Get the free Form 550 - first tuesday - firsttuesday

Show details

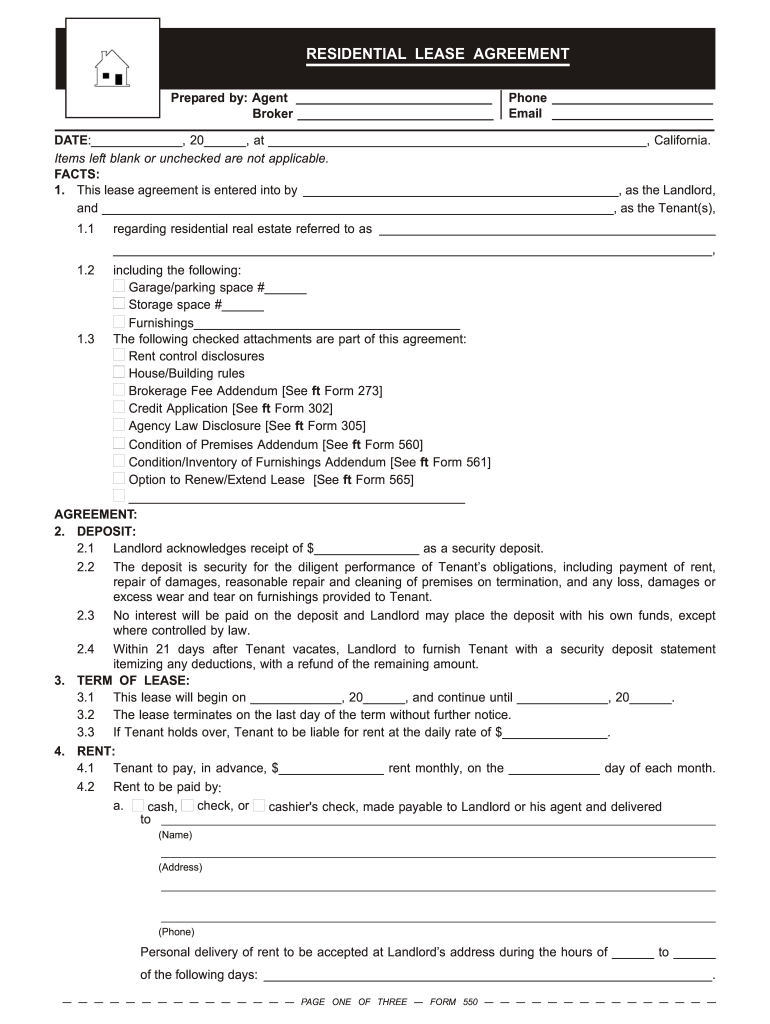

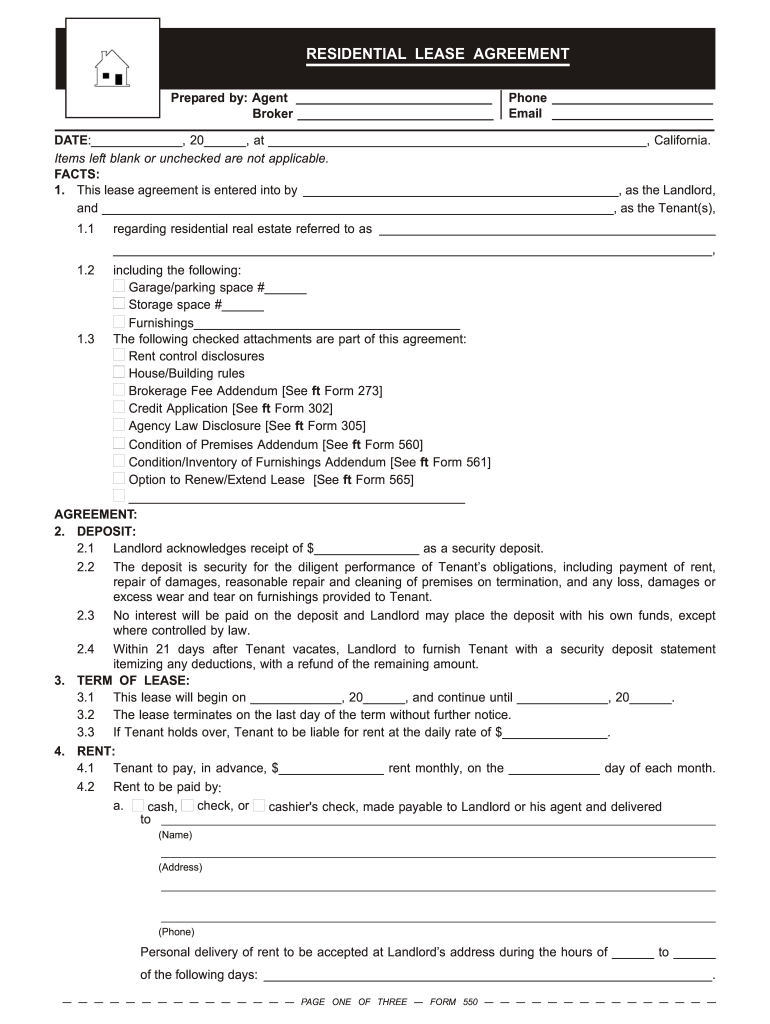

RESIDENTIAL LEASE AGREEMENT Prepared by: Agent Broker Phone Email DATE:, 20, at, California. Items left blank or unchecked are not applicable. FACTS: 1. This lease agreement is entered into by, as

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 550 - first form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 550 - first form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 550 - first online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 550 - first. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

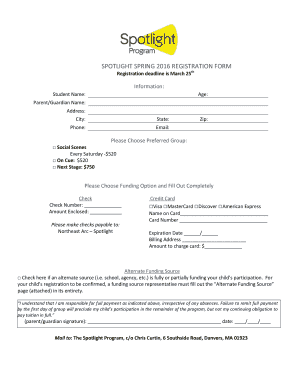

How to fill out form 550 - first

How to fill out form 550 - first:

01

Gather all the necessary information and documents required to complete the form.

02

Carefully read the instructions provided with the form to understand the specific requirements and guidelines.

03

Start by filling out the personal information section, including your name, address, and contact details.

04

Provide the relevant financial information as requested in the form, such as income, expenses, and any other relevant financial details.

05

Double-check all the entered information for accuracy and completeness.

06

Sign and date the form as required.

07

Make a copy of the completed form for your records before submitting it.

Who needs form 550 - first:

01

Individuals or businesses who are eligible for certain tax deductions, credits, or exclusions.

02

Those who have sold or exchanged property, received income from foreign sources, or made contributions to an individual retirement account.

03

Anyone who needs to report their income and financial information to the Internal Revenue Service (IRS) for the specific purposes outlined in form 550 - first.

