Get the free nurse tax deduction worksheet form

Get, Create, Make and Sign

How to edit nurse tax deduction worksheet online

How to fill out nurse tax deduction worksheet

How to fill out nurse tax deduction worksheet:

Who needs nurse tax deduction worksheet:

Video instructions and help with filling out and completing nurse tax deduction worksheet

Instructions and Help about printable itemized tax deduction worksheet form

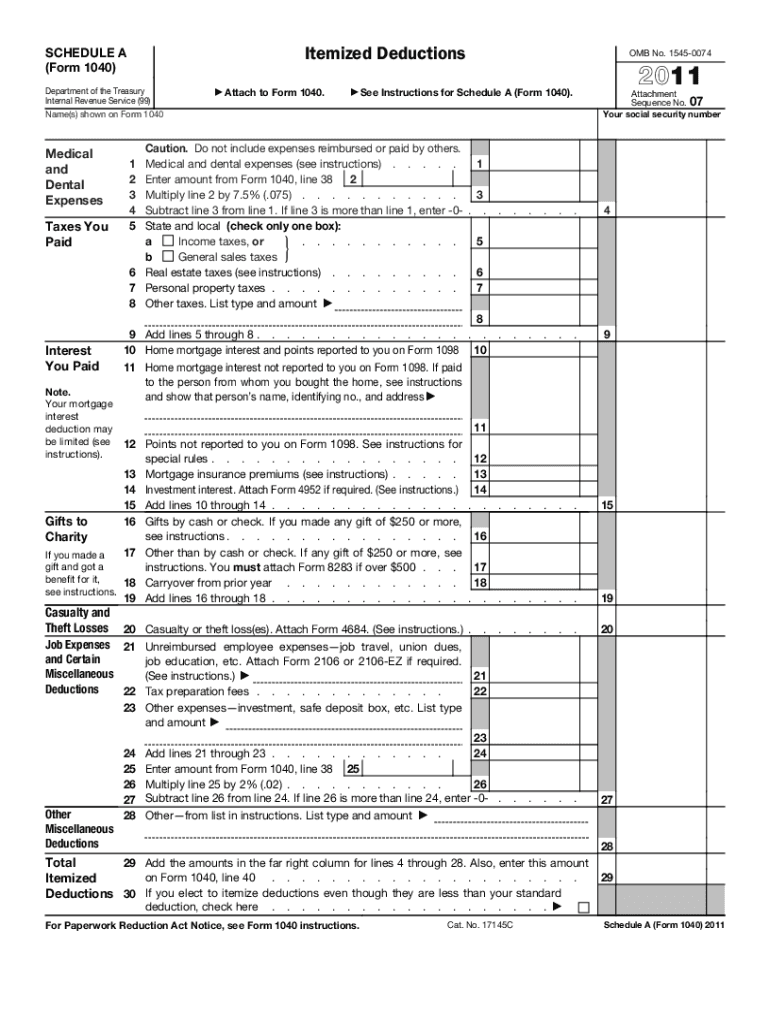

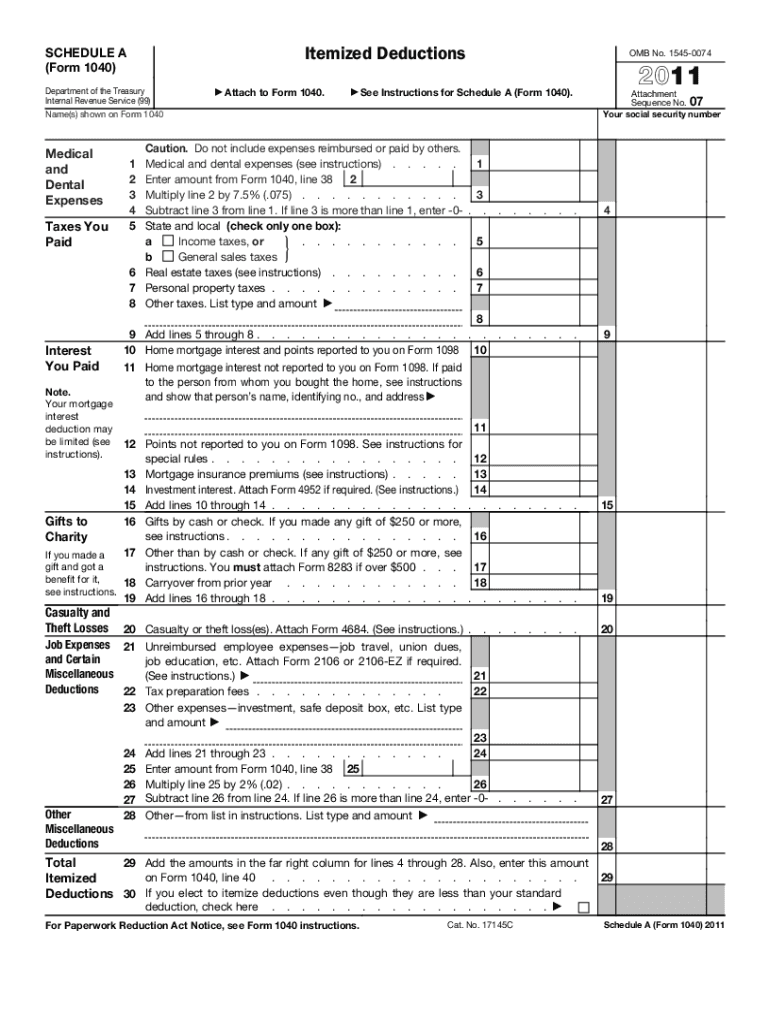

Laws dot-com legal forms guide itemized deductions form 1040 schedule a following instructional guide under the IRS will supplement these instructions step 1 you only deduct medical and dental expenses that exceed 7.5 percent of the amount on form 1040 line 38 regard the instructional guide to see what expenses you can deduct then take the following steps number to enter amount from form 1040 38 number 3 multiply line 2 by point zero seven five number four subtract line three from line one if line three is more enter zero step two check the appropriate box on line five and enter the amount then take the following steps number six includes state local and foreign taxes you paid for non-business but only if taxes are based on assessed value of the property number seven enter amount of personal property taxes number eight list other taxes and the type number nine add lines five through eight step three on line 10 enter the home mortgage interest and points reported on form 1098 then take the following steps number 11 list mortgage interest not reported on 1098 see instructions have paid to former homeowner number 12 points not reported on 1098 C instructions for special rules number 13 list amount of mortgage insurance premiums after December 31st 2006 C instructions number 14 list investment interest and attached form 49 52 C instructions number 15 add lines 10 through 14 step 4 number 16 amount for gifts by cash or check see instructions for gifts over $250 number 17 amounts for gifts not by cash or check see instructions number 18 carryover from prior year number 19 add line 16 through 18 steps 5 number 20 amount of theft or casualty losses attached form 46 84 and see instructions number 21 reimbursed employee expenses attached form 2106 or 20 106 — easy and instructions number 22 tax preparation fee number 23 other expenses number 24 add lines 21 through 23 number 25 amount from form 1040 line 38 number 26 multiply line 25 by 2% number 27 subtract lines 26 from 24 if 26 is more into zero number 28 list other miscellaneous deductions from instructions step 6 number 29 add a mountain right column 4 4 through 28 and enter amount from form 1040 line 42 watch more videos please make sure to visit laws comm

Fill itemized deductions template : Try Risk Free

People Also Ask about nurse tax deduction worksheet

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your nurse tax deduction worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.