NY C-4.0 2015 free printable template

Show details

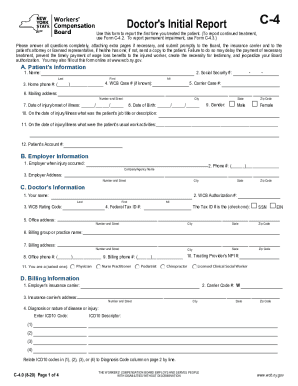

C-4 Doctor's Initial Report Use this form to report the first time you treated the patient. (To report continued treatment, use Form C-4.2. To report permanent impairment, use Form C-4.3.) Please

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your c 4 0 2015 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your c 4 0 2015 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit c 4 0 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit doctor report form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

NY C-4.0 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out c 4 0 2015

How to fill out c 4 0?

01

Begin by gathering all the necessary information and documentation required for filling out form c 4 0.

02

Carefully read and understand the instructions provided with the form to ensure accurate completion.

03

Start by entering your personal information, such as your name, address, and contact details, in the designated fields.

04

Proceed to provide any additional details or information requested, such as your social security number or tax identification number.

05

Complete the form by accurately answering all the questions and providing any necessary supporting documentation.

06

Double-check all the information you have entered to ensure it is correct and complete.

07

Review the form one final time to ensure you have not missed any sections or made any mistakes.

08

Sign and date the form as required.

09

Submit the filled-out c 4 0 form by the designated method, whether it is through mail, online submission, or by hand delivery.

Who needs c 4 0?

01

Organizations or individuals applying for tax-exempt status under section 501(c)(4) of the Internal Revenue Code may need to fill out form c 4 0.

02

These organizations typically engage in social welfare activities and want to establish themselves as tax-exempt entities.

03

Form c 4 0 is used to apply for a determination letter from the IRS, confirming the organization's eligibility for tax-exempt status.

04

It is essential to accurately fill out and submit form c 4 0 to initiate the application process and provide all necessary information to the IRS for evaluation.

Fill doctor report form : Try Risk Free

People Also Ask about c 4 0

Where is NCR formula used?

What is nPr formula?

How do you calculate nCr?

How to calculate 5C3?

How to solve 4C2?

What is 4C0 equal to?

What is 4c4?

How to calculate 4C0?

What is the value of 4C4?

What is the value of nC0?

What is NCR formula called?

What is the value of 4C0?

How do you solve a 4C4 combination?

What is 4C1?

How to solve 4p2?

What is NCR in algebra?

How do you solve 4C0 combination?

What is the formula of nCr?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is c 4 0?

The value of C 4 0 is 1.

Who is required to file c 4 0?

Form C-4 is typically used to file quarterly wage and withholding information for employers in certain states, such as New York. It is required to be filed by employers who are subject to state income tax withholding and have employees in those states.

How to fill out c 4 0?

To fill out Form C-40, you must follow these steps:

1. Start by downloading Form C-40 from the official website of the relevant government agency or department.

2. Gather all the necessary information and supporting documents required to complete the form. This may include your personal information, social security number (SSN), tax identification number (TIN), employment details, and any other related information.

3. Review the instructions provided with the form to understand the requirements and ensure you have all the necessary information ready.

4. Begin by filling out the identification section, which typically requires your name, address, SSN, and TIN.

5. Complete the sections that pertain to your income, deductions, and credits accurately. This might involve reporting your wages, self-employment income, investment income, and any other applicable forms of income.

6. Proceed to the adjustments section, where you can claim deductions or adjustments to your income, such as student loan interest, self-employment taxes, or contributions to retirement accounts.

7. Calculate your total income, deductions, and taxable income as instructed on the form.

8. Move on to the section for claiming tax credits, such as child tax credit, education credits, or earned income credit. Follow the instructions provided and fill in the necessary details accurately.

9. Calculate your total tax liability based on the information provided. If you have already made tax payments or have other applicable credits, ensure they are appropriately accounted for to determine your final tax owed or refund.

10. Complete the bottom section of the form, which typically requires your signature and date.

11. Before submitting the form, review all the information you have provided to ensure accuracy and double-check that you have not missed anything. Consider making copies of the completed form for your records.

12. Submit the completed and signed Form C-40 to the appropriate government agency as indicated in the instructions. Ensure you follow any additional filing requirements, such as attaching copies of supporting documents or including any necessary fee payments.

Note: The specific instructions for filling out Form C-40 may vary depending on your jurisdiction and the purpose of the form. It is important to refer to the detailed instructions provided with the form to ensure accurate completion.

What is the purpose of c 4 0?

It is unclear what "c 4 0" refers to without any context. It might not have a specific purpose. Please provide more information or clarify the question.

What information must be reported on c 4 0?

Form 990 is the reporting form for tax-exempt organizations, including certain social welfare organizations known as 501(c)(4) organizations. The information that must be reported on Form 990 for a 501(c)(4) organization includes:

1. Basic Information: The name, address, and Employer Identification Number (EIN) of the organization.

2. Revenue: Details about the organization's revenue, including contributions, program service revenue, investment income, and other sources of revenue.

3. Expenses: A breakdown of the organization's expenses, including program service expenses, fundraising expenses, administrative expenses, and other expenses.

4. Activities: Description of the organization's activities, accomplishments, and programs during the reporting period.

5. Governance and Leadership: Information about the organization's governing body, officers, directors, and key employees.

6. Compensation: Disclosure of compensation paid to the organization's officers, directors, and key employees.

7. Grants and Assistance: Information about the organization's grants, scholarships, and other forms of assistance provided during the reporting period.

8. Public Support: Details about the organization's sources of public support and whether it meets the public support test.

9. Lobbying Activities: Reporting on the organization's lobbying activities, including direct and grassroots lobbying expenses.

10. Financial Statements: Submission of audited financial statements, if the organization's annual gross receipts exceed a certain threshold.

These are some of the key areas that must be reported on Form 990 for a 501(c)(4) organization. However, it is important to note that the form contains various schedules and additional reporting requirements that may pertain to specific organizations, depending on their activities and financial situation.

What is the penalty for the late filing of c 4 0?

The penalty for late filing of a Form 1040 (not C 4 0) can vary depending on individual circumstances. Generally, if you fail to file your federal income tax return by the deadline (typically April 15th), you may be subject to a penalty for late filing.

The penalty for late filing is usually 5% of the unpaid taxes for each month the return is late, up to a maximum of 25% of the unpaid taxes. However, if you file your return more than 60 days after the due date, the minimum penalty is either $435 or 100% of the unpaid tax, whichever is less.

It is important to note that the penalties for late filing may differ in certain situations, such as if you have a valid extension or if you are owed a refund. It is recommended to consult with a tax professional or refer to official IRS guidelines for accurate information pertaining to your specific circumstances.

Where do I find c 4 0?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the doctor report form in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for signing my workers compensation c4 form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your doctor report form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit doctor initial on an Android device?

You can edit, sign, and distribute c 4 0 form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your c 4 0 2015 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Workers Compensation c4 Form is not the form you're looking for?Search for another form here.

Keywords relevant to workers compensation c4 form

Related to doctor initial

If you believe that this page should be taken down, please follow our DMCA take down process

here

.