Tax Invoice Template 2013-2024 free printable template

Show details

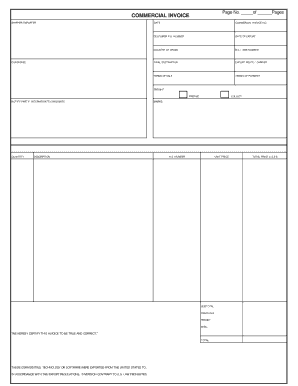

Your Business Name Insert logo here Street Address, City, State Postcode, Country Tel : (456) 3456-1234, Fax : (456) 3456-1235, Email : your name yoursite.com Website : www.yoursite.com, Tax Registration

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your invoice-template-service-1tax-basicxlsx form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your invoice-template-service-1tax-basicxlsx form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit invoice-template-service-1tax-basicxlsx online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit invoice-template-service-1tax-basicxlsx. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

How to fill out invoice-template-service-1tax-basicxlsx

How to fill out invoice-template-service-1tax-basicxlsx:

01

Open the invoice-template-service-1tax-basicxlsx file on your computer.

02

Fill in the appropriate information in the designated fields such as your company name, address, and contact details.

03

Enter the customer's name, address, and contact information in the customer section.

04

Complete the invoice details including the invoice number, date, due date, and payment terms.

05

List the products or services provided in the description column along with their corresponding quantities and prices.

06

Calculate the subtotal by multiplying the quantity with the price for each item and then summing them up.

07

Add any applicable taxes or fees in the appropriate tax column.

08

Include any discounts or deductions if applicable.

09

Calculate the total amount due by adding the subtotal, taxes, and deductions.

10

Double-check all the filled information for accuracy and completeness.

11

Save the filled invoice-template-service-1tax-basicxlsx as a new file or print it for physical copies.

Who needs invoice-template-service-1tax-basicxlsx:

01

Small business owners who provide services and need a simple but professional invoice template.

02

Freelancers or self-employed individuals who require an invoice template for their clients.

03

Anyone who wants a pre-made invoice template that includes basic tax calculations for easy invoicing.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is invoice-template-service-1tax-basicxlsx?

Invoice-template-service-1tax-basic.xlsx is a template for creating invoices that includes basic features and calculations for adding a single tax rate to the total amount. It is a spreadsheet file in the XLSX format, commonly used with Microsoft Excel and other spreadsheet software. The template simplifies the process of creating and calculating invoices by providing predefined formulas and formatting. The inclusion of 1 tax rate allows for easy customization based on specific tax requirements applicable to the invoiced items or services.

Who is required to file invoice-template-service-1tax-basicxlsx?

It is usually the service provider who is required to file the invoice-template-service-1tax-basic.xlsx. This is because the invoice is created by the service provider and sent to the customer as a record of the transaction and for payment purposes. However, both the service provider and the customer may keep a copy of the invoice for their records.

How to fill out invoice-template-service-1tax-basicxlsx?

To fill out the "invoice-template-service-1tax-basic.xlsx" template, follow these steps:

1. Open the invoice template file using spreadsheet software like Microsoft Excel or Google Sheets.

2. Locate the relevant sections or cells in the template where you need to enter information. Usually, these sections are labeled or marked to indicate what should be filled in.

3. Start with the header section, which typically includes your company's name, logo, and contact details. Replace the existing placeholder information with your own.

4. Move on to the client or customer details section. Enter the recipient's name, address, email, and other necessary contact information.

5. Fill in the invoice details section, which includes information about the specific service provided. This typically involves entering each item's description, quantity, rate, and subtotal. Add or remove rows as needed to accommodate multiple items.

6. Calculate the tax amount based on the applicable tax rate, usually specified in the template. Multiply the tax rate by the subtotal and enter the result in the appropriate cell.

7. Include any additional charges, such as shipping fees or discounts, in their respective sections.

8. Calculate the final total by summing up the subtotal, tax amount, and any additional charges. Enter this grand total in the designated cell.

9. Fill in the payment terms and conditions section, including due date, payment methods, and any late payment penalties or discounts.

10. Review the completed invoice carefully to ensure accuracy. Verify all information, calculations, and formatting.

11. Save the filled-out template with a new file name or export it to your preferred file format (e.g., PDF) for easy sharing with clients.

12. Print a physical copy for your records or send the invoice electronically to the client as per your usual invoicing process.

Note: The steps provided may vary slightly based on the specific layout and design of the invoice template you are using.

What is the purpose of invoice-template-service-1tax-basicxlsx?

The purpose of the "invoice-template-service-1tax-basic.xlsx" is to provide a pre-designed and customizable template for creating invoices with a single tax rate. It is a Microsoft Excel file that allows users to enter their invoice details, such as client information, product or service details, quantities, prices, and tax rates, to generate professional-looking invoices. The template includes formulas and formatting to automatically calculate subtotals, taxes, and totals, simplifying the invoicing process for businesses or individuals.

What information must be reported on invoice-template-service-1tax-basicxlsx?

The information that must be reported on invoice-template-service-1tax-basic.xlsx are:

1. Company Name and Logo: The name and logo of the company issuing the invoice.

2. Contact Information: The company's address, phone number, and email address.

3. Invoice Number: A unique identification number assigned to the invoice for tracking and reference purposes.

4. Invoice Date: The date when the invoice is issued.

5. Customer Information: The name, address, and contact details of the customer receiving the invoice.

6. Description of Services: A detailed description of the services provided, including the quantity and price per unit.

7. Subtotal: The total amount for the services provided before applying any taxes or discounts.

8. Tax Information: The tax rate applicable, such as sales tax or value-added tax (VAT), and the calculated tax amount.

9. Total Amount: The final amount to be paid by the customer, including taxes and any discounts.

10. Payment Terms: The agreed-upon terms for payment, such as due date and accepted payment methods.

11. Notes or Terms: Any additional information, terms, or conditions related to the invoice.

12. Company Bank Details: Bank account information where the customer can make the payment.

It is important to note that the specific details and formatting may vary depending on the country, industry, and individual business requirements.

How can I send invoice-template-service-1tax-basicxlsx to be eSigned by others?

To distribute your invoice-template-service-1tax-basicxlsx, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I edit invoice-template-service-1tax-basicxlsx on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign invoice-template-service-1tax-basicxlsx. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How can I fill out invoice-template-service-1tax-basicxlsx on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your invoice-template-service-1tax-basicxlsx by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your invoice-template-service-1tax-basicxlsx online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.