Get the free COMMON AUDIT VIOLATIONS - sctax

Show details

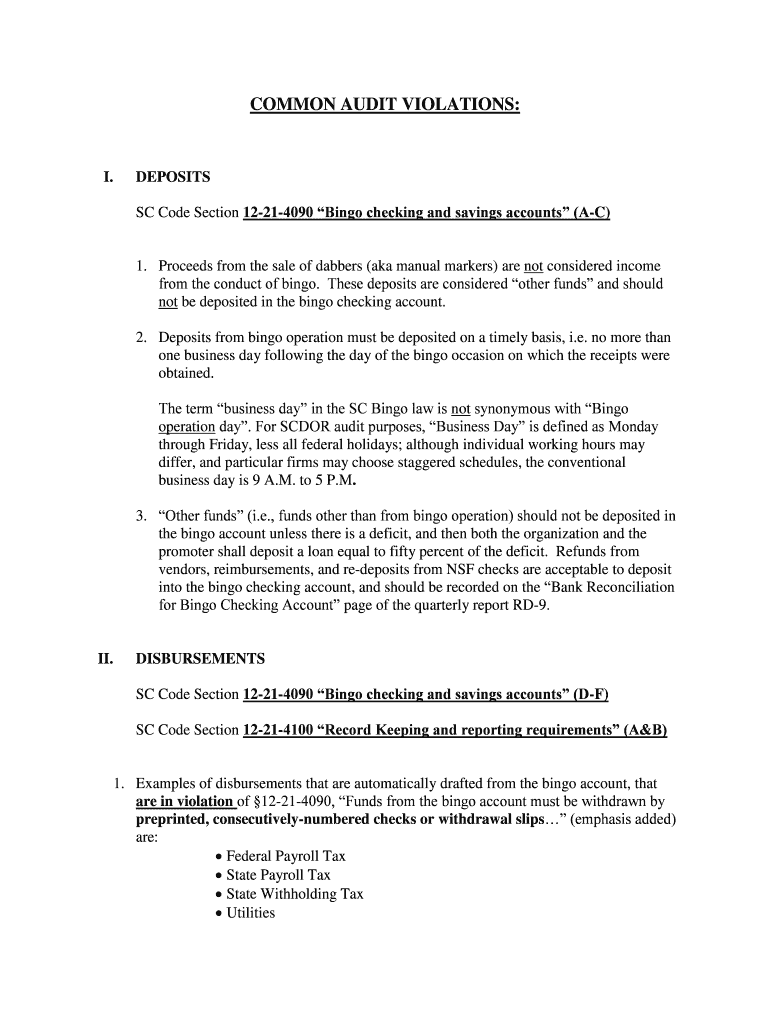

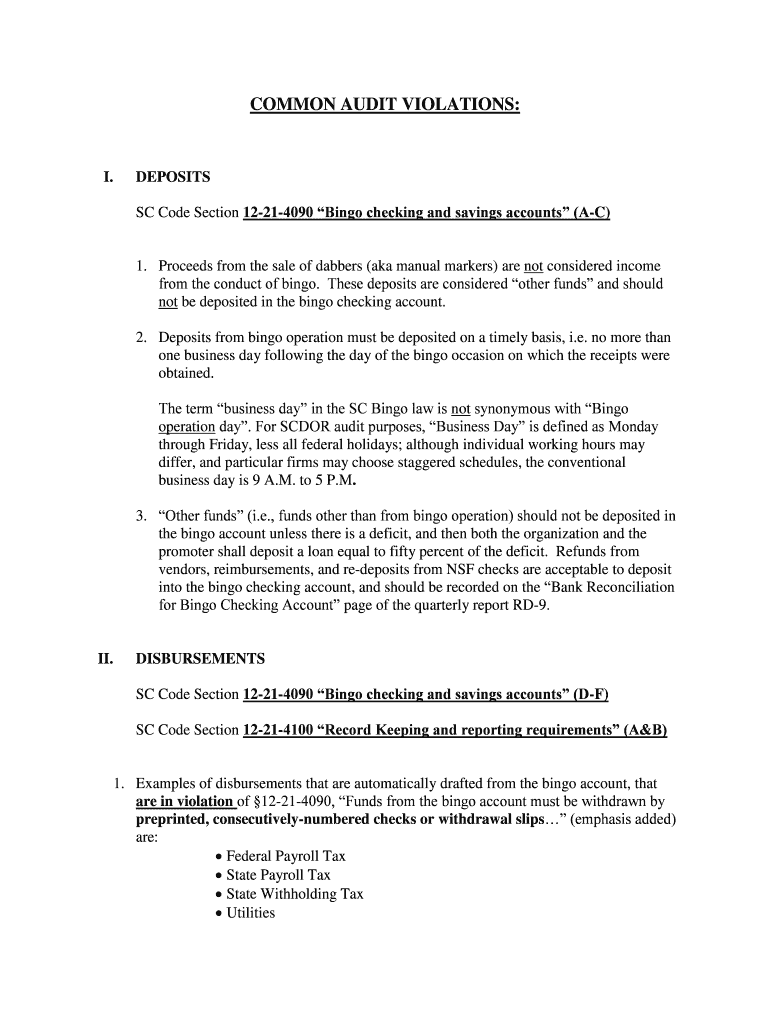

COMMON AUDIT VIOLATIONS: I. DEPOSITS SC Code Section 12-21-4090 Bingo checking and savings accounts (A-C) 1. Proceeds from the sale of dabbers (aka manual markers) are not considered income from the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your common audit violations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your common audit violations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit common audit violations online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit common audit violations. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is common audit violations?

Common audit violations include fraud, failure to maintain proper records, misrepresentation of financial information, and conflicts of interest.

Who is required to file common audit violations?

Companies and individuals who are subject to audit requirements are required to file common audit violations.

How to fill out common audit violations?

Common audit violations can be filled out by providing accurate and detailed information about any violations that occurred during the audit process.

What is the purpose of common audit violations?

The purpose of common audit violations is to ensure transparency and accountability in financial reporting, and to detect and deter fraudulent activities.

What information must be reported on common audit violations?

Information such as the nature of the violation, the parties involved, and any corrective actions taken must be reported on common audit violations.

When is the deadline to file common audit violations in 2023?

The deadline to file common audit violations in 2023 is typically determined by the regulatory body overseeing the audit requirements.

What is the penalty for the late filing of common audit violations?

The penalty for the late filing of common audit violations can vary depending on the severity of the violation, but may include fines, sanctions, or legal action.

How do I make edits in common audit violations without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your common audit violations, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the common audit violations in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your common audit violations right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the common audit violations form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign common audit violations and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your common audit violations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.