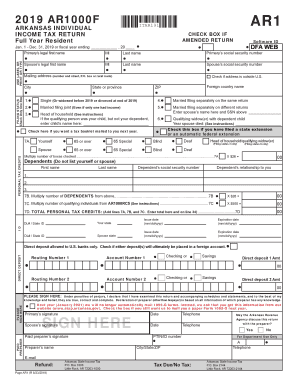

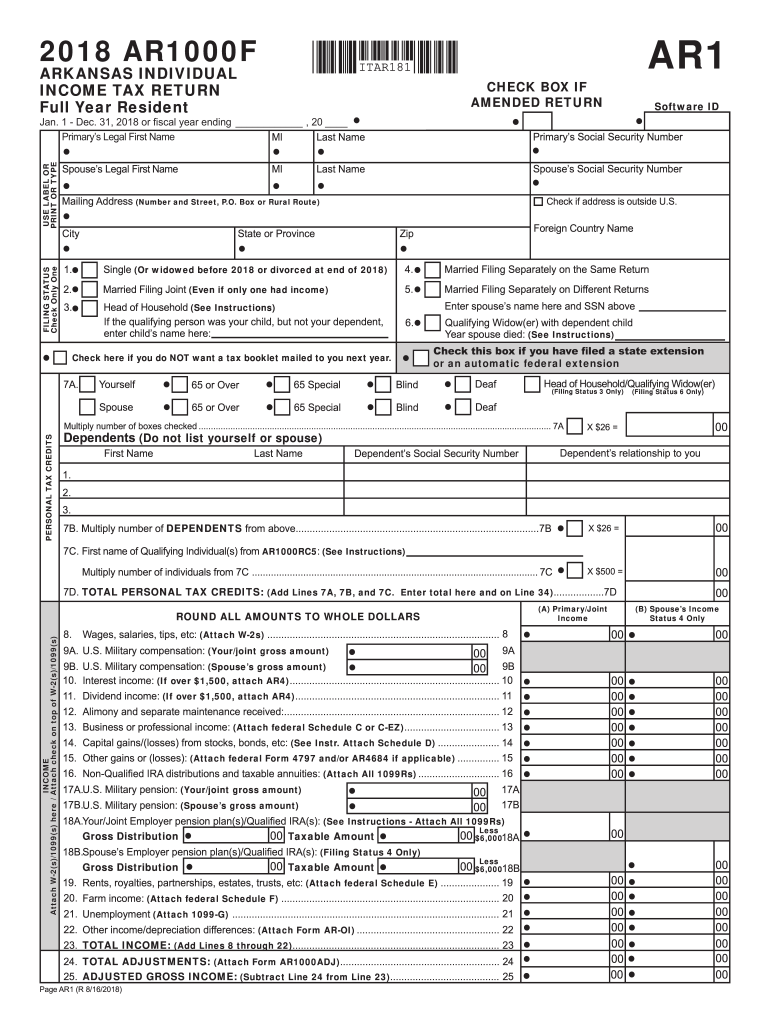

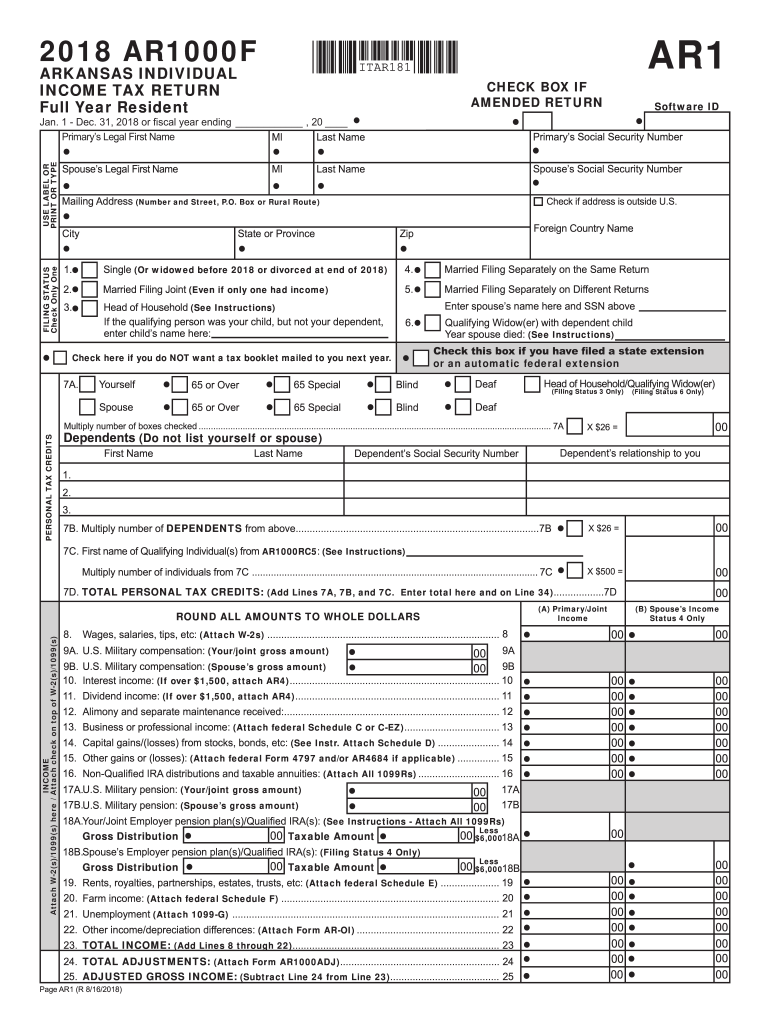

AR DFA AR1000F 2018 free printable template

Show details

19 20. Other income/depreciation differences Attach Form AR-OI. 20 21. 727 / 1 20 Add Lines 8 through 20. 21 22. 727 / -8670 176 Attach Form AR1000ADJ. 22 23. -867 5266 1 20 Subtract Line 22 from Line 21. 23 Page AR1 R 8/31/2016 Primary SSN - - A PAYMENTS TAX COMPUTATION 25. 36 Arkansas income tax withheld Attach state copies of W-2 and/or 1099R Form s. 37 Estimated tax paid or credit brought forward from 2015. TOTAL DUE 50C 50A. UEP Attach Form AR2210 or AR2210A. If required enter exception...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR DFA AR1000F

Edit your AR DFA AR1000F form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR DFA AR1000F form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AR DFA AR1000F online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AR DFA AR1000F. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR DFA AR1000F Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR DFA AR1000F

How to fill out AR DFA AR1000F

01

Gather all necessary financial documents and information regarding your income, expenses, and deductions.

02

Start by filling out your personal information at the top of the form, including your name, address, and Social Security number.

03

Report your total income in the appropriate sections of the form, ensuring you include all income sources.

04

Fill in any applicable deductions or credits that you may qualify for, following the guidelines provided in the instruction booklet.

05

Calculate your total taxable income by subtracting deductions from your total income.

06

Use the tax tables provided to determine your tax liability based on your taxable income.

07

If applicable, include any payments you have already made or any estimated tax payments.

08

Double-check all calculations for accuracy.

09

Sign and date the form where indicated.

10

Submit the completed form to the appropriate address or e-file it as per the instructions.

Who needs AR DFA AR1000F?

01

Individuals and businesses in Arkansas who are required to report their income and determine their tax liability.

02

Residents who earn income within Arkansas and are subject to the state income tax regulations.

03

Taxpayers seeking to claim deductions or credits that reduce their taxable income or tax owed.

Instructions and Help about AR DFA AR1000F

Fill

form

: Try Risk Free

People Also Ask about

What is the Arkansas state tax form called?

AR1000F Full Year Resident Individual Income Tax Return (Instructions) AR1000NR Part Year or Non-Resident Individual Income Tax Return (Instructions)

Does Arkansas have a state income tax form?

Arkansas State Income Tax Forms for the current Tax Year can be e-Filed in conjunction with a IRS Income Tax Return. Details on how to only prepare and print an Arkansas Tax Return. Prior back taxes forms can no longer be e-Filed.

