Get the free 2017 Estimated Payments Vouchers

Show details

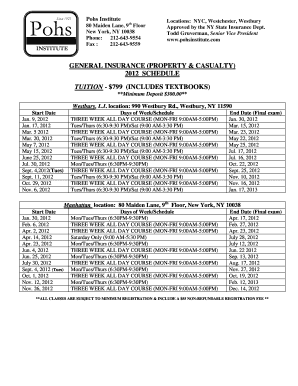

City of Albion Estimated Individual Income Tax Voucher AL1040ES General Information

WHO MUST FILE ESTIMATED TAX PAYMENTS

You must make estimated income tax payments throughout the year if you expect

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2017 estimated payments vouchers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2017 estimated payments vouchers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2017 estimated payments vouchers online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2017 estimated payments vouchers. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out 2017 estimated payments vouchers

How to fill out 2017 estimated payments vouchers:

01

Gather the necessary information: To fill out the 2017 estimated payments vouchers, you will need to gather your personal information, including your name, Social Security number, mailing address, and any other relevant details required by the tax authorities.

02

Calculate your estimated tax liability: Estimate your total tax liability for the year 2017. This can be done by taking into account your income, deductions, and credits. It is essential to accurately estimate this amount as it will determine how much you need to pay in estimated tax.

03

Determine the payment frequency: The 2017 estimated payments vouchers offer different payment options - quarterly or annual. Depending on your financial situation and preference, choose the frequency that best suits you.

04

Fill out the details on the voucher: Carefully fill out the required details on the 2017 estimated payments voucher. This may include your name, Social Security number, filing status, and address. Additionally, provide the estimated tax amount for the corresponding payment period.

05

Make a copy for your records: It is always recommended to keep a copy of the filled-out 2017 estimated payments voucher for your records. This will serve as a reference when you file your tax return for the year.

Who needs 2017 estimated payments vouchers:

01

Self-employed individuals: If you are self-employed, meaning you earn income through a business you operate yourself or as a freelancer, you will likely need to make estimated tax payments. This helps you stay current on your tax obligations and avoid penalties.

02

Individuals with substantial investment income: If you earn significant income from investments, such as interest, dividends, or capital gains, you may need to make estimated tax payments to cover your tax liability on this income.

03

Individuals with irregular income: If your income fluctuates throughout the year, making estimated tax payments can help ensure that you are making sufficient tax payments despite the irregularity.

04

Individuals with additional sources of income: If you have sources of income not subject to withholding, such as rental income or income from a side gig, you may need to make estimated tax payments to account for these earnings.

05

Those who expect to owe $1,000 or more in taxes: If you anticipate owing $1,000 or more in taxes for the year after considering your withholding and credits, you should consider making estimated tax payments to avoid penalties.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is estimated payments vouchers?

Estimated payments vouchers are payments made to the government on a periodic basis throughout the tax year to cover an individual's or business's tax liability.

Who is required to file estimated payments vouchers?

Individuals or businesses with income that is not subject to withholding, such as self-employed individuals or partnerships, are generally required to file estimated payments vouchers.

How to fill out estimated payments vouchers?

Estimated payments vouchers can be filled out manually or electronically, using the relevant tax forms provided by the government. The forms typically require information such as income earned, deductions, and tax credits.

What is the purpose of estimated payments vouchers?

The purpose of estimated payments vouchers is to ensure that individuals or businesses pay their estimated tax liability throughout the year, rather than in one lump sum at the end of the tax year.

What information must be reported on estimated payments vouchers?

Estimated payments vouchers typically require information such as income earned, deductions, tax credits, and the estimated tax liability for the tax year.

When is the deadline to file estimated payments vouchers in 2023?

The deadline to file estimated payments vouchers in 2023 is generally on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

What is the penalty for the late filing of estimated payments vouchers?

The penalty for the late filing of estimated payments vouchers is typically a percentage of the underpaid tax amount, calculated based on how long the payment is overdue.

How do I modify my 2017 estimated payments vouchers in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 2017 estimated payments vouchers and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send 2017 estimated payments vouchers to be eSigned by others?

Once your 2017 estimated payments vouchers is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in 2017 estimated payments vouchers?

The editing procedure is simple with pdfFiller. Open your 2017 estimated payments vouchers in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Fill out your 2017 estimated payments vouchers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.