkansas sources, you need to report that income in this section.

6. Other Taxes: This section includes any additional taxes you owe, such as use tax, self-employment tax, or healthcare individual responsibility payment.

7. Tax Credits: You can claim various tax credits, such as the child tax credit, credit for elderly or disabled, education credits, and other applicable tax credits.

8. Arkansas Tax: This section calculates your Arkansas tax liability based on the information provided.

9. Payments and Refunds: You report any payments made towards your tax liability, including estimated tax payments, extension payments, and any overpayment from the previous year. You also mention how you want to receive your refund, either by direct deposit or check.

10. Signatures: Both the taxpayer and spouse (if applicable) must sign and date the form.

It is important to note that this information is a general overview, and you should consult the instructions provided with the AR1000F form or seek professional advice to ensure accurate reporting.

How can I send ar1000f 2019 for eSignature?

Once your ar1000f form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out the arkansas income tax forms form on my smartphone?

Use the pdfFiller mobile app to complete and sign arkansas state tax forms on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit 2019 ar1000f on an Android device?

You can make any changes to PDF files, such as arkansas state income tax form 2019, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your ar1000f 2016 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arkansas Income Tax Forms is not the form you're looking for?Search for another form here.

Keywords relevant to arkansas state tax form 2019 printable

Related to arkansas state income tax form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.