Get the free 2011 Net Profit Form - spencercountyky

Show details

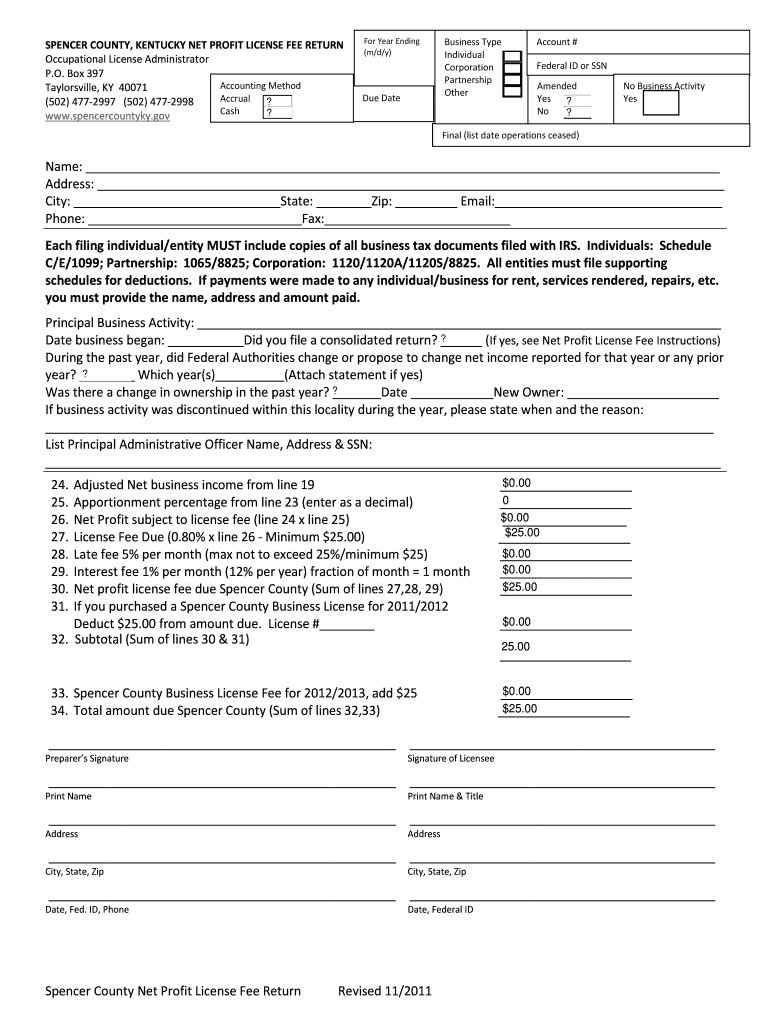

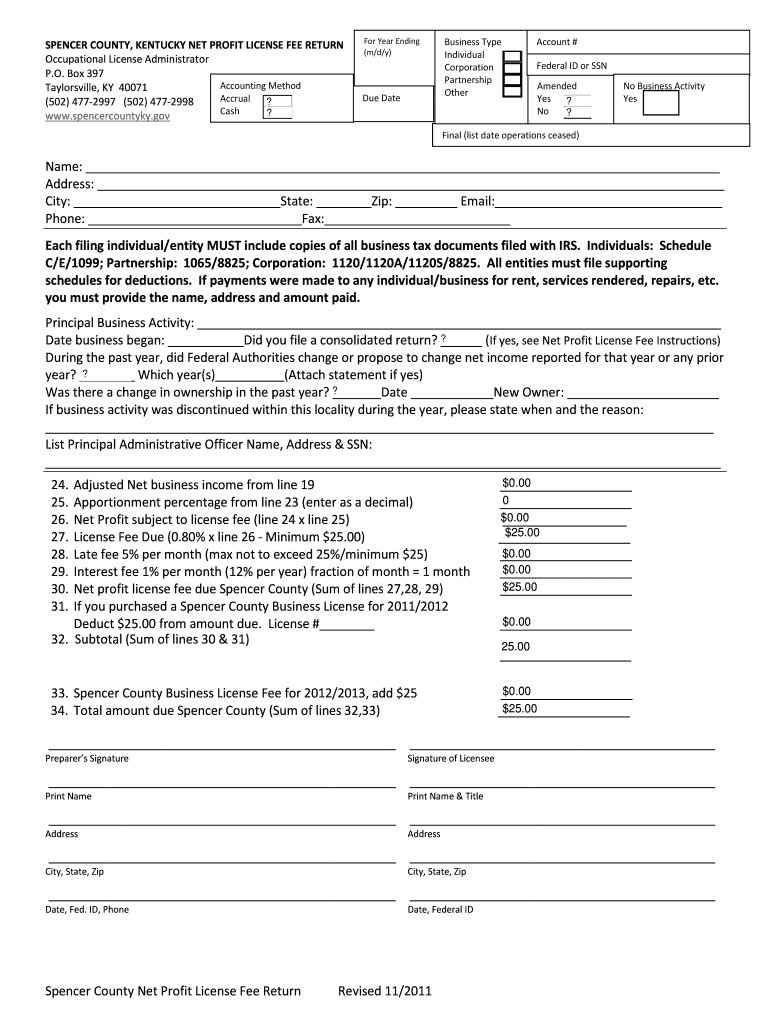

SPENCER COUNTY, KENTUCKY NET PROFIT LICENSE FEE RETURN Occupational License Administrator P.O. Box 397 Accounting Method Taylorsville, KY 40071 Accrual ? (502) 477-2997 (502) 477-2998 Cash ? www.spencercountyky.gov

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2011 net profit form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 net profit form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2011 net profit form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2011 net profit form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

How to fill out 2011 net profit form

How to fill out 2011 net profit form:

01

Start by gathering all necessary financial documents for the year 2011, including income statements, balance sheets, and tax returns.

02

Fill in the relevant information regarding your business, such as the name, address, and tax identification number.

03

Identify the period for which you are reporting the net profit. In this case, it would be for the year 2011.

04

Calculate and input the total revenue or sales generated by your business during 2011.

05

Deduct any operating expenses and costs incurred in running your business to determine the net profit. These expenses may include rent, utilities, salaries, and advertising costs.

06

If applicable, account for any non-operating income or expenses that may have affected your net profit, such as gains or losses from investments.

07

Double-check all the figures and calculations to ensure accuracy.

08

Sign and date the form to certify its authenticity and completeness.

09

Keep a copy of the filled-out form for your records and submit it to the relevant authorities or tax agency as instructed.

Who needs 2011 net profit form:

01

Any business owner or self-employed individual who operated a business during the year 2011 would require the 2011 net profit form.

02

It is typically needed for tax reporting purposes to determine the taxable income of the business.

03

The form may also be required by lenders or investors to assess the financial performance of the business during that specific year.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is net profit form?

Net profit form is a form used to report the net profit of a business after deducting expenses from total revenue.

Who is required to file net profit form?

All businesses or individuals who earn income through business activities are required to file net profit form.

How to fill out net profit form?

Net profit form is filled out by entering total revenue, deducting expenses, and calculating net profit.

What is the purpose of net profit form?

The purpose of net profit form is to determine the profitability of a business and calculate the amount of income tax owed.

What information must be reported on net profit form?

Information such as total revenue, expenses, net profit, and any additional deductions must be reported on net profit form.

When is the deadline to file net profit form in 2023?

The deadline to file net profit form in 2023 is April 15th for most taxpayers.

What is the penalty for the late filing of net profit form?

The penalty for late filing of net profit form is a percentage of the unpaid tax amount, with additional penalties for each month the form is late.

How do I modify my 2011 net profit form in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your 2011 net profit form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit 2011 net profit form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your 2011 net profit form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete 2011 net profit form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your 2011 net profit form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your 2011 net profit form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.