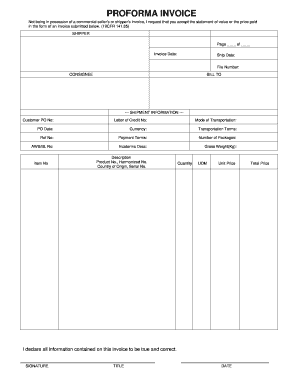

Get the free proforma invoice

Show details

PROFORMA INVOICE/EXPORT ORDER. SHIPPER: Tech International. 1000 J Street, NW. Washington, DC 20005. CUSTOMER: Gomez Y. Cartagena. Apt do.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your proforma invoice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your proforma invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing proforma invoice online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit proforma. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

How to fill out proforma invoice

How to fill out proforma invoice:

01

Start by providing your own contact information, including your name, address, phone number, and email address. This will ensure that the recipient can easily reach you for any queries or clarifications.

02

Enter the recipient's contact information, including their name, company name, address, phone number, and email address. Make sure the details are accurate to facilitate smooth communication.

03

Include a unique invoice number and date. This is crucial for record-keeping purposes and helps to distinguish one invoice from another.

04

State a detailed description of the goods or services being provided. Include any pertinent information such as quantities, item numbers, descriptions, and unit prices. This enables the recipient to clearly understand what they are being invoiced for.

05

Specify the terms of payment, including the due date and any applicable discounts or penalties for late payment. It is important to clearly communicate the timeline and consequences to avoid any confusion or disputes.

06

Calculate the total amount due by multiplying the quantity by the unit price for each item and adding any additional charges, such as shipping or taxes. Clearly layout the subtotals and provide a final total at the bottom of the invoice.

07

Include your payment instructions, such as acceptable payment methods and instructions for wire transfers or online payments. Make it easy for the recipient to understand how to fulfill their payment obligations.

Who needs proforma invoice:

01

Importers and exporters often require proforma invoices when dealing with international trade transactions. These invoices provide a detailed breakdown of the goods being shipped and their value, ensuring compliance with customs regulations.

02

Companies selling goods or services to new customers may use pro forma invoices to provide an estimate of costs before a formal sales agreement is reached. This allows potential customers to evaluate and budget for the purchase.

03

Proforma invoices are also commonly used when applying for financing or securing letters of credit. The detailed information provided in the invoice helps financial institutions or lenders assess the value and risk associated with the transaction.

In summary, proforma invoices are needed by importers, exporters, companies dealing with new customers, and for financial and credit-related purposes. The invoices should be filled out accurately and provide detailed information on the goods or services, payment terms, and contact information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is proforma invoice?

A proforma invoice is a preliminary document sent by a seller to a buyer before shipment or delivery of goods or services. It is not a legally binding document but serves as a quotation or estimate for the buyer. The proforma invoice includes details such as the description and quantity of goods or services, prices, terms of sale, and any additional charges or discounts. It helps the buyer to review and confirm the order before proceeding with the actual purchase and serves as a reference document for future transactions.

Who is required to file proforma invoice?

The exporter or seller is typically required to file a proforma invoice. This document is used to provide detailed information about the goods or services being sold, including the quantity, price, and terms of sale. It is often used by the buyer for customs clearance or to obtain a letter of credit.

How to fill out proforma invoice?

Filling out a proforma invoice is a relatively straightforward process. Here are the steps to follow:

1. Identify your company's information: Start by entering your company's name, address, contact information, and any other relevant details at the top of the invoice. Include your logo if desired.

2. Add the customer's information: Below your company's information, enter the customer's name, address, contact details, and any other necessary information.

3. Generate a unique invoice number: Assign a unique identification number to the proforma invoice for tracking purposes. This number could include letters and numbers, such as "PI-2022-001".

4. Include the invoice date: Specify the date the proforma invoice is issued. This may be the current date or a future date, depending on the circumstances.

5. Provide a breakdown of the products or services: Itemize the goods or services being provided, along with their corresponding quantities, unit prices, and any additional charges. Include a clear description of each item, including specifications if necessary.

