Get the free california inheritance tax waiver form

Get, Create, Make and Sign

How to edit california inheritance tax waiver form online

How to fill out california inheritance tax waiver

How to fill out California inheritance tax waiver:

Who needs a California inheritance tax waiver:

Video instructions and help with filling out and completing california inheritance tax waiver form

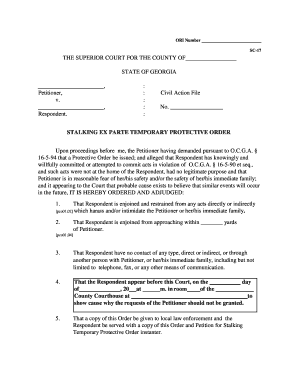

Instructions and Help about california booking waiver form extradition

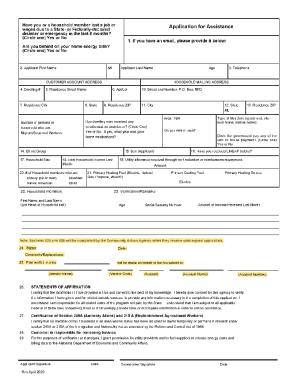

Hello this video tutorial is for the request to way of court fees this is form FW 0 0 1 if you are applying to have your fees waived you will also need to fill out form FW — 0 0 3 so let's get started to fill out this form you need to start with your name your address your city California if it's not California obviously don't write California and then your zip code if you are working fill out this section if you're not working that's fine if you have a lawyer hopefully your lawyer should help you fill this out ok so under number 4 ask what court fees and costs are you asking to be waived if this is so you can file in court in Area then that is superior court fees ok here's the important part of this particular form the fee waiver is based on income if you are receiving any of these specific state benefits mark the box next to it for example if you're on food stamps mark the box for food stamps and then print your name and sign at the bottom ok if you are not receiving any of these benefits what you need to do is look at this table here I'm going to find your family size there's one of you and your household then your income has to be below one thousand two hundred and sixty-four dollars and 59 cents okay if you are asking for your fees to be waived based on your income you will need to check box B and then on the second page fill out seven eight and nine lists all of your sources of income wherever your income make may come from if you don't have any just write in no income you could write no income, or you could write if you had a job you could put in cutting lawns or whatever the case may be you also have to list other people who live in your house and what they contribute to the household income and if you're living with children put the children in their even though their gross monthly income may be zero okay so let's go back to the first page here, so you can ask for the fees to be waived just if your income may be over one of these amounts, but you have exceptional expenses or hardship you can ask for them to be waived and what you'll have to do is in addition to filling out seven eight and nine you will have to fill out ten and eleven for the court to consider and that's how you do that form

Fill california vaccination waiver form : Try Risk Free

People Also Ask about california inheritance tax waiver form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your california inheritance tax waiver online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.