Get the free 2012 Schedule G (Form 990EZ) Instructions These instructions are intended to help cl...

Show details

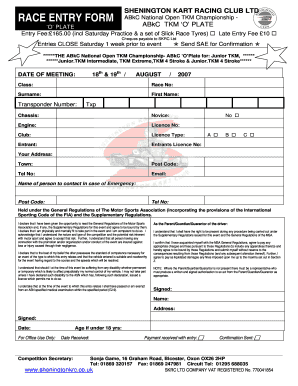

2012 Schedule G (Form 990EZ) Instructions These instructions are intended to help clarify, for PTA local units, the Instructions for Schedule G (990EZ) as published by the Internal Revenue Service.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2012 schedule g form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 schedule g form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2012 schedule g form online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2012 schedule g form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

How to fill out 2012 schedule g form

How to fill out 2012 schedule g form:

01

Begin by downloading the 2012 schedule g form from the official website of the relevant tax authority.

02

Familiarize yourself with the purpose of the form and gather all the necessary information and documentation required to complete it.

03

Start by entering your personal information such as your name, address, and social security number in the designated fields.

04

Carefully read through each question on the form and provide accurate and complete answers. Double-check your entries to ensure they are error-free.

05

If applicable, provide the details of any income or expenses that are relevant to the purpose of the form. This may include information related to investments, rental property, or self-employment.

06

Be sure to include any supporting documents or schedules that may be required to substantiate your entries on the form.

07

Once you have completed filling out the form, review it one final time to ensure all necessary information has been provided and there are no mistakes.

08

Sign and date the form in the designated areas to validate your submission.

09

Keep a copy of the completed form for your records.

10

Submit the filled-out form to the appropriate tax authority by the specified deadline.

Who needs 2012 schedule g form:

01

Individuals or businesses who have income or expenses that are relevant to the specific purpose of the 2012 schedule g form may be required to fill it out.

02

This may include individuals with investment income, rental property owners, or those with self-employment income, among others.

03

It is essential to consult the official guidelines provided by the relevant tax authority to determine if you need to fill out the 2012 schedule g form based on your specific financial situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is schedule g form 990ez?

Schedule G is used to report information about certain transactions with interested persons, excess benefit transactions, certain grants and other assistance benefiting interested persons.

Who is required to file schedule g form 990ez?

Organizations that file Form 990EZ and have any transactions or relationships that need to be reported on Schedule G are required to file this form.

How to fill out schedule g form 990ez?

Schedule G must be completed by providing all the requested information about transactions with interested persons, excess benefit transactions, grants and other assistance provided to interested persons.

What is the purpose of schedule g form 990ez?

The purpose of Schedule G is to provide the IRS with information about transactions and relationships that may present a conflict of interest or raise questions about the organization's compliance with tax-exempt laws.

What information must be reported on schedule g form 990ez?

Information about transactions with interested persons, excess benefit transactions, grants and other assistance provided to interested persons must be reported on Schedule G.

When is the deadline to file schedule g form 990ez in 2023?

The deadline to file Schedule G form 990EZ in 2023 is typically the same as the deadline for filing Form 990EZ, which is the 15th day of the 5th month after the organization's fiscal year ends.

What is the penalty for the late filing of schedule g form 990ez?

The penalty for late filing of Schedule G form 990EZ is $20 per day, up to a maximum of $10,000 or 5% of the organization's gross receipts, whichever is less.

How do I execute 2012 schedule g form online?

pdfFiller makes it easy to finish and sign 2012 schedule g form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit 2012 schedule g form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like 2012 schedule g form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I fill out 2012 schedule g form on an Android device?

Use the pdfFiller app for Android to finish your 2012 schedule g form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your 2012 schedule g form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.