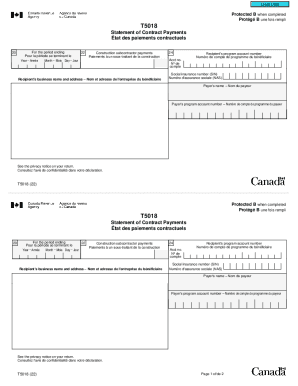

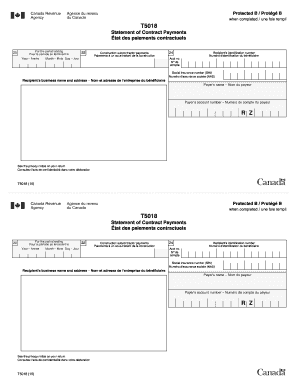

Canada T5018 2012 free printable template

Get, Create, Make and Sign

Editing t5018 form online

Canada T5018 Form Versions

How to fill out t5018 form 2012

How to fill out t5018 form:

Who needs t5018 form:

Video instructions and help with filling out and completing t5018 form

Instructions and Help about t5018 fillable form

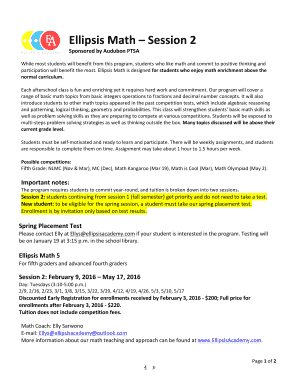

Welcome to our comp sense tutorial video series this video will walk you through the process so setting up either a 1099 form for American companies or the t5 o18 form for Canadian companies comp sense opening Suites helps you streamline your 1099 for IRS or t5 o18 for CRA forms for tax purposes opening Suites refers to these forms generically as contract payment forms the system generates these forms for those suppliers or service providers designated as 1099 or t5 o18 suppliers and where payments to that supplier exceed pre-specified amounts which you set for your own company the first step is to configure the supplier to become a 1099 or t5 o-18 supplier so under system's options you're going to go to supplier, and they call up the supplier in question once you have the proper supplier listed click on the profile tab over on the right-hand side you will see the 1099 box put a check mark there then you need to put the identifiers in for your system and from there you need to put which contract payment there you're going to be using so in our case I'm going to pick 1099 miscellaneous seven once I've selected all of these all I need to do is hit save and close, and I'm ready to move on to the next step once you set up your suppliers you'll next need to configure your report management here you can specify defaults for the reports by your division so on the reports will open up report management my division automatically came up and my categories have been expanded if my categories were not expanded you simply just click on the plus sign beside the category, and it will expand your options here we're going to pick contract payment form and over on the right-hand side is where the options for this report or the settings for this report will show by clicking on my plus sign my parameters will drop first thing you want to check here is to make sure that both the visible and print dialog visible boxes both have a checkmark in them the parameters that are listed below are optional parameters that can be configured here as default if the visible option is checked beside them that parameter will also be editable when printing the report as we quickly go through these options the first one is minimum out this option is used to filter which suppliers will be included by default when running the contract payment form, so you can set your parameters here at all put mine at 1500 when I'm running my report will show suppliers only that I have 1500 or higher outstanding the next parameter is your state identification number, so you would put in a state identification number if applicable the next four parameters are used for printing the reports since this report must be printed on a pre-established government from the alignment is important the margin parameters are designed to allow you to line up the printing to the form it is important that the top and the bottom margin and left and right margins equal a half-inch when making your margin adjustments the...

Fill t5018 pdf : Try Risk Free

People Also Ask about t5018 form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your t5018 form 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.