Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is nc real estate contracts?

NC real estate contracts are contracts that are used in the state of North Carolina to facilitate the purchase or sale of real estate property. These contracts outline the terms and conditions of the transaction, including the purchase price, financing arrangements, closing date, and any contingencies or conditions that need to be met.

NC real estate contracts typically include information about the property being sold, such as the address, legal description, and any known defects or issues. They also specify the responsibilities and obligations of both the buyer and the seller, such as who will pay for certain closing costs or repairs.

These contracts are legally binding documents that protect the rights and interests of both parties involved in the real estate transaction. They provide a framework for the purchase or sale of property and help ensure transparency and clarity throughout the process.

Who is required to file nc real estate contracts?

In North Carolina, both the buyer and seller are required to sign and file real estate contracts. Additionally, the real estate agent or broker involved in the transaction may also be involved in preparing and filing the contract. It is important to note that each state may have different laws and regulations regarding the filing of real estate contracts, so it is always advisable to consult with a local real estate professional or attorney for accurate and specific information.

How to fill out nc real estate contracts?

Filling out NC real estate contracts involves several steps. Here is a general guide to help you with the process:

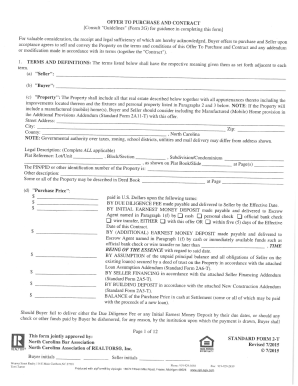

1. Obtain the necessary contract forms: Obtain the official North Carolina real estate contract forms from a reliable source such as the North Carolina Association of Realtors (NCAR). These forms are legally binding and commonly used in the state.

2. Gather information: Collect all the relevant information about the transaction, including the property details, buyer and seller information, purchase price, closing date, and any additional terms or conditions. Ensure all parties involved have agreed to these terms beforehand.

3. Complete the contract sections: Start by entering the contract's effective date, which is typically the date it is signed. Fill in the buyer's and seller's information, including their names, addresses, and contact details. Provide complete and accurate details of the property being sold, including its address, legal description, and tax identification number.

4. Specify the purchase price and financing details: Clearly state the purchase price agreed upon by the buyer and seller. Indicate how the purchase will be financed, whether through cash, a loan, or other arrangements. Include any required earnest money deposit amount and detail how it will be handled in case of default or completion of the sale.

5. Include contingencies and special conditions: NC real estate contracts often include contingencies and special conditions, such as financing contingencies, home inspection contingencies, and repair requests. Clearly state these contingencies and any specific conditions agreed upon, ensuring they are written in clear and concise terms.

6. Review and sign the contract: Carefully review the entire contract for accuracy and completeness. Ensure that all parties involved understand and agree to the terms outlined. Once satisfied, have both the buyer and seller sign and date the contract. It is advisable to have a witness present during the signing process.

7. Distribute copies: Make copies of the signed contract for all parties involved, including the buyer, seller, and their respective attorneys or real estate agents. Each party should keep a copy for their records.

8. Consult an attorney or real estate professional if needed: If you are unsure about any aspect of the contract or need legal advice, it is recommended to consult an attorney or a qualified real estate professional who is well-versed in North Carolina real estate law.

Remember, it is crucial to understand that real estate contracts can have legal implications, so it's important to ensure accuracy, clarity, and compliance with relevant laws. If in doubt, seek professional guidance.

What is the purpose of nc real estate contracts?

The purpose of North Carolina (NC) real estate contracts is to establish legally binding agreements between a buyer and a seller for the purchase or sale of a property within the state of North Carolina. These contracts define the terms and conditions of the transaction, including the purchase price, property description, financing arrangements, closing date, and other contingencies.

NC real estate contracts serve to protect the rights and interests of both parties involved in a real estate transaction. They provide a framework for negotiating and structuring the deal, ensuring that all parties have a clear understanding of their obligations and responsibilities. These contracts also provide legal remedies in case of a breach by either party.

By using a standardized contract, such as the North Carolina Association of Realtors (NCAR) standard purchase agreement, the process of buying or selling real estate becomes more transparent and consistent. It helps prevent misunderstandings and disputes that may arise during the transaction, ensuring a smoother and more efficient closing process.

What information must be reported on nc real estate contracts?

In North Carolina, real estate contracts should typically include the following information:

1. Parties: Names of the buyer(s) and seller(s) involved in the transaction.

2. Property Description: A detailed description of the property being sold, including the address, boundaries, and any improvements.

3. Purchase Price: The agreed-upon price for the property.

4. Financing Terms: If the buyer is obtaining financing, the details of the loan, including the mortgage amount, interest rate, and any contingencies related to financing.

5. Earnest Money: The amount of earnest money deposit provided by the buyer as a sign of their commitment to the purchase.

6. Closing Date: The agreed-upon date for the closing of the transaction.

7. Contingencies: Any conditions or contingencies that need to be met for the contract to remain valid, such as home inspections, financing approval, or property repairs.

8. Disclosures: Any known material defects or issues with the property that the seller must disclose to the buyer.

9. Closing Costs: A breakdown of the anticipated closing costs, including fees for title search, survey, attorney fees, and any other expenses associated with transferring the property.

10. Default and Remedies: The consequences and remedies that apply in case of default by either party.

11. Signatures: Signatures of all parties involved in the transaction, including the buyers, sellers, and real estate agents, if applicable.

It is important to note that real estate contracts can vary, and additional clauses or provisions may be included depending on the specific circumstances of the transaction. It is advisable to consult with a real estate attorney or licensed real estate professional for legal advice and to ensure compliance with all applicable laws and regulations.

What is the penalty for the late filing of nc real estate contracts?

I'm not a legal expert, but I can try to provide some general information. However, please note that real estate laws can vary by jurisdiction within North Carolina, and there may be specific regulations or penalties related to late filing of real estate contracts in the state. It is always best to consult a real estate attorney or professional for accurate and up-to-date information.

In general, the penalties for late filing of real estate contracts can vary depending on the circumstances and the governing laws. Some potential penalties could include:

1. Late filing fees: The county or state recorder's office may impose late filing fees if a real estate contract is not filed within a specified timeframe. These fees can vary depending on the county or specific requirements.

2. Voidability: Late filing of certain real estate contracts may make the contract voidable (subject to cancellation or termination). This could occur if the filing deadline is crucial for meeting legal requirements or acquiring certain rights.

3. Breach of contract: If the parties involved in the real estate contract agreed upon specific timelines for filing and one party fails to do so, it could be considered a breach of contract. The non-complying party may be held liable for any damages incurred by the other party due to the delay.

4. Legal or financial complications: Late filing may result in missed deadlines for other legal or financial obligations associated with the real estate transaction, such as mortgage financing or inspections. Failure to fulfill these obligations within the agreed timeframe could result in additional penalties or even the cancellation of the transaction.

It's important to note that penalties and consequences for late filing of real estate contracts may differ from case to case and can be impacted by local regulations and the terms set forth in the contract itself. Thus, consulting with a legal professional would be the best course of action to obtain accurate advice tailored to your specific circumstances.

How can I get nc real estate contracts?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific offer to purchase land contract nc form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in which nc standard form 2 t?

With pdfFiller, the editing process is straightforward. Open your can nc offer purchase and contract form 2 t in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete can north carolina purchase contract real estate on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your can nc offer purchase and contract form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.