Get the free CT23 Schedule 113 - Ministry of Finance - fin gov on

Show details

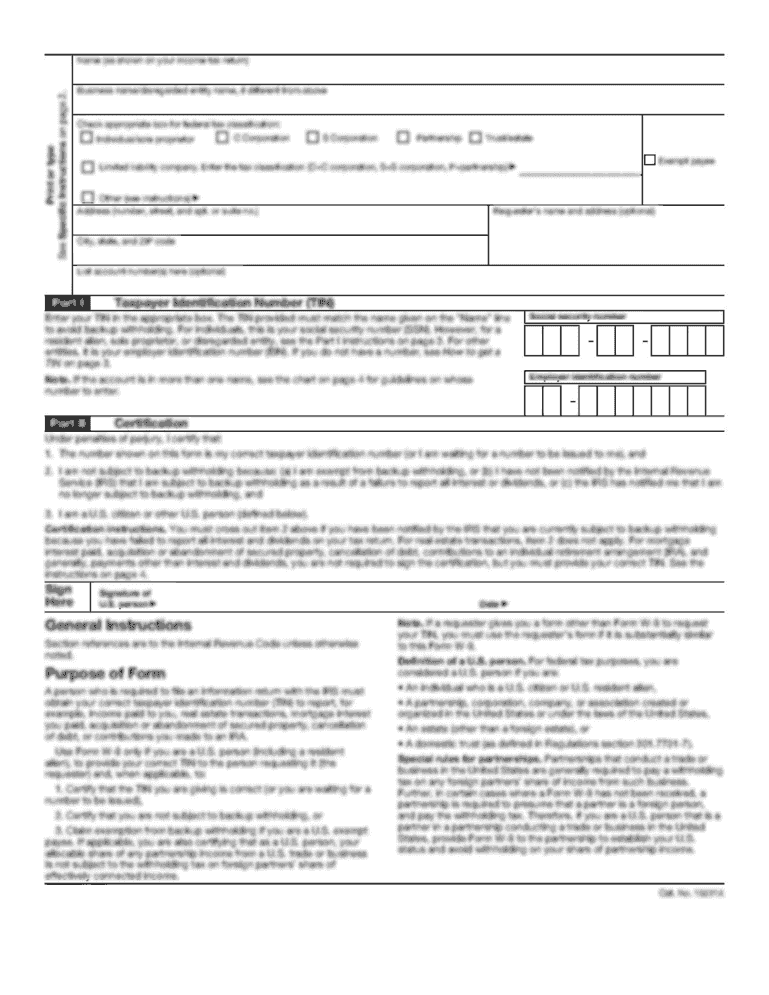

Ministry of Finance Corporations Tax 33 King Street West PO Box 620 Oshawa ON L1H 8E9 Cooperative Education Tax Credit (ETC) CT23 Schedule 113-Page 1 of 2 Corporations s Legal Name Ontario Corporations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ct23 schedule 113 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct23 schedule 113 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct23 schedule 113 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ct23 schedule 113. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

How to fill out ct23 schedule 113

How to fill out ct23 schedule 113:

01

Start by gathering all the necessary information and documents needed to complete the form. This may include your company's financial records, profit and loss statements, and other relevant financial information.

02

Fill in your company's basic information, such as its name, address, and tax identification number, in the designated fields on the form.

03

Provide details about your company's business activities, such as the type of products or services it offers, the markets it operates in, and any relevant industry codes.

04

Enter the financial information required by the form, such as your company's revenue, expenses, and net income. Make sure to provide accurate and up-to-date figures.

05

Complete any additional sections or schedules that may be applicable to your company's situation. Review the instructions provided with the form to ensure that you're filling out all the necessary sections correctly.

06

Double-check all the information you've entered on the form for accuracy and completeness. Any errors or omissions may result in delays or penalties.

07

Once you're satisfied with the accuracy of the form, sign and date it as required. If necessary, have it reviewed and signed by a designated company representative or tax professional.

08

Keep a copy of the completed form and any supporting documents for your records. Make sure to submit the form within the designated timeframe to the appropriate tax authorities.

Who needs ct23 schedule 113?

01

Companies operating in Canada that are required to file corporate income tax returns may need to submit ct23 schedule 113.

02

This schedule is specifically applicable to corporations that have investment income from foreign sources, such as dividends, interest, or capital gains.

03

The purpose of ct23 schedule 113 is to report and calculate the federal and provincial taxes payable on the foreign investment income earned by the corporation.

04

Companies that have significant foreign investment income or engage in international business transactions are more likely to require this schedule.

05

It's important to consult with a tax professional or refer to the Canada Revenue Agency (CRA) guidelines to determine if your company needs to file ct23 schedule 113. The filing requirements may vary based on the specific circumstances of your business.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ct23 schedule 113?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the ct23 schedule 113. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in ct23 schedule 113 without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing ct23 schedule 113 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I edit ct23 schedule 113 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing ct23 schedule 113.

Fill out your ct23 schedule 113 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.