Get the free Gift Tax Returns - Form 709 - Philadelphia Bar Association - philadelphiabar

Show details

Get the Gift Tax Returns Form 709 Philadelphia Bar Association Philadelphia. Description. Fill & Sign Online, Print, Email, Fax, or Download. Fill Online.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gift tax returns form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift tax returns form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gift tax returns online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift tax returns. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out gift tax returns

How to fill out gift tax returns?

01

Gather necessary documents: Before starting the process of filling out gift tax returns, gather all the necessary documents including any relevant financial records, receipts, and documentation of the gifts made.

02

Understand the applicable gift tax laws: Familiarize yourself with the current gift tax laws and regulations in your country or jurisdiction. This will ensure that you accurately report the gifts and comply with any tax obligations.

03

Determine if you need to file: Not everyone is required to file gift tax returns. Generally, if you have made gifts above a certain threshold during the tax year, you may be required to file. Check the specific guidelines and exemption limits set by the tax authorities in your jurisdiction to determine if you need to file.

04

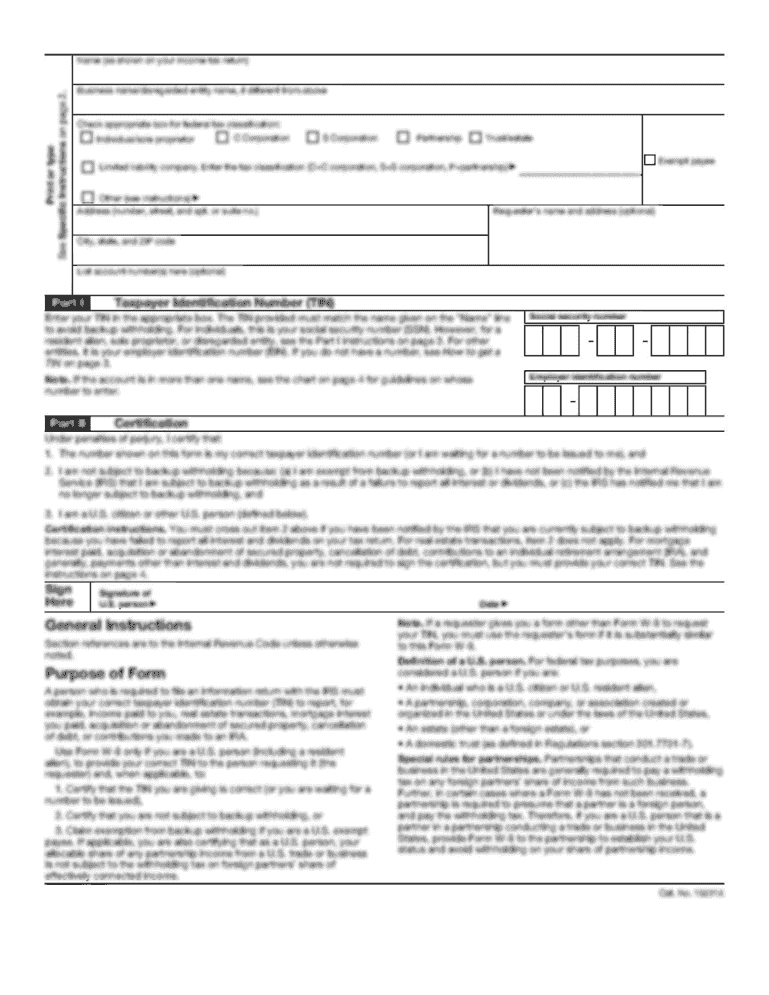

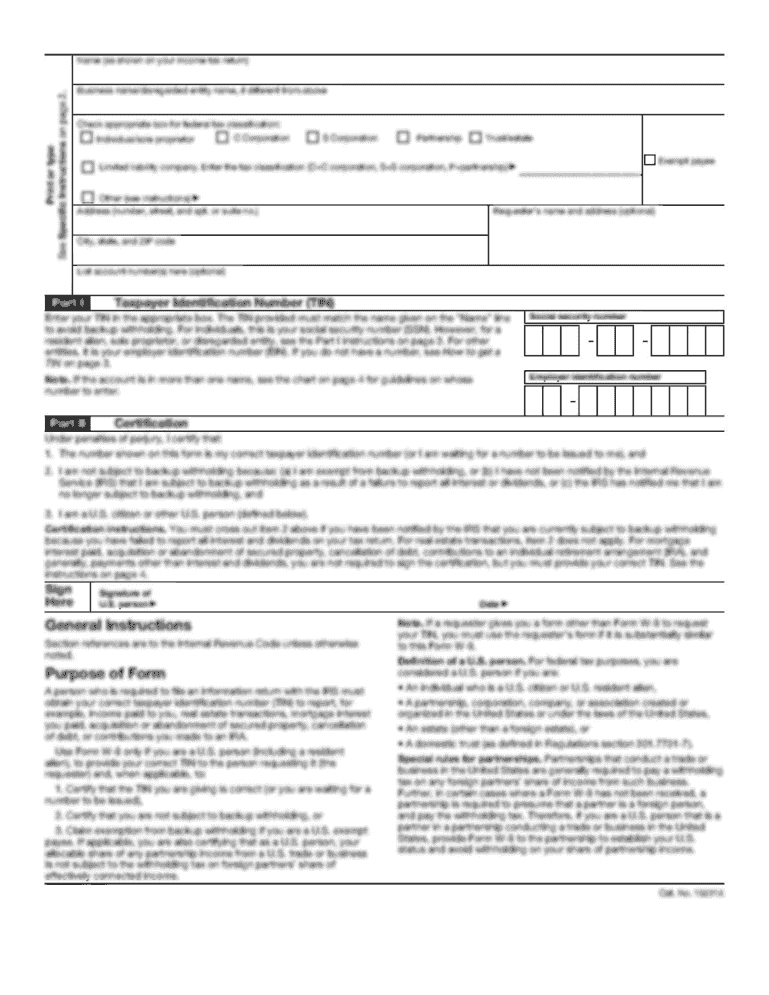

Complete the necessary forms: Obtain the appropriate gift tax return forms from the tax authority or consult with a tax professional for assistance. Fill out the forms accurately, providing all the required information such as your personal details, details of the gift recipients, descriptions of the gifts, and their respective values.

05

Calculate the gift tax: If the value of the gifts made during the tax year exceeds the gift tax exemption limit, calculate the gift tax owed using the applicable tax rates and rules. Consider consulting a tax professional or utilizing online resources for accurate calculations.

06

Report and disclose the gifts: Clearly report all the gifts made during the tax year on the gift tax return forms. Provide detailed information about each gift, including the recipient's name, relationship to the donor, and the fair market value of the gift at the time it was given.

07

File and submit the returns: Once you have completed the forms and calculated the gift tax, it is time to file the gift tax return. Ensure that you carefully review the information provided before submitting the returns to avoid any errors or omissions.

