MHA Dodd-Frank Certification 2010-2024 free printable template

Show details

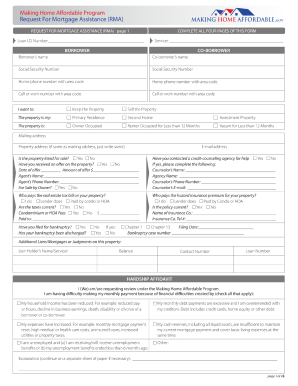

Supplemental Directive 10-11 September 21, 2010, Making Home Affordable Program Dodd-Frank Certification Requirement In February 2009, the Obama Administration introduced the Making Home Affordable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your dodd frank certificate form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dodd frank certificate form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dodd frank certificate form online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2010 directive dodd frank form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

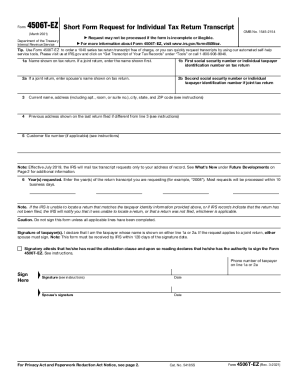

How to fill out dodd frank certificate form

How to fill out the Dodd Frank certificate form:

01

Start by downloading the Dodd Frank certificate form from a reliable source, such as the official website of the regulatory authority or a trusted financial institution.

02

Read the instructions carefully to understand the purpose and requirements of the form. Make sure you have all the necessary information and supporting documents before you begin filling it out.

03

Begin by providing your personal information, such as your name, address, contact details, and social security number. Make sure to double-check the accuracy of the information you provide.

04

Proceed to fill out the sections of the form that pertain to your financial institution or organization, including its name, address, and contact details.

05

Enter the relevant details about the financial transaction or product that requires the Dodd Frank certificate. This may include information about the parties involved, the nature of the transaction, and any applicable regulations or exemptions.

06

If required, provide any supporting documentation or attachments that are necessary to substantiate the information provided in the form. These may include contracts, agreements, or other relevant documents.

07

Before submitting the form, carefully review all the information you have entered to ensure its accuracy and completeness. Make any necessary corrections or additions as needed.

08

Finally, sign and date the form to certify that the information provided is true and accurate to the best of your knowledge.

09

Retain a copy of the filled-out Dodd Frank certificate form for your records.

Who needs the Dodd Frank certificate form:

01

The Dodd Frank certificate form may be required by individuals or entities engaging in certain financial transactions or activities.

02

Financial institutions, such as banks, investment firms, or mortgage lenders, may need to obtain and fill out this form to comply with the regulatory requirements set forth by the Dodd-Frank Wall Street Reform and Consumer Protection Act.

03

Individuals or businesses involved in the buying, selling, or trading of certain financial instruments, commodities, or derivatives may also need to complete this form as part of their compliance obligations.

04

It is advisable to consult with legal or financial professionals to determine whether you or your organization requires the Dodd Frank certificate form in the specific context of your financial activities.

Fill 2010 directive form dodd frank : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is dodd frank certificate form?

The Dodd Frank Certificate Form is a form issued by the US Department of the Treasury that certifies a person or entity's compliance with the Dodd-Frank Wall Street Reform and Consumer Protection Act. The form is used when a person or entity applies for a loan, mortgage, or other financial transaction. It is also used when an institution applies for an exemption from certain provisions of the Act.

How to fill out dodd frank certificate form?

1. Begin by entering information about the business entity. This includes the name, address, and contact information of the entity.

2. Enter information about the person filling out the form. This includes name, title, and contact information.

3. Read and review the Dodd-Frank Certification statement and check the box to indicate that you agree with the statement.

4. Sign and date the form.

5. Make a copy of the form for your records.

6. Submit the form to the entity or agency that requested it.

What is the purpose of dodd frank certificate form?

The Dodd-Frank Wall Street Reform and Consumer Protection Act requires that all residential mortgage loan originators be registered with the Nationwide Mortgage Licensing System & Registry (NMLS). The Dodd-Frank Certificate Form is used by loan originators to verify their NMLS registration and demonstrate compliance with the Act. The form must be completed and signed by the loan originator and presented to the consumer prior to the consumer entering into a binding obligation for the loan.

When is the deadline to file dodd frank certificate form in 2023?

The deadline to file a Dodd-Frank Certificate Form in 2023 is not yet known, as the deadline is determined by the regulatory agencies that administer the Dodd-Frank Wall Street Reform and Consumer Protection Act.

What is the penalty for the late filing of dodd frank certificate form?

The penalty for the late filing of a Dodd-Frank Certificate Form is up to $10,000 per violation, plus up to $1,000 for each day the violation continues.

Who is required to file dodd frank certificate form?

The Dodd-Frank certificate form is required to be filed by certain individuals who are appointed to certain positions within financial institutions regulated by the Dodd-Frank Wall Street Reform and Consumer Protection Act. These individuals include, but are not limited to, chief executive officers, chief financial officers, chief compliance officers, and any individuals responsible for the institution's financial statements, internal accounting controls, or compliance with securities laws. The filing of the form is typically required annually.

What information must be reported on dodd frank certificate form?

The Dodd-Frank Certificate is required under the Dodd-Frank Wall Street Reform and Consumer Protection Act. It must include the following information:

1. Identification of the entity issuing the certificate, which typically includes the name, address, and contact information of the entity.

2. Identification of the loan or transaction that the certificate is being issued for, including the loan number, loan amount, and transaction details.

3. Certification that the loan or transaction meets the requirements set forth under the Dodd-Frank Act, such as the prohibition on certain abusive lending practices.

4. Statement of compliance with any other applicable federal or state laws, regulations, or guidelines.

5. Verification that the entity issuing the certificate has performed its due diligence in reviewing the loan or transaction and has found it to be in compliance with applicable laws.

6. Any additional information or disclosures required by the regulatory authority overseeing the transaction.

It's important to note that the specific requirements for the Dodd-Frank Certificate may vary depending on the type of loan or transaction and the regulatory jurisdiction. Therefore, it is recommended to consult the relevant regulations and legal counsel to ensure compliance with the reporting requirements.

How do I edit dodd frank certificate form straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing 2010 directive dodd frank form, you need to install and log in to the app.

How do I fill out frank dodd certification pdf using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign 2010 form dodd frank and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit 2010 mha dodd frank on an iOS device?

Create, modify, and share 2010 directive form dodd frank using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your dodd frank certificate form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Frank Dodd Certification Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to 2010 sd10 11 dodd frank form

Related to what is dodd frank certificate pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.