Get the free 2013 Personal Property Tax Forms - Kentucky: Department of ... - revenue ky

Show details

61A500(P)(10-12) 2013 PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS FOR COMMUNICATIONS SERVICE PROVIDERS AND MULTICHANNEL VIDEO PROGRAMMING SERVICE PROVIDERS * * * * * * * * * * * * * * *****************************

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2013 personal property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 personal property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2013 personal property tax online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2013 personal property tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

How to fill out 2013 personal property tax

How to fill out 2013 personal property tax:

01

Gather necessary documents: Make sure you have all the required documents such as your asset inventory, proof of ownership, and any supporting documents related to your personal property.

02

Understand the guidelines: Familiarize yourself with the guidelines and instructions provided by your local tax authority or municipality. These guidelines will provide detailed information on how to accurately fill out the 2013 personal property tax form.

03

Complete the form: Start by entering your personal information, including your name, contact details, and social security number. Ensure that all the required fields are filled out accurately.

04

Provide asset details: List all the personal property assets you own as of January 1, 2013. This can include items such as vehicles, boats, furniture, equipment, and any other taxable personal property. Include relevant details such as the make, model, year, and estimated value of each item.

05

Calculate the total value: Calculate the total value of all your personal property assets by adding up the estimated value of each item.

06

Determine exemptions or deductions: Check if there are any exemptions or deductions available for certain types of personal property. Some jurisdictions may provide exemptions for assets used for specific purposes or certain types of businesses. Make sure to accurately apply any exemptions or deductions as instructed.

07

Sign and submit: Once you have completed the form, review it for any errors or missing information. Sign the form as required and submit it to the designated tax authority by the specified deadline. If required, make copies for your records.

Who needs 2013 personal property tax?

01

Property owners: Any individual or entity that owned taxable personal property during the 2013 tax year is typically required to file a personal property tax return.

02

Various businesses: Both small and large businesses may need to file personal property tax returns for the assets they utilize for their operations. This includes businesses such as retail stores, restaurants, manufacturing facilities, and service providers.

03

Homeowners: In some jurisdictions, homeowners are also required to report certain personal property assets such as home appliances, furniture, or recreational equipment.

It is important to note that the criteria for who needs to file personal property tax may vary depending on the specific laws and regulations of your local jurisdiction. Consulting with a tax professional or contacting your local tax authority can provide you with accurate information regarding your specific situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

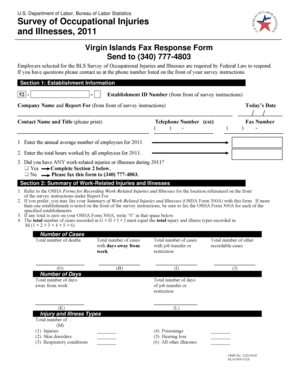

What is personal property tax forms?

Personal property tax forms are documents that individuals or businesses must fill out and submit to the tax authorities in order to report their taxable personal property.

Who is required to file personal property tax forms?

Individuals or businesses who own personal property that is subject to taxation are required to file personal property tax forms.

How to fill out personal property tax forms?

Personal property tax forms can typically be filled out either online or by mail, depending on the requirements of the tax authorities. Taxpayers must provide information about the value and type of personal property they own.

What is the purpose of personal property tax forms?

The purpose of personal property tax forms is to assess and collect taxes on personal property owned by individuals or businesses.

What information must be reported on personal property tax forms?

Taxpayers must report detailed information about their personal property, including its value, type, and any relevant exemptions or deductions.

When is the deadline to file personal property tax forms in 2023?

The deadline to file personal property tax forms in 2023 may vary depending on the location and tax authority. Taxpayers should check with their local tax authority for specific deadlines.

What is the penalty for the late filing of personal property tax forms?

The penalty for late filing of personal property tax forms may also vary depending on the location and tax authority. Taxpayers may be subject to fines or interest charges for filing their forms after the deadline.

How can I manage my 2013 personal property tax directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 2013 personal property tax and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I complete 2013 personal property tax online?

pdfFiller makes it easy to finish and sign 2013 personal property tax online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make changes in 2013 personal property tax?

With pdfFiller, it's easy to make changes. Open your 2013 personal property tax in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Fill out your 2013 personal property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.