ATA Carnet Proforma Invoice Form free printable template

Show details

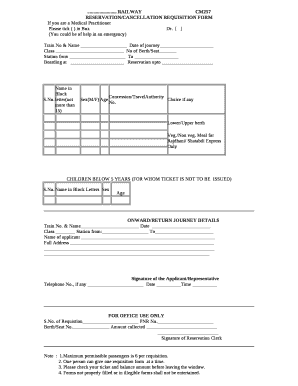

PROFORMA INVOICE Exporter Invoice No. Date Exporte s Ref Buyer s Order No. Date Other Refrence s Consignee Buyer if other than consignee Country of Origin of goods Country of Final Destination Terms of Delivery and Payment Pre-Carriage by Place of Receipt by Pre-Carrier Port of Discharge Final Destination Marks Nos. To Vessel /Flight No. No. Kind Description of Container No. of Package Goods Amount Chargeable TOTAL FOB VALUE Quantity Port of Loading Rate In Words Signature Date Declaration We...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ata proforma invoice form sample

Edit your ata proforma form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ata carnet proforma invoice secretariat online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ata proforma invoice form secretariat fill online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ATA Carnet Proforma Invoice Form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ATA Carnet Proforma Invoice Form

How to fill out ATA Carnet Proforma Invoice Form

01

Obtain the ATA Carnet Proforma Invoice Form from your local chamber of commerce or authorized issuing body.

02

Fill in the name and address of the exporter or their representative.

03

Provide the name and address of the consignee, who is the recipient of the goods.

04

List all the items intended for temporary export, including descriptions, quantities, and values.

05

Indicate the purpose of export (e.g., trade show, exhibition, etc.).

06

Include the dates of travel and return for the items being exported.

07

Review the information for accuracy before signing and dating the form.

08

Submit the completed Proforma Invoice along with any required attachments to the issuing authority.

Who needs ATA Carnet Proforma Invoice Form?

01

Businesses or individuals planning to temporarily export goods to a foreign country without paying customs duties.

02

Exhibitors at international trade shows and exhibitions.

03

Musicians and artists traveling with equipment for performances abroad.

04

Companies involved in the sale or demonstration of products overseas.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ATA Carnet Proforma Invoice Form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific ATA Carnet Proforma Invoice Form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit ATA Carnet Proforma Invoice Form on an Android device?

You can edit, sign, and distribute ATA Carnet Proforma Invoice Form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I complete ATA Carnet Proforma Invoice Form on an Android device?

Use the pdfFiller mobile app and complete your ATA Carnet Proforma Invoice Form and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is ATA Carnet Proforma Invoice Form?

The ATA Carnet Proforma Invoice Form is a document that outlines the items being temporarily exported under the ATA Carnet system, providing proof of their value and description for customs.

Who is required to file ATA Carnet Proforma Invoice Form?

Individuals or businesses that are temporarily exporting goods for purposes such as trade shows, exhibitions, or professional events are required to file the ATA Carnet Proforma Invoice Form.

How to fill out ATA Carnet Proforma Invoice Form?

To fill out the ATA Carnet Proforma Invoice Form, you must include details such as the description of the goods, value, quantity, weight, and the purpose of travel for each item, ensuring all entries are clear and accurate.

What is the purpose of ATA Carnet Proforma Invoice Form?

The purpose of the ATA Carnet Proforma Invoice Form is to facilitate the temporary export of goods by simplifying customs procedures and ensuring that all items are documented for compliance with international regulations.

What information must be reported on ATA Carnet Proforma Invoice Form?

The ATA Carnet Proforma Invoice Form must report information including the item description, value, quantity, country of origin, purpose of exportation, and any other relevant trade details.

Fill out your ATA Carnet Proforma Invoice Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ATA Carnet Proforma Invoice Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.