Get the free Vendor Finance

Show details

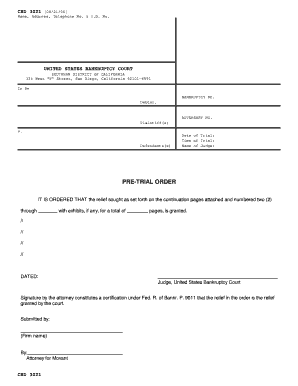

Vendor Finance Application This page is intentionally left blank. Vendor Finance Application APPLICANT(S) / 1ST BORROWER / : 2ND BORROWER / : COMPANY NAME / : PROPERTY ADDRESS / : PURCHASE PRICE /

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your vendor finance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vendor finance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vendor finance online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit vendor finance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out vendor finance

How to fill out vendor finance?

01

Research your options: Start by exploring various vendors and understanding the type of financing they offer. Look for vendors that specialize in your industry and have a good reputation in providing financing solutions.

02

Gather necessary documents: Before filling out the vendor finance application, gather all the required documentation. This may include financial statements, tax returns, bank statements, business licenses, and any other relevant documents that the vendor may request.

03

Know your financial situation: Understand your business's financial position before applying for vendor finance. This includes having a clear understanding of your cash flow, debt-to-equity ratio, and credit score. Vendors will assess your financial health to determine if you qualify for financing.

04

Fill out the application accurately: When filling out the vendor finance application, take the time to accurately provide all the necessary information. Double-check your entries to ensure there are no errors or omissions that may delay the approval process.

05

Provide supporting information: In addition to the application, vendors may require additional information to assess your creditworthiness. This may include personal and business tax returns, financial projections, or business plans. Be prepared to provide these documents in a timely manner.

06

Review the terms and conditions: Carefