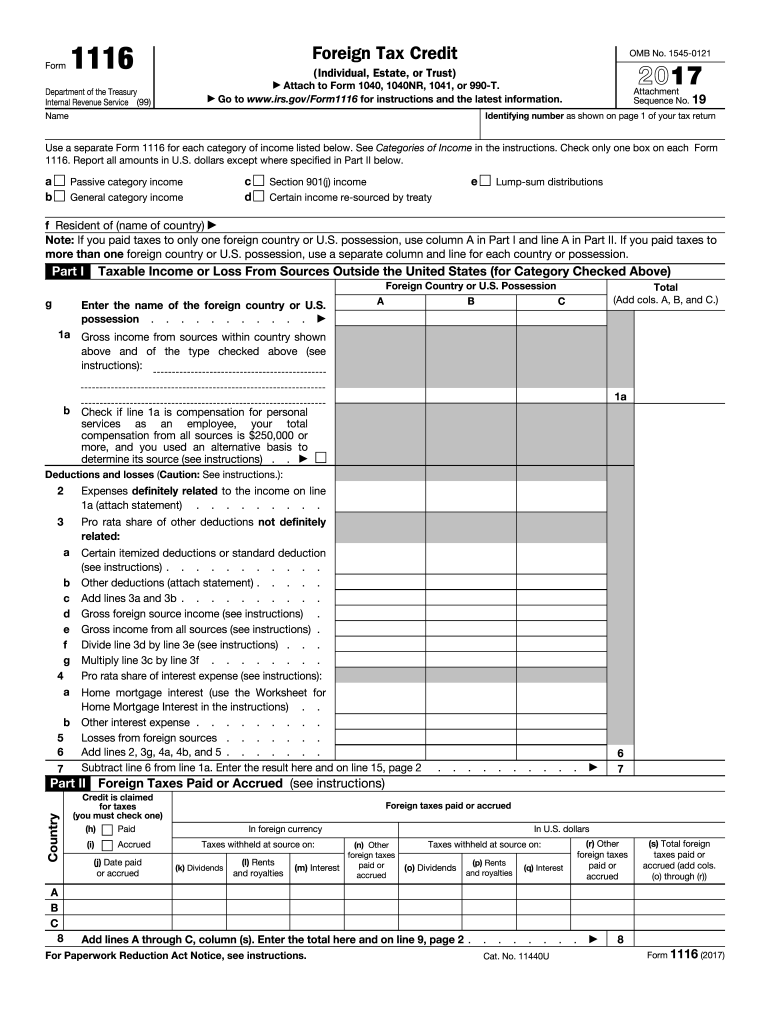

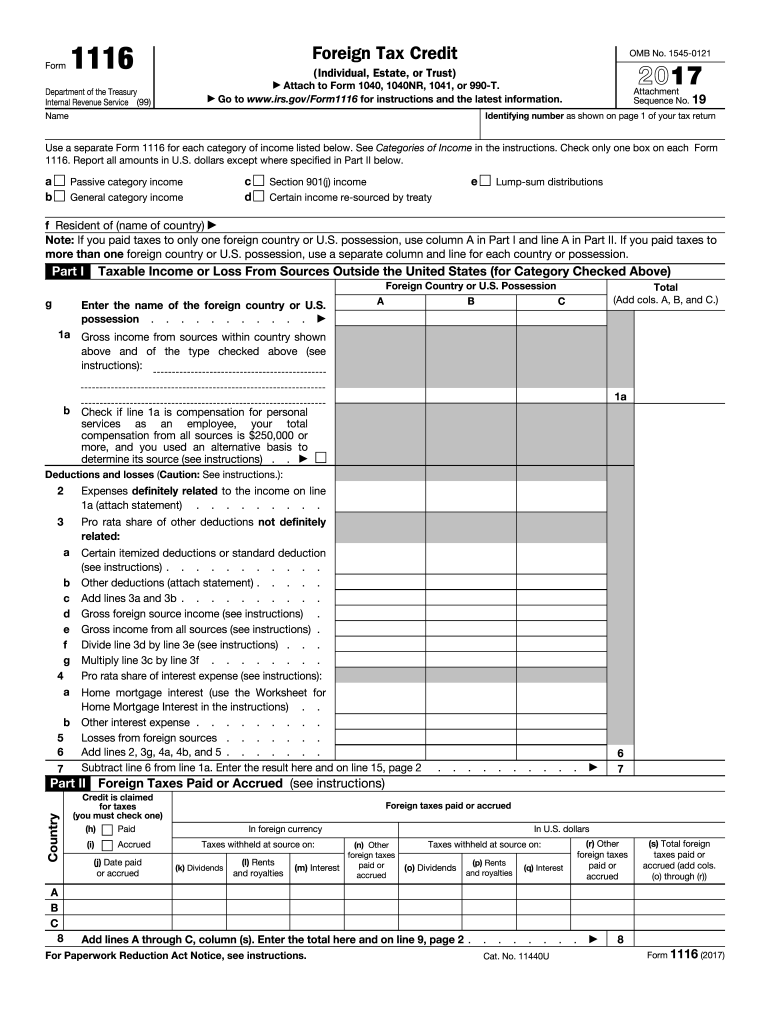

Category of Income Check Box Type of Income from interest, dividends, rents, royalties or other income Not to exceed the limits on Form 1040 and Form 1040NR Gross Income From Self-Employment and Other Sources Less Than 18,300 Unrelated Business Income Less Than 1,650 Unrelated Business Income 18,300 – 36,950 25% Tax on Qualified Charitable Donations of Over 5,000.00 Qualified Charitable Contributions of Over 5,000.00 to Individuals or Charitable Trusts Less Than 5,000.00 Gross Income From Interest, Dividends and Rents Not Over 250,000 Self-Employed Individuals and Others (Not To Exceed 9,525) 9,525 – 37,850 25% Tax on Unrelated Business Income 37,850 – 78,475 Unrelated Business Income 78,475 and over 37,850

(1) Unrelated Business Income includes interest, dividends, rents, royalties, annuities, trusts, and estates. Not related to any taxpayer's regular business activities.

(2) Gross income includes (1) self-employment income, (2) wages and salaries, (3) investment income, and (4) dividends from the sale of interests in corporations. Not related to a taxpayer's regular business activities.

(3) Qualified Charitable Contributions includes:

(i) Distributions from a qualified charitable organization,

(ii) Distributions received from a qualified hospital or health maintenance organization,

(iii) Distributions from a public or private elementary or secondary school, college, university or other educational institution, or

(iv) Contributions received from a veterans' or a domestic relations agency or from a nonprofit domestic relations service such as a family law agency.

(Back to Menu)

IRS Form 1116

(1) Use Form 1116T, Income Tax Return, Schedule A. See instructions at for more details.

(2) If you are filing a joint return, use Form 1116J to report the income of each spouse, and Form 1116K, if applicable, to report the income of your dependent children.

Get the free - irs

Show details

