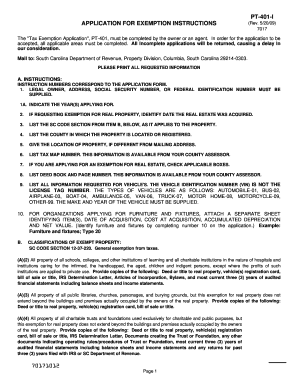

Get the free pt 401 1 sc dept of revenue fillable forms

Get, Create, Make and Sign

Editing pt 401 1 sc dept of revenue fillable forms online

How to fill out pt 401 1 sc

How to fill out pt 401 1 sc:

Who needs pt 401 1 sc:

Video instructions and help with filling out and completing pt 401 1 sc dept of revenue fillable forms

Instructions and Help about sc dept of revenue fillable form pt 401 1

Law.com legal forms guide form SC 1120 C corporation income tax return c corporations operating in South Carolina file their income taxes owed to the state with a form SC 1120 when filing you must attach a copy of your federal file 1120 or 1120 a return this state tax form can be found on the website of the South Carolina Department of Revenue step one in the box at the top left of the first page enter your filing number the end date of your income tax and license fee periods your federal employer identification number and your business name and address indicate with a check mark if there has been a change of address or accounting period dates since your last return step 2 in the box at the top right give the address of the property located in South Carolina and the name and number of a contact person in case of an audit check the box where indicated if filing a consolidated return step 3 enter your total gross receipts cost of depreciable personal property located in the state and indicate with a check mark if filing a return for a business that has been withdrawn merged reorganized or dissolved step 4 enter your total federal taxable income on line one skip to the second page to complete schedule a and B and transfer the total from line 12 there to line two on the first page step 5 follow the instructions on lines 3 through 19 to determine your total income tax liability to complete line 10 you will first need to complete schedule c on the second page step 6 follow the instructions on lines 20 through 30 to calculate total income tax and license fee liability an officer should sign and date the bottom of the first page step 7 Schedule D on the third page must be completed by all corporations schedules throw h3r for multi-state corporations only schedule j is only for corporations included in a consolidated return to watch more videos please make sure to visit laws calm

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your pt 401 1 sc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.