Get the free Best Practices in Receipt Writing - Massage Therapy Association of ...

Show details

Canadian Life and Health Insurance Association Inc. Association Canadian DES companies d?assurances DE personnel inc. Service Provider Receipt Best Practices for Group Insurance Reimbursement The

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your best practices in receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your best practices in receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit best practices in receipt online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit best practices in receipt. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

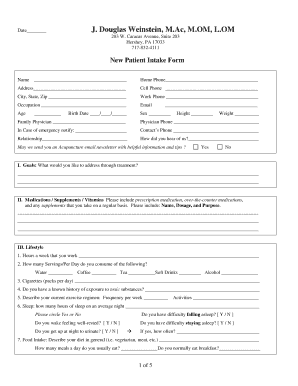

How to fill out best practices in receipt

01

The first step in filling out best practices in a receipt is to clearly identify the seller and the buyer. This includes providing the names, addresses, and contact information of both parties involved.

02

Next, accurately list the items or services that were purchased or provided. Include a description of each item or service, along with the quantity and price for each.

03

It is essential to calculate and include any applicable taxes or fees in the receipt. This ensures transparency and helps the buyer understand the total cost of their purchase.

04

Date the receipt with the exact day and time of the transaction. This information is crucial for record-keeping purposes and can be helpful in case of any disputes or warranty claims.

05

In addition to the basic details, it is important to mention any payment terms or methods used. Specify whether the payment was made in cash, credit card, online transfer, or any other form.

06

Provide a breakdown of any discounts, coupons, or promotional offers applied. This helps the buyer understand how the final price was calculated and adds transparency to the transaction.

07

Finally, make sure to include an area for both the seller and the buyer to sign and date the receipt. This serves as proof of purchase and allows both parties to acknowledge the transaction's completion.

Who needs best practices in receipt?

01

Any business or individual involved in selling goods or providing services can benefit from following best practices in receipt. This includes retail stores, restaurants, freelancers, contractors, and service providers of all kinds.

02

Customers or clients who value proper record-keeping and professionalism also appreciate receiving well-documented receipts. These receipts serve as proof of purchase, may be needed for tax purposes, and can be important for warranty claims or future references.

03

In addition, complying with best practices in receipt can be a legal requirement in many jurisdictions. It helps businesses maintain accurate financial records and ensures they are operating within the law.

Overall, anyone involved in financial transactions should strive to adhere to best practices in receipt to foster transparency, trust, and effective record-keeping.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is best practices in receipt?

Best practices in receipt include providing clear and detailed information about the transaction, such as date, amount, and description of goods or services.

Who is required to file best practices in receipt?

Any individual or business that conducts transactions and issues receipts is required to follow best practices in receipt.

How to fill out best practices in receipt?

Fill out a receipt with accurate and complete details of the transaction, use a template or software for consistency, and provide a copy to the customer.

What is the purpose of best practices in receipt?

The purpose of best practices in receipt is to ensure transparency, accountability, and record-keeping for financial transactions.

What information must be reported on best practices in receipt?

Information such as date of transaction, amount paid, description of goods or services, payment method, and contact information of the issuer should be reported on a receipt.

When is the deadline to file best practices in receipt in 2023?

The deadline to file best practices in receipt in 2023 is typically at the end of the tax year or fiscal year, but it may vary depending on the jurisdiction.

What is the penalty for the late filing of best practices in receipt?

The penalty for the late filing of best practices in receipt may include fines, interest charges, and potential audits by tax authorities.

How do I modify my best practices in receipt in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign best practices in receipt and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit best practices in receipt straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing best practices in receipt right away.

How do I edit best practices in receipt on an Android device?

You can make any changes to PDF files, like best practices in receipt, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your best practices in receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.