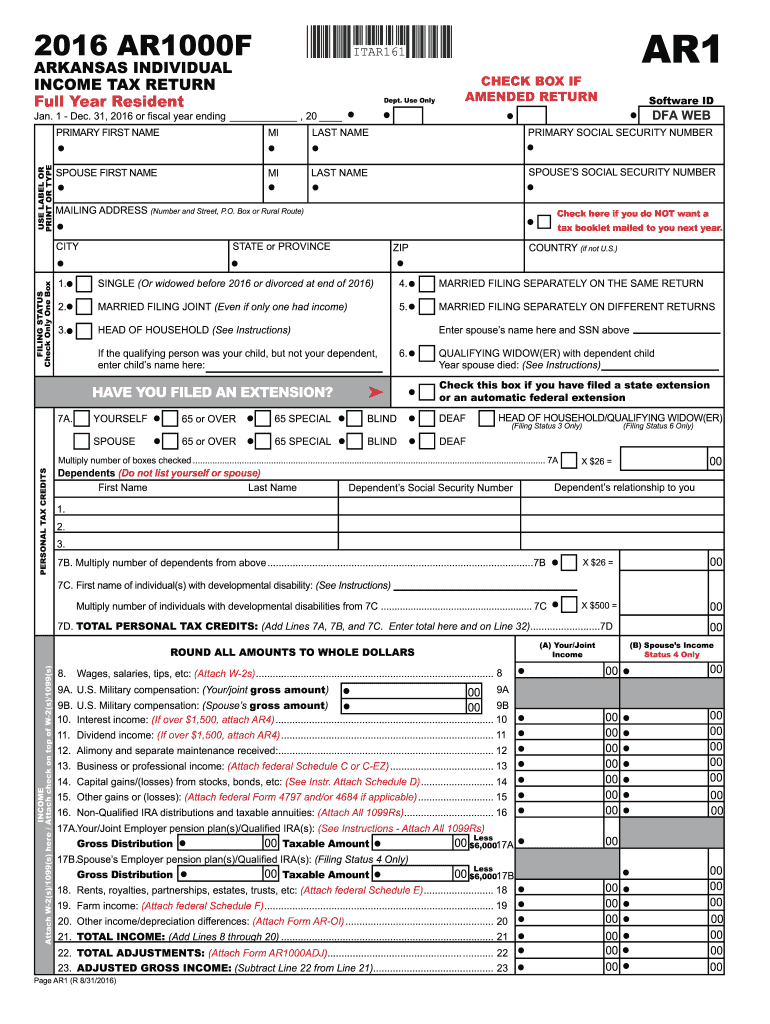

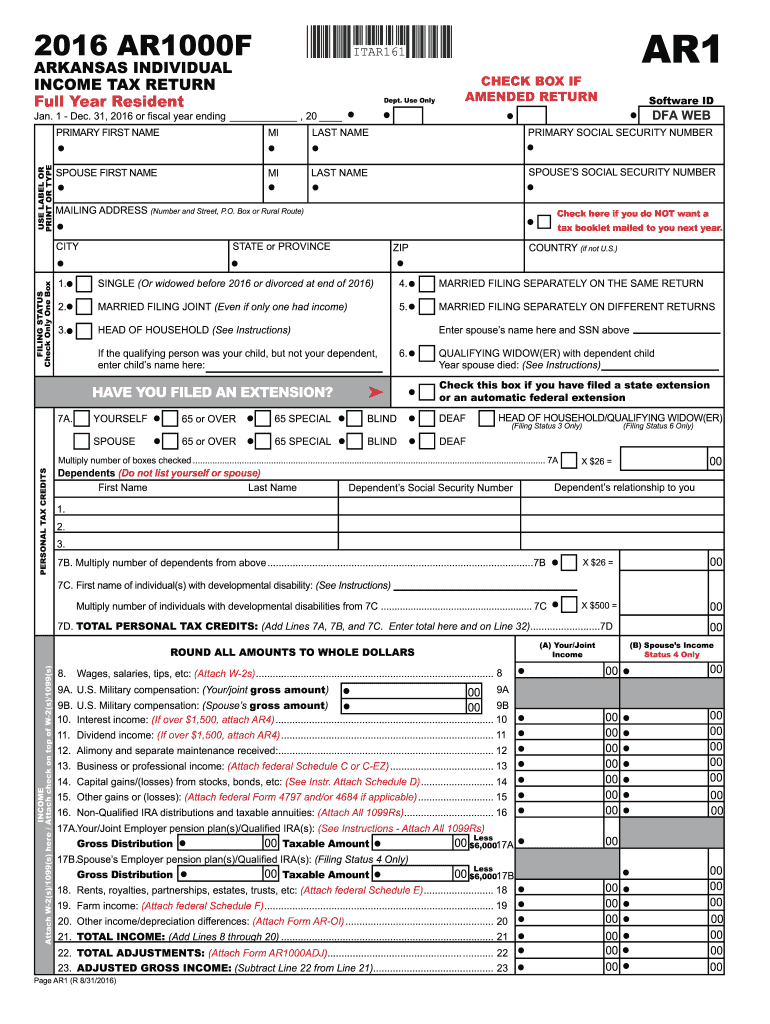

AR DFA AR1000F 2016 free printable template

Show details

19 20. Other income/depreciation differences Attach Form AR-OI. 20 21. 727 / 1 20 Add Lines 8 through 20. 21 22. 727 / -8670 176 Attach Form AR1000ADJ. 22 23. -867 5266 1 20 Subtract Line 22 from Line 21. 23 Page AR1 R 8/31/2016 Primary SSN - - A PAYMENTS TAX COMPUTATION 25. 36 Arkansas income tax withheld Attach state copies of W-2 and/or 1099R Form s. 37 Estimated tax paid or credit brought forward from 2015. TOTAL DUE 50C 50A. UEP Attach Form AR2210 or AR2210A. If required enter exception...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR DFA AR1000F

Edit your AR DFA AR1000F form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR DFA AR1000F form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AR DFA AR1000F online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit AR DFA AR1000F. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR DFA AR1000F Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR DFA AR1000F

How to fill out AR DFA AR1000F

01

Obtain the AR DFA AR1000F form from the Arkansas Department of Finance and Administration website or local office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate your filing status (e.g., single, married, head of household).

04

Report your total income for the year from all sources.

05

Deduct any allowable exemptions and credits as outlined in the instructions.

06

Calculate your total tax liability using the provided tax table or formula.

07

Fill out any additional schedules or attachments as required by your specific tax situation.

08

Review your form for accuracy and completeness.

09

Sign and date the form.

10

Submit the completed form to the Arkansas Department of Finance and Administration by the due date.

Who needs AR DFA AR1000F?

01

Individuals or businesses who reside in Arkansas and have taxable income to report.

02

Taxpayers who need to comply with state income tax filing requirements.

03

Anyone who has received income that is subject to Arkansas state tax.

Instructions and Help about AR DFA AR1000F

Fill

form

: Try Risk Free

People Also Ask about

Where to get Arkansas tax forms?

State Tax Forms In Person: Arkansas Revenue Office, 206 Southwest Drive, Jonesboro, AR. Phone: Arkansas Revenue Office, 870-932-2716 (Jonesboro) 1-800-882-9275 (Little Rock) Email: Individual.Income@rev.state.ar.us.

What is a AR1000F tax form?

AR1000F, Page 1 (R 7/21/2022) 2022 AR1000F. ARKANSAS INDIVIDUAL. INCOME TAX RETURN. Full Year Resident.

Is Arkansas eliminating state income tax?