What taxes do you pay in Arkansas?

Arkansas also has a 1.0 to 5.30 percent corporate income tax rate. Arkansas has a 6.50 percent state sales tax rate, a max local sales tax rate of 6.125 percent, and an average combined state and local sales tax rate of 9.46 percent. Arkansas's tax system ranks 40th overall on our 2023 State Business Tax Climate Index.

What income is taxed in Arkansas?

Arkansas taxes income from all sources, such as wages, interest and business income. You're taxed differently depending on whether you qualify as low income or regular income.

Where can I get Arkansas state tax forms?

State Tax Forms In Person: Arkansas Revenue Office, 206 Southwest Drive, Jonesboro, AR. Phone: Arkansas Revenue Office, 870-932-2716 (Jonesboro) 1-800-882-9275 (Little Rock) Email: Individual.Income@rev.state.ar.us.

Is Arkansas a tax friendly state?

Arkansas is a mid-sized state, with a population of about three million people. Retirees living in Arkansas enjoy relatively low taxes, especially on income and property. The state does not tax Social Security, and its property taxes are among the lowest in the U.S. On the other hand, sales taxes in Arkansas are high.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out AR DFA AR1000F using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign AR DFA AR1000F. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit AR DFA AR1000F on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as AR DFA AR1000F. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I complete AR DFA AR1000F on an Android device?

On Android, use the pdfFiller mobile app to finish your AR DFA AR1000F. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is AR DFA AR1000F?

AR DFA AR1000F is a form used by the Arkansas Division of Finance and Administration for reporting various financial information related to individual income tax.

Who is required to file AR DFA AR1000F?

Individuals who have earned income in Arkansas and meet certain income thresholds are required to file AR DFA AR1000F.

How to fill out AR DFA AR1000F?

To fill out AR DFA AR1000F, individuals must provide their personal information, report their income, claim deductions and credits, and calculate their tax liability.

What is the purpose of AR DFA AR1000F?

The purpose of AR DFA AR1000F is to collect income tax information from residents of Arkansas to ensure compliance and facilitate the calculation of taxes owed.

What information must be reported on AR DFA AR1000F?

The information that must be reported on AR DFA AR1000F includes personal identification details, total income, deductions, credits, and calculated tax due or refund amount.

Fill out your AR DFA AR1000F online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR DFA ar1000f is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.