Get the free PAYMENT SYSTEMS IN SINGAPORE - mas gov

Show details

PAYMENT SYSTEMS IN SINGAPORE CONTENTS List of abbreviations ..............................................................................................................390 Overview................................................................................................................................391

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

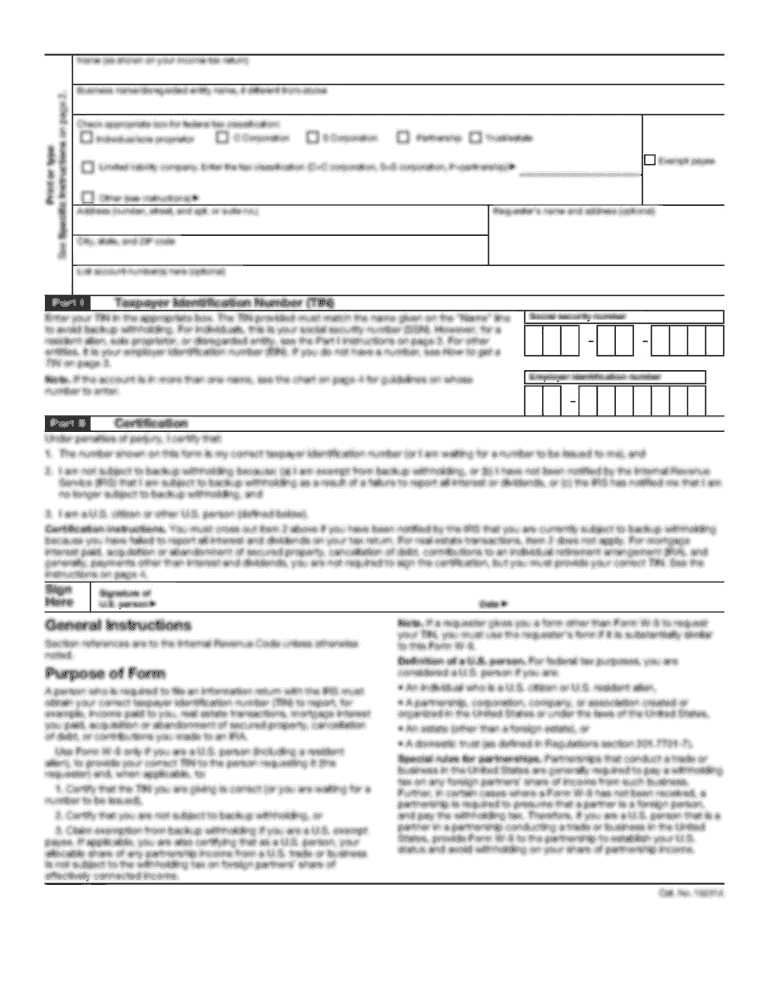

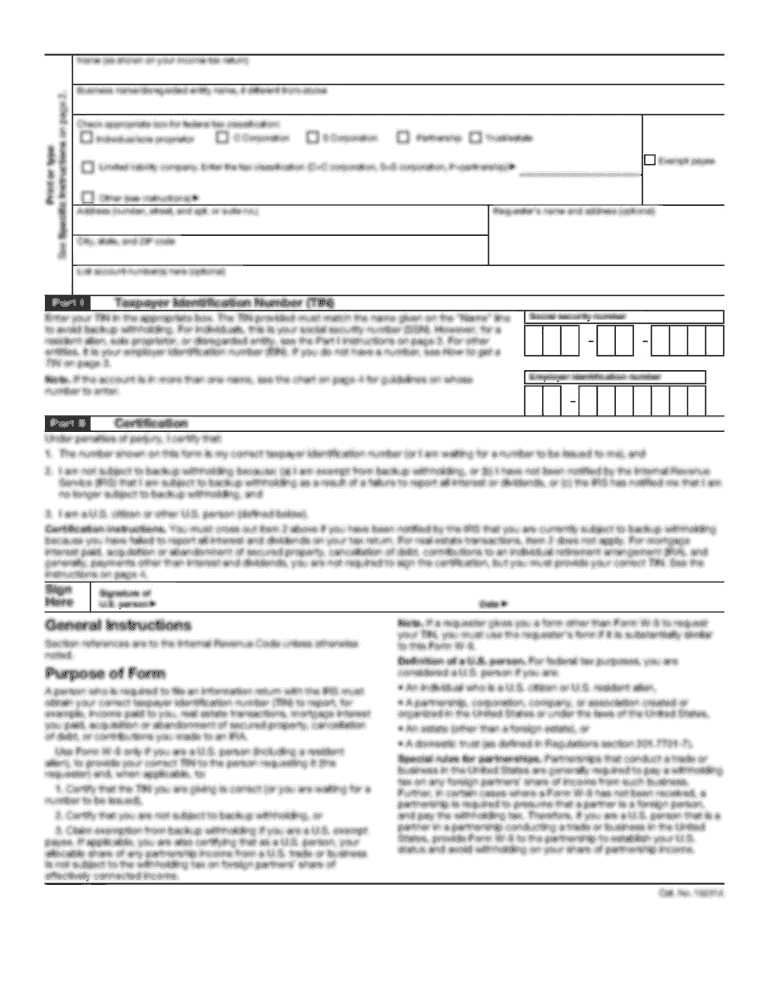

Edit your payment systems in singapore form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payment systems in singapore form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payment systems in singapore online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit payment systems in singapore. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

How to fill out payment systems in singapore

How to fill out payment systems in Singapore:

01

Research available payment systems: Start by exploring the various payment systems available in Singapore. This can include options like PayNow, NETS, GrabPay, and more. Understand the features, benefits, and costs associated with each system to make an informed decision.

02

Verify eligibility: Before filling out any payment system application, ensure that you meet the eligibility criteria. Some payment systems may have specific requirements, such as being a registered business or having a local bank account. Cross-check your eligibility to avoid any unnecessary complications.

03

Gather necessary documents: Each payment system application may require specific documents to be submitted. Common documents include identification proof, business registration documents, bank statements, and proof of address. Take the time to gather all the required documents beforehand to streamline the application process.

04

Fill out the application form: Once you have selected the payment system and collected the necessary documents, fill out the application form accurately. Pay attention to every detail and provide the required information as requested. Mistakes or missing information may delay the approval process.

05

Review and submit the application: Carefully review the completed application form to ensure its accuracy and completeness. Double-check all the information provided and make any necessary corrections. Once you are satisfied with the accuracy, submit the application as per the instructions provided by the payment system provider.

Who needs payment systems in Singapore:

01

Businesses: Payment systems are essential for businesses in Singapore, irrespective of their size or nature. From retail stores to online merchants, payment systems enable businesses to accept various forms of payments from customers, enhancing convenience and increasing sales opportunities.

02