Form1116Foreign Tax Credit OMB No. 154501212017(Individual, Estate, or Trust)Attach to Form 1040, 1040NR, 1041, or 990T. Go to www.irs.gov/Form1116 for instructions and the latest information. Department

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Fill form : Try Risk Free

People Also Ask about irs

How do I get my IRS form?

What is IRS tax form?

What is IRS 1040 and W-2?

Is a 1040 the same as a w2?

Is a w9 an IRS form?

Is IRS Form 1040 the same as W-2?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs?

The IRS (Internal Revenue Service) is the federal agency responsible for tax collection and enforcement in the United States.

Who is required to file irs?

Individuals and businesses that have taxable income or meet other filing requirements are required to file with the IRS.

How to fill out irs?

You can fill out IRS forms either online, by mail, or through a tax professional. The specific forms you need to fill out will depend on your tax situation.

What is the purpose of irs?

The purpose of the IRS is to collect taxes to fund government operations and programs.

What information must be reported on irs?

Information such as income, deductions, credits, and other tax-related details must be reported on IRS forms.

When is the deadline to file irs in 2023?

The deadline to file IRS tax returns for the year 2023 is typically April 15th, unless it falls on a weekend or holiday.

What is the penalty for the late filing of irs?

The penalty for late filing of IRS returns is typically a percentage of the unpaid taxes due, with additional penalties for continued non-compliance.

How can I send irs to be eSigned by others?

When you're ready to share your irs, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit irs online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your irs to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in irs without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing irs and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Fill out your irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.