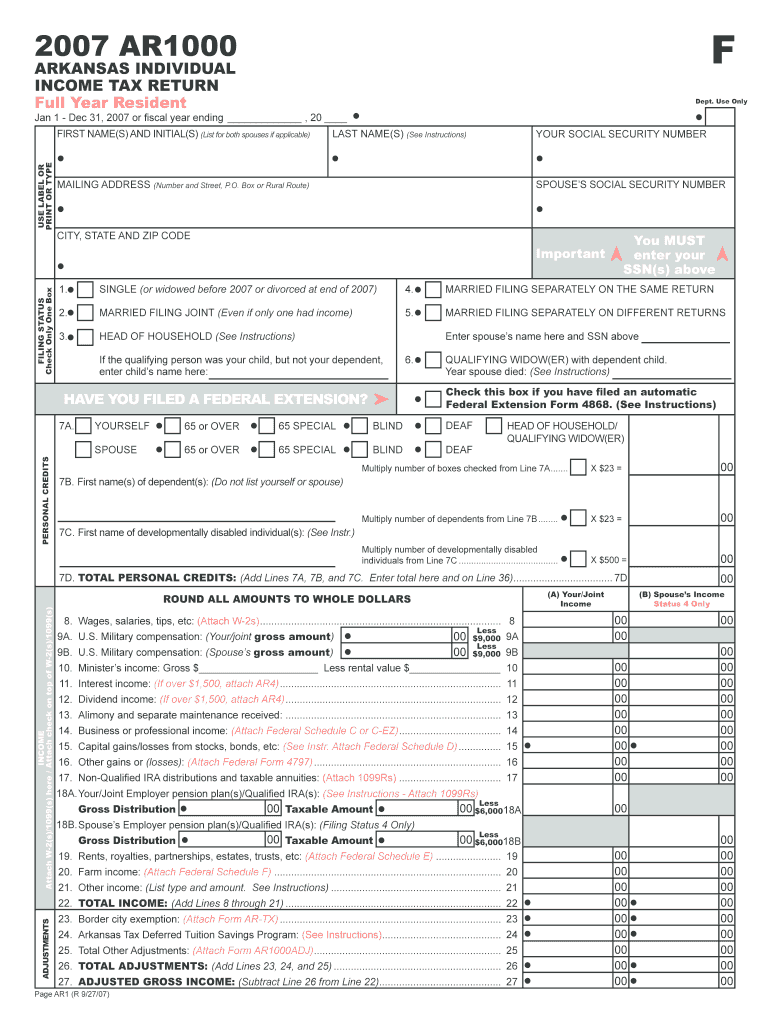

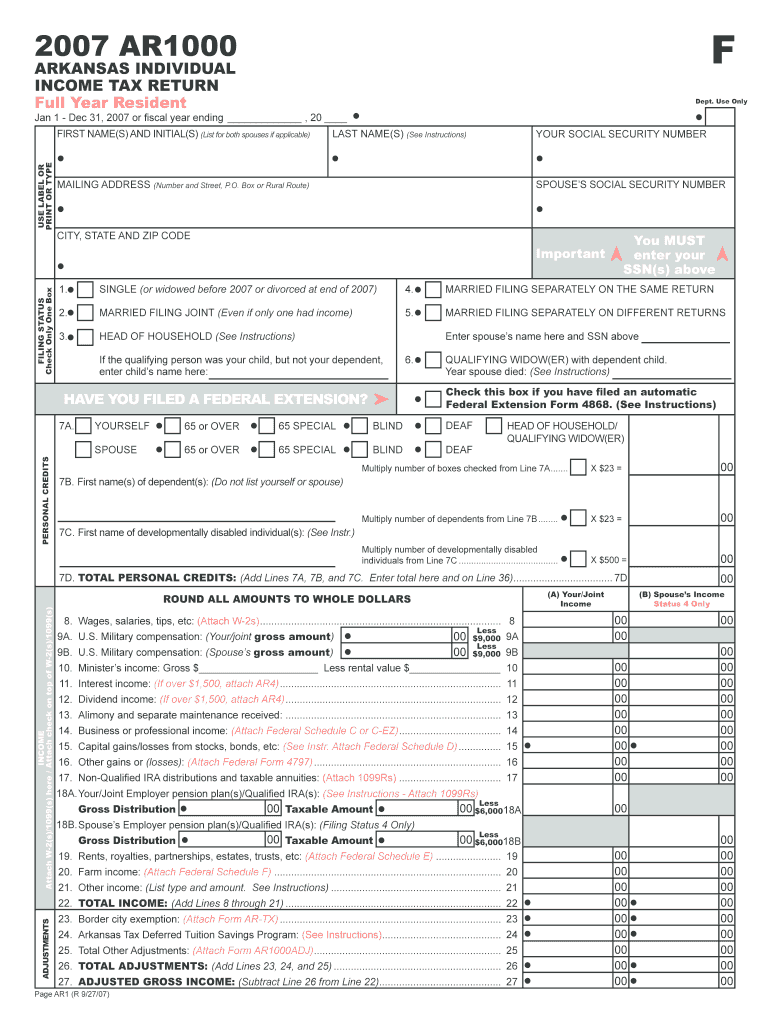

AR DFA AR1000F 2007 free printable template

Show details

F 2007 AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept. Use Only Jan 1 Dec 31, 2007 scaly area ending, 20 USE LABEL OR PRINT OR TYPE FIRST NAME(S) AND INITIAL(S) (List for both

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR DFA AR1000F

Edit your AR DFA AR1000F form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR DFA AR1000F form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AR DFA AR1000F online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AR DFA AR1000F. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR DFA AR1000F Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR DFA AR1000F

How to fill out AR DFA AR1000F

01

Gather all necessary financial documents including income statements, receipts, and supporting schedules.