Fill form : Try Risk Free

People Also Ask about form 550 - first

How many days notice does a landlord need to give in California?

Do I have rights as a tenant without a lease in California?

Can I give 30 days notice in the middle of the month California?

What is the 30 day notice to vacate in Minnesota?

What are your rights as a tenant without a lease in California?

Can I be evicted without a lease in California?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 550 - first?

Form 550 is a U.S. Internal Revenue Service (IRS) form used for reporting the wages and taxes withheld for employees who are nonresident aliens. It is known as the "Statement of Income Tax Withheld for Foreign Residents of the United States" and is filed by employers who have nonresident alien employees working in the United States. The form helps the IRS track the income and taxes paid by these employees, ensuring compliance with tax laws and regulations.

Who is required to file form 550 - first?

Form 550 is not a specific form that is required to be filed by any specific individual or entity. It is likely that you are referring to a different form number or a specific form related to a particular tax, financial, or informational filing requirement. Please provide more details or clarify your query so that I can provide a more accurate response.

How to fill out form 550 - first?

To begin filling out IRS Form 550, it is essential to gather all the required information and documents. Form 550 is typically used by corporations and partnerships to report income, deductions, credits, and other pertinent information for tax purposes. Here are the steps to fill it out:

1. Header section:

- Provide the information regarding the corporation or partnership, including the name, address, and employer identification number (EIN).