Consumers: Payment systems make transactions seamless for consumers in Singapore. Whether it's mobile payments or online shopping, payment systems offer secure and efficient ways for individuals to make purchases, transfer funds, and manage their finances.

03

Freelancers and gig economy workers: With the rise of the gig economy, freelancers and independent workers rely on payment systems to receive payments from clients or customers. These systems streamline the payment process, ensuring timely and convenient compensation for their services.

04

Non-profit organizations: Even non-profit organizations in Singapore can benefit from payment systems. Donors can make online donations easily, and the organizations can track and manage their finances effectively, thereby promoting transparency and accountability.

In summary, anyone involved in financial transactions in Singapore, be it businesses, consumers, freelancers, or non-profit organizations, can benefit from utilizing payment systems for their convenience, security, and efficiency.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is payment systems in singapore?

Payment systems in Singapore refer to the infrastructure that enables funds to be transferred electronically between banks, businesses, and individuals.

Who is required to file payment systems in Singapore?

Entities that operate payment systems in Singapore are required to file with the Monetary Authority of Singapore (MAS).

How to fill out payment systems in Singapore?

To fill out payment systems in Singapore, entities need to provide required information such as transaction volume, user statistics, and compliance with regulations.

What is the purpose of payment systems in Singapore?

The purpose of payment systems in Singapore is to ensure the efficiency, safety, and reliability of electronic fund transfers in the country.

What information must be reported on payment systems in Singapore?

Entities filing payment systems in Singapore must report on transaction volume, user statistics, and compliance with regulations set by MAS.

When is the deadline to file payment systems in Singapore in 2023?

The deadline to file payment systems in Singapore in 2023 is typically in the first quarter of the following year.

What is the penalty for the late filing of payment systems in Singapore?

The penalty for the late filing of payment systems in Singapore may include fines and other regulatory actions imposed by MAS.

Can I create an electronic signature for the payment systems in singapore in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your payment systems in singapore in minutes.

Can I edit payment systems in singapore on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign payment systems in singapore on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete payment systems in singapore on an Android device?

Use the pdfFiller mobile app to complete your payment systems in singapore on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your payment systems in singapore online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.