(AP) — Republican Gov. Sarah Huckabee Sanders on Monday signed into law a measure cutting individual and corporate income taxes in Arkansas by $124 million a year. Sanders signed the bill she and legislative leaders backed that will cut the top individual income tax rate to 4.7% from 4.9%.

How do I fill out a 2019 tax return?

0:00 10:52 How to fill out 2019 Form 1040 Tax Return line by line instructions YouTube Start of suggested clip End of suggested clip This is the top portion of form 1040. At the top of the form check your filing status in our exampleMoreThis is the top portion of form 1040. At the top of the form check your filing status in our example you are single. But if you are one of the other filing statuses. This video will still be helpful.

What is the AR1000F form?

AR1000F, Page 1 (R 7/21/2022) 2022 AR1000F. ARKANSAS INDIVIDUAL. INCOME TAX RETURN. Full Year Resident.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AR DFA AR1000F for eSignature?

Once your AR DFA AR1000F is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out the AR DFA AR1000F form on my smartphone?

Use the pdfFiller mobile app to complete and sign AR DFA AR1000F on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit AR DFA AR1000F on an Android device?

You can make any changes to PDF files, such as AR DFA AR1000F, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is AR DFA AR1000F?

The AR DFA AR1000F is a form used by the Arkansas Department of Finance and Administration for reporting income tax information.

Who is required to file AR DFA AR1000F?

Individuals, businesses, and entities that earn income in Arkansas and are subject to Arkansas state income tax are required to file the AR DFA AR1000F.

How to fill out AR DFA AR1000F?

To fill out the AR DFA AR1000F, taxpayers must provide their personal and business information, report total income, deductions, and credits, and calculate their tax liability according to the guidelines provided by the Arkansas Department of Finance and Administration.

What is the purpose of AR DFA AR1000F?

The purpose of the AR DFA AR1000F is to ensure compliance with state tax laws by collecting the necessary income tax information for individuals and businesses in Arkansas.

What information must be reported on AR DFA AR1000F?

The information that must be reported on the AR DFA AR1000F includes the taxpayer's personal details, income sources, total income, allowable deductions, tax credits, and the calculated tax due or refund amount.

Fill out your AR DFA AR1000F online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR DFA ar1000f is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.