02

Obtain the AR DFA AR1000F form from the Arkansas Department of Finance and Administration website or office.

03

Complete the identification section by providing your name, address, and Social Security number.

04

Fill in the income section with your total income from all sources for the tax year.

05

Report any deductions and credits that you are eligible for on the appropriate lines.

06

Calculate your total tax liability using the provided tax tables or formulas in the instructions.

07

Determine if you are owed a refund or if you need to make a payment.

08

Review the completed form for accuracy and completeness.

09

Sign and date the form before submission.

10

Submit the completed form by mail or electronically, following the guidelines provided by the Arkansas DFA.

Who needs AR DFA AR1000F?

01

Individuals and businesses who are residents of Arkansas and need to report their state income taxes.

02

Taxpayers who have earned income, claims deductions or credits for the tax year.

03

Those required to file tax returns in Arkansas based on income thresholds established by the state.

Fill

form

: Try Risk Free

People Also Ask about

Can you print tax forms front and back?

Print Tax Return Double-Sided Forms with Caution While each form can be double-sided, different forms cannot share the same page – so for example, each page of a Form 1040 can be double-sided. But part of the Form 1040 cannot share a page with a Form 7004.

Where can I get federal tax forms and booklets?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

Do I need to file an Arkansas state tax return?

State Income Tax Filing Requirements To claim any refund due, you must file an Arkansas income tax return. Residents of Ar- kansas must complete Form AR1000. Nonresidents and Part-Year Residents must complete Form AR1000NR.

Do you use the same form for state and federal taxes?

While residents of all states use the same forms to file their federal income tax returns, state income tax forms differ from state to state. As a result, you'll need to use the appropriate forms to file your state income tax return.

Where can I get Illinois tax forms?

Submit a request to have forms or publications mailed to you. You can also request certain forms and publications by calling our 24-hour forms order hotline at 1 800 356-6302.

Can you buy tax forms?

You can order the tax forms, instructions and publications you need to complete your 2021 tax return here. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2022.

Does Arkansas have a state w4?

This form has essentially the same information on it, but makes sure you have the correct notations for looking up how much needs to be withheld from each paycheck. It is generally acceptable to substitute the federal W-4 form in place of an Arkansas State AR4EC form, but it is recommended to have both on file.

Does Arkansas have a state tax form?

Arkansas Form 1000F/1000NR – Personal Income Tax Return for Residents and Nonresidents. Arkansas Form 1000-CO – Check Off Contributions Schedule.

Where can I get Arkansas state tax forms?

State Tax Forms The Arkansas Department of Finance and Administration distributes Arkansas tax forms and instructions in the following ways: In Person: Arkansas Revenue Office, 206 Southwest Drive, Jonesboro, AR. Phone: Arkansas Revenue Office, 870-932-2716 (Jonesboro) 1-800-882-9275 (Little Rock)

Who is required to file Arkansas state tax return?

to return to it after leaving or if a person spends more than six months of the taxable year in Arkansas, they are considered an Arkansas resident for state tax purposes. All non-residents must file a state tax return if they receive any in- come from an Arkansas source.

Do I have to file a state tax return in Arkansas?

State Income Tax Filing Requirements To claim any refund due, you must file an Arkansas income tax return. Residents of Ar- kansas must complete Form AR1000. Nonresidents and Part-Year Residents must complete Form AR1000NR.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit AR DFA AR1000F from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your AR DFA AR1000F into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete AR DFA AR1000F online?

Completing and signing AR DFA AR1000F online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit AR DFA AR1000F on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign AR DFA AR1000F. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is AR DFA AR1000F?

AR DFA AR1000F is a specific tax form used for filing income tax returns in the state of Arkansas. It serves as a way for individuals and businesses to report their income and calculate the tax owed to the state.

Who is required to file AR DFA AR1000F?

Individuals or entities who earn income in Arkansas and are subject to state income tax are required to file the AR DFA AR1000F. This includes residents, part-year residents, and non-residents with Arkansas-source income.

How to fill out AR DFA AR1000F?

To fill out the AR DFA AR1000F, taxpayers need to gather their income documentation, complete the form by reporting income, deductions, and credits as applicable, and then submit it to the Arkansas Department of Finance and Administration, usually by the tax filing deadline.

What is the purpose of AR DFA AR1000F?

The primary purpose of the AR DFA AR1000F is to collect accurate income information from taxpayers in Arkansas to calculate the appropriate state income tax owed, and to ensure compliance with state tax laws.

What information must be reported on AR DFA AR1000F?

On AR DFA AR1000F, taxpayers must report their total income, any exemptions, deductions, and tax credits they are eligible for, as well as the final tax amount calculated based on the income reported.

Fill out your AR DFA AR1000F online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR DFA ar1000f is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.