Who needs gift tax returns?

01

Individuals who have made gifts exceeding the specified threshold during the tax year may need to file gift tax returns.

02

Business entities, such as corporations or partnerships, may also be required to file gift tax returns if they have made gifts that surpass the exemption limit.

03

It is important to consult the tax laws and regulations specific to your jurisdiction to determine who exactly needs to file gift tax returns, as the requirements may vary.

Note: This response provides general information and should not be considered as professional tax advice. It is always recommended to consult with a qualified tax professional for personalized guidance regarding gift tax returns.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gift tax returns?

Gift tax returns are forms that individuals must file with the IRS to report gifts that exceed the annual exclusion limit.

Who is required to file gift tax returns?

Any individual who gives gifts that exceed the annual exclusion limit is required to file gift tax returns.

How to fill out gift tax returns?

Gift tax returns can be filled out using Form 709, which requires information about the gifts given and any applicable exclusions.

What is the purpose of gift tax returns?

The purpose of gift tax returns is to ensure that individuals are properly reporting gifts that exceed the annual exclusion limit and paying any applicable gift taxes.

What information must be reported on gift tax returns?

Gift tax returns must include information about the gifts given, any exclusions claimed, and details about the donor and recipient.

When is the deadline to file gift tax returns in 2023?

The deadline to file gift tax returns in 2023 is April 15th.

What is the penalty for the late filing of gift tax returns?

The penalty for the late filing of gift tax returns is 5% of the unpaid tax amount for each month the return is late, up to a maximum of 25%.

How do I complete gift tax returns on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your gift tax returns by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I edit gift tax returns on an Android device?

You can make any changes to PDF files, like gift tax returns, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I complete gift tax returns on an Android device?

On an Android device, use the pdfFiller mobile app to finish your gift tax returns. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your gift tax returns online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.