Get the free Form N-301 Rev 2014 Application for Automatic Extension of Time ...

Show details

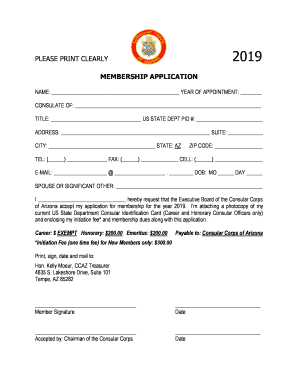

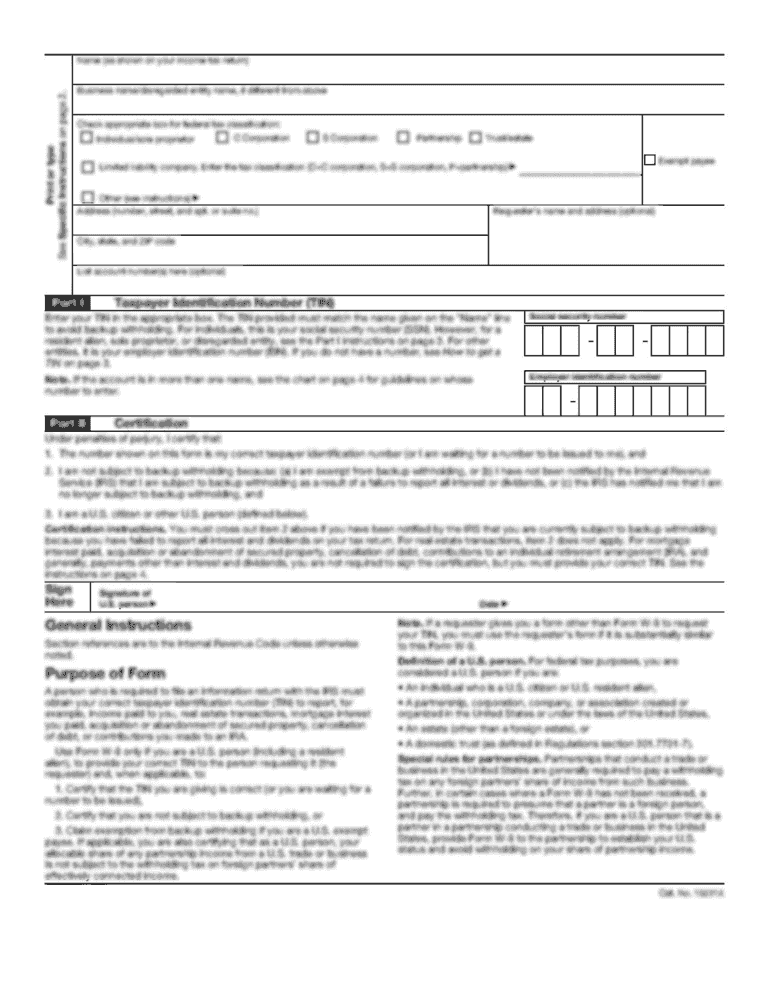

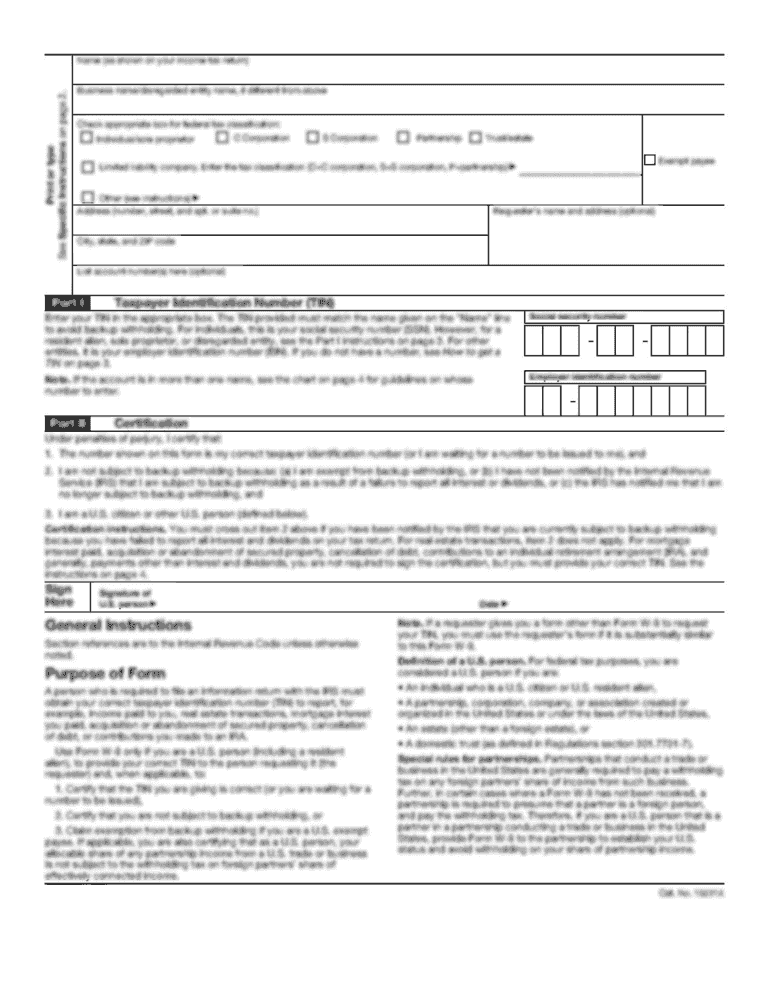

Write your FEIN and 2014 Form N-301 on your check or money order. Pay in U.S. dollars. Do not send cash. Write your FEIN and 2014 Form N-301 on it. Attach your check or money order to the front of Form N-301. Write your Federal Employer Identification Number and 2014 Form N-301 on the check or money order. Pay in U.S. dollars drawn on U.S. bank. Clear Form FORM REV. 2014 STATE OF HAWAII DEPARTMENT OF TAXATION N-301 APPLICATION FOR AUTOMATIC EXTE...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form n-301 rev 2014 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form n-301 rev 2014 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form n-301 rev 2014 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form n-301 rev 2014. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form n-301 rev application?

Form N-301 Rev Application is a form used to request a reduction in penalty fees for late filing or failure to file the required report on time.

Who is required to file form n-301 rev application?

Any individual or entity who wishes to request a reduction in penalties for late filing or failure to file the required report on time may be required to file Form N-301 Rev Application.

How to fill out form n-301 rev application?

To fill out Form N-301 Rev Application, you will need to provide information about the late or missed filing, the reasons for the delay, and any supporting documentation that may be required. You should follow the instructions provided on the form carefully.

What is the purpose of form n-301 rev application?

The purpose of Form N-301 Rev Application is to request a reduction in penalty fees for late filing or failure to file the required report on time.

What information must be reported on form n-301 rev application?

The information required on Form N-301 Rev Application may include details about the late or missed filing, the reasons for the delay, and any supporting documentation that may be necessary to support the request for a reduction in penalties.

When is the deadline to file form n-301 rev application in 2023?

The deadline to file Form N-301 Rev Application in 2023 will depend on the specific circumstances and requirements of the filing. It is recommended to file the form as soon as possible to avoid further penalties.

What is the penalty for the late filing of form n-301 rev application?

The penalty for late filing of Form N-301 Rev Application may vary depending on the specific circumstances and requirements. It is recommended to file the form as soon as possible to minimize any potential penalties.

How can I modify form n-301 rev 2014 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your form n-301 rev 2014 into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the form n-301 rev 2014 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your form n-301 rev 2014 in seconds.

Can I edit form n-301 rev 2014 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share form n-301 rev 2014 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your form n-301 rev 2014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.