Get the free nm 4a 301 2019 forms

Get, Create, Make and Sign

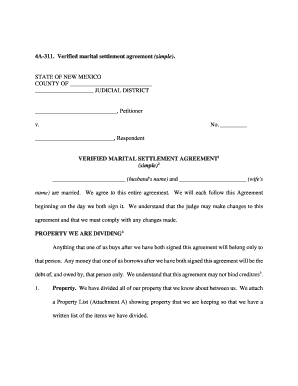

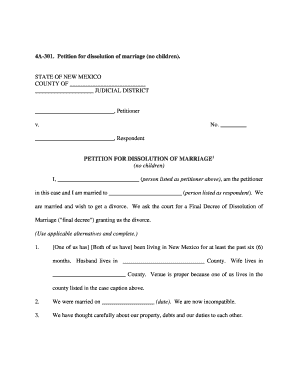

Editing nm 4a 301 2019 forms online

How to fill out nm 4a 301 2019

To fill out nm 4a 301 2019, follow these steps:

Who needs nm 4a 301 2019?

Video instructions and help with filling out and completing nm 4a 301 2019 forms

Instructions and Help about new mexico marital agreement form

Part three execution of sender's payment order by receiving bank for a — 301 execution and execution date a payment order is executed by the receiving bank when it issues a payment order intended to carry out the payment order received by the bank it payment order received by the beneficiary's bank can be accepted but cannot be executed a paint mother is executed by the receiving bank when it issues a payment order intended to carry out the payment order received by the beneficiary bank can be accepted but cannot be executed I don't understand that execution date of a payment order means the day on which the receiving bank may properly issue a payment order in execution of the sender's order the execution date may be determined by instruction of the sender it cannot be earlier than the day the order is received and unless otherwise determined is the day the order is received if the sender's instruction states of payment date the execution day is the payment day or an earlier date on which the execution is reasonably necessary to allow payment to the beneficiary on the payment date for 302 obligations of receiving bank in execution of payment order except as provided by subsection B through D if the receiving bank accepts a payment order pursuant to section 4a 209 the bank has the following obligations in executing the order the receiving bank is obliged to issue on the execution day a payment order complying with the sender's order and to follow the sender's instructions concerning any intermediary bank or funds transfer system to be used in carrying out the funds transfer or to the means by which payment orders are to be transmitted in the funds transfer if the originators bank issues a payment order to an intermediary Bank the originators bank is obliged to instruct the intermediary bank according to the instruction of the originator and intermediary Bank in the funds transfer is similarly bound by an instruction given to it by the center of the payment order it except if the sender's instruction the state sets the funds transfer for is to be carried out telephone Nikolai or by wire transfer or otherwise indicates that the funds transfer is to be carried out by the most Expedia's expeditious means the receiving bank is obliged to transmit its payment order by the most expeditious available means and to instruct any needs Amalia Bank accordingly if the sender's instructions takes a payment date the receiver buying is obliged to transmit its payment order at a time and by means reasonably necessary to allow payment to the beneficiary on the payment date or as soon thereafter as is feasible unless otherwise instructed a receiving by executing a payment order it may use any funds transfer system if you use of that system is reasonable in the circumstances and to issue a payment order to the beneficiary bank or to an intermediary bank through which the payment order confirming the sender's order can expeditiously be issued to the beneficiary bank...

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your nm 4a 301 2019 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.