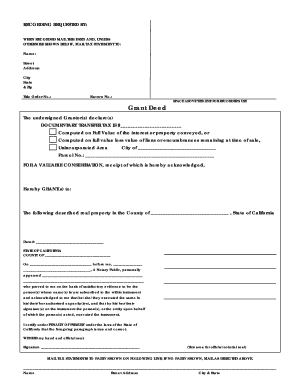

Who Needs Grant Deed?

The sale of the property is often associated with much paperwork. Grant deed is a document commonly used by a granter that is a seller of the property and a grantee, a buyer of the property. A granter is also a person who transfers an interest of the property to the buyer.

What is Grant Deed for?

With a grant deed a person selling the property guarantees that the property has not been sold to anyone else and that there are no mortgage debts or other kinds of burden except those already disclosed. It is not necessary that a grant deed be recorded. However, many prefer the grant deed to be notarized to make sure that the process of selling and buying property is legal.

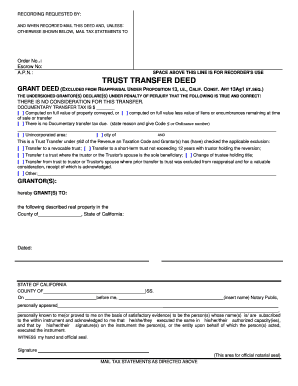

Is Grant Deed Accompanied by Other Forms?

The law about grant deed may differ from state to state. If you’re living in California you should be aware of the rules how to compose a deed. Grant deed should include the following elements to be valid:

- Granting clause, the clause that transfers title

- Description of the property that is being transferred

- Execution, delivery and acceptance statement. They must be signed by a granter specialized to handle issues of this kind

When is Grant Deed due ?

There is no specific due date for the grant deed. It depends on when the real estate is sold.

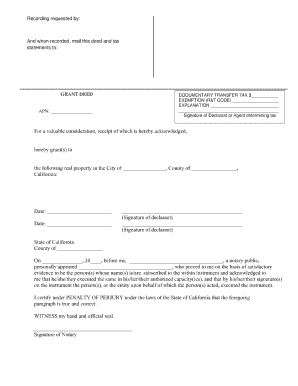

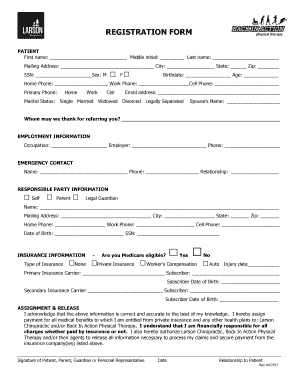

How Do I Fill out Grant Deed?

Grant deed is easy to fill out. It requires the following information:

- Documentary transfer tax

- City tax

- Granter signature and notary signature

Where Do I Send Grant Deed?

Make two copies of the deed and send the one to the buyer of the property. Keep the grant deed for your records.