6. Calculate the total amount: Determine the total amount due by multiplying the quantity of each item by its corresponding unit price and adding any additional charges or taxes. Display the total prominently.

7. Mention payment terms and conditions: Clearly state the payment terms, such as the accepted payment methods, due date, and any other relevant conditions. Specify any applicable discounts or payment deadlines.

8. Include your company's bank details: If you anticipate receiving payment via bank transfer, provide your bank account information, including the account name, number, and relevant routing codes.

9. Add any additional notes or comments: Include any necessary disclaimers, special instructions, or other information relevant to the transaction. This could involve shipping details, delivery terms, or any contractual agreements.

10. Provide contact details for customer inquiries: Include your company's contact information, such as phone number, email address, and website, for any inquiries or clarifications.

11. Review and verify the information: Before finalizing the proforma invoice, double-check all the entered information to ensure accuracy and clarity. It's essential to maintain professionalism and precision.

12. Save and distribute the proforma invoice: Save a copy of the completed proforma invoice for your records. Share it with the customer via email, fax, or any other agreed-upon method.

What is the purpose of proforma invoice?

The purpose of a proforma invoice is to provide a detailed description of a potential transaction between a buyer and a seller. It serves as a preliminary or estimated bill that outlines the goods or services being offered, their quantities, prices, and any other relevant terms and conditions. Proforma invoices are commonly used in international trade to help buyers and sellers understand the costs and requirements associated with a potential transaction. They can also be used for budgeting, planning, and obtaining approvals from relevant parties before finalizing a transaction. However, it should be noted that a proforma invoice is not a legally binding document and is subject to change until a formal purchase order or commercial invoice is issued.

What information must be reported on proforma invoice?

A proforma invoice is a preliminary bill of sale issued by a seller to a buyer in advance of a shipment or delivery of goods. Although there is no standardized format, some common information that is typically included in a proforma invoice includes:

1. Seller's information: Name, address, contact details, and any relevant tax or business identification numbers.

2. Buyer's information: Name, address, contact details, and any relevant tax or business identification numbers.

3. Invoice number: A unique identifier given to the proforma invoice for easy reference in future communication.

4. Date: The date on which the proforma invoice is issued.

5. Description of goods: A detailed list of the goods being sold, including the quantity, unit price, and total price for each item.

6. Terms of sale: The agreed-upon payment terms between the buyer and seller, including payment due date, method of payment, and any discounts or penalties for early or late payment.

7. Shipping details: Information about the mode of transport, estimated delivery date, and the buyer's responsibilities for shipping, insurance, or customs duties, if applicable.

8. Any additional charges: This may include taxes, customs duties, freight charges, or packaging costs that are not included in the unit price of the goods.

9. Validity period: The timeframe during which the proforma invoice is considered valid. This ensures that prices and terms are only valid for a specific period, typically a few weeks or months.

10. Seller's signature or seal: The proforma invoice should be signed or stamped by the seller as an acknowledgment of its authenticity and agreement to the terms stated.

It's important to note that a proforma invoice does not represent a formal demand for payment, nor does it create a legally binding contract. Instead, it serves as a preliminary estimation and agreement between the buyer and seller.

When is the deadline to file proforma invoice in 2023?

I apologize, but I do not have access to specific dates or deadlines for filing proforma invoices in 2023. These deadlines can vary depending on the country, industry, and specific requirements of the transaction. It would be best to reach out to the relevant authorities or consult with a professional to determine the specific deadline for your situation.

What is the penalty for the late filing of proforma invoice?

The penalty for the late filing of a proforma invoice can vary depending on the specific circumstances and the jurisdiction in which the invoice is being filed. In some cases, there may not be a specific penalty for late filing, but it could result in delays or complications in the transaction or business process. It is advisable to consult with a legal or financial professional to understand the specific penalties or implications for late filing in your situation.

Can I create an eSignature for the proforma invoice in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your proforma right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit order proforma on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign invoice proforma filled right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How can I fill out proforma order on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your filled proforma invoice. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your proforma invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Order Proforma is not the form you're looking for?Search for another form here.

Keywords relevant to proforma invoice export order

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.