Get the free 2013 tax relief application - Fairfax County Government - fairfaxcounty

Show details

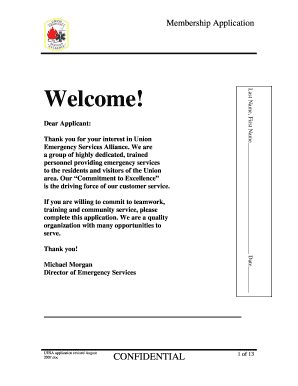

2013 Desiree M. Baltimore, Manager, Tax Relief Section Department of Tax Administration 703-222-8234 tax relief fairfaxcounty.gov TTY: 703-222-7594 APPLICATION FOR TAX RELIEF COUNTY OF FAIRFAX DEPARTMENT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2013 tax relief application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 tax relief application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2013 tax relief application online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2013 tax relief application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out 2013 tax relief application

How to fill out 2013 tax relief application:

01

Gather all necessary documents such as W-2 forms, 1099 forms, and any other relevant tax documents from the year 2013.

02

Download or obtain a copy of the 2013 tax relief application form. You can usually find this form on the official website of the tax authority or by visiting a local tax office.

03

Carefully read and understand the instructions provided with the application form. Make sure you have a clear understanding of what information is required and how it should be filled.

04

Start filling out the application form by entering your personal information, such as your name, address, and social security number. Ensure the accuracy of this information to avoid any complications in the processing of your application.

05

Move on to the income section of the form. Enter all relevant income information from the year 2013, including wages, self-employment income, rental income, investment income, etc. Double-check the accuracy of these figures before proceeding.

06

If you are eligible for any deductions or credits, make sure to include them in the appropriate sections of the form. This may include deductions for health expenses, education expenses, or energy-efficient purchases, among others. Refer to official tax guidelines or consult with a tax professional if you are unsure about eligible deductions or credits.

07

Complete the tax liability section of the form by calculating the amount you owe or the refund you are entitled to. Carefully review your calculations to ensure accuracy.

08

Attach all necessary supporting documents requested by the application form. This may include copies of relevant tax forms, receipts, or any other documentation that supports the information you provided.

09

Sign and date the application form, declaring that the information provided to the best of your knowledge is accurate and complete.

10

Make a copy of the completed application form and all supporting documents for your records.

Who needs 2013 tax relief application:

01

Individuals or businesses who experienced financial hardships or losses during the year 2013 and meet the criteria for tax relief may need to fill out a 2013 tax relief application.

02

Individuals who qualify for specific tax credits, deductions, or exemptions related to the year 2013 may also require this application to claim these benefits.

03

Applicants who need to amend their 2013 tax returns or request adjustments to their tax liability for that year may need to submit a 2013 tax relief application. It is essential to consult with a tax professional or review the official guidelines to determine if you qualify for tax relief and need to fill out this application form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax relief application?

Tax relief application is a formal request submitted to the government to seek relief from paying certain taxes or to reduce the amount of taxes owed.

Who is required to file tax relief application?

Individuals or businesses who qualify for tax relief based on specific criteria set by the government are required to file a tax relief application.

How to fill out tax relief application?

To fill out a tax relief application, individuals or businesses must provide personal or financial information requested on the application form accurately and completely.

What is the purpose of tax relief application?

The purpose of a tax relief application is to help individuals or businesses reduce their tax burden or seek relief from specific taxes based on their financial situation or other qualifying factors.

What information must be reported on tax relief application?

Tax relief applications typically require information such as income, expenses, deductions, credits, and any other relevant financial details that may determine eligibility for relief.

When is the deadline to file tax relief application in 2023?

The deadline to file tax relief application in 2023 is typically determined by the government agency responsible for processing tax relief applications.

What is the penalty for the late filing of tax relief application?

The penalty for the late filing of a tax relief application may vary depending on the specific tax relief program or the regulations set by the government. It is important to file the application on time to avoid penalties.

How can I modify 2013 tax relief application without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including 2013 tax relief application, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Where do I find 2013 tax relief application?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the 2013 tax relief application in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit 2013 tax relief application on an Android device?

The pdfFiller app for Android allows you to edit PDF files like 2013 tax relief application. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your 2013 tax relief application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.