- Specify the tax year that the form is being filed for.

2. Part I: Income:

- Report the corporation or partnership's gross receipts, sales, or revenues received during the tax year.

- Include any returns and allowances, cost of goods sold, and other adjustments like an allocation of income or deductions.

3. Part II: Deductions:

- Detail various deductible expenses such as employee wages, rent, utilities, interest, professional fees, taxes, etc.

- Attach any necessary schedules or additional documentation, depending on the nature and complexity of deductions.

4. Part III: Tax computation:

- Calculate the tax liability based on the information provided in Part I and II.

- Utilize the tax rate schedule mentioned in the instructions for Form 550.

5. Part IV: Credits:

- Enter the applicable tax credits, if eligible, such as general business credits, investment credits, etc.

- Ensure that any necessary supporting documentation or schedules are attached.

6. Part V: Other information:

- Provide any additional required information or disclosures relevant to the corporation or partnership.

- This section may include information about accounting methods, environmental tax information, tax-exempt organizations, etc.

7. Signature:

- Sign and date the form based on the authorized capacity (e.g., corporate officer, partner), including providing the name and title.

- If the return is prepared by a tax professional, they should also sign and provide their Preparer Tax Identification Number (PTIN).

Before submitting the completed Form 550, review it thoroughly to ensure accuracy and check if any additional forms or schedules need to be attached. It is advisable to consult a tax professional or refer to the IRS instructions for a more detailed understanding of the form and any specific requirements that may apply.

What is the purpose of form 550 - first?

Form 550-First is not a recognized form in the United States tax system. It may be a typographical error or a form specific to a particular organization or entity. Without additional information, it is impossible to determine the purpose of this specific form.

What information must be reported on form 550 - first?

Form 550 refers to Form 5500, the Annual Return/Report of Employee Benefit Plan. This form is used to report information about employee benefit plans, including pension and welfare plans, to the Internal Revenue Service (IRS) and the Department of Labor (DOL). The information that must be reported on Form 5500 includes:

1. Basic plan information: This includes details such as plan name, plan sponsor's name and address, plan administrator's name and address, Employer Identification Number (EIN), plan year, etc.

2. Financial information: This section requires reporting the plan's financial condition, including the value of plan assets, contributions made by both employers and employees, expenses, reimbursements, distributions, and any income earned by the plan.

3. Participant information: This section includes details about the number of participants in the plan, their age ranges, participation in the plan, etc.

4. Insurance information: If the plan has any insurance policies, details such as the name of the insurance carrier, premiums paid, covered benefits, etc., need to be reported.

5. Trust information: If the plan holds assets in a trust, information about the trustee(s) and copies of the trust agreement need to be submitted.

6. Service provider information: Information about service providers such as investment managers, administrators, consultants, etc., must be reported.

7. Compliance information: Compliance questions related to various legal requirements and regulations must be answered.

It's important to note that the specific information required on Form 5500 may vary depending on the type of plan, plan size, and whether the plan is subject to ERISA (Employee Retirement Income Security Act). Additionally, there are different versions of Form 5500 (5500-SF, 5500-EZ) depending on the size and type of the plan.

When is the deadline to file form 550 - first in 2023?

The deadline to file Form 550 - First for the year 2023 would typically be April 17th, 2023. However, it is important to note that tax deadlines may vary depending on specific circumstances and changes in tax laws. Therefore, it is advisable to consult the IRS or a tax professional to obtain accurate and updated information regarding filing deadlines.

What is the penalty for the late filing of form 550 - first?

The penalty for late filing of Form 550-First can vary depending on the jurisdiction and the specific circumstances. It is best to refer to the rules and regulations set by the governing authority in your jurisdiction or consult with a tax professional for accurate information on the penalties.

How do I execute form 550 - first online?

Easy online form 550 - first completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit form 550 - first online?

The editing procedure is simple with pdfFiller. Open your form 550 - first in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out form 550 - first on an Android device?

On an Android device, use the pdfFiller mobile app to finish your form 550 - first. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your form 550 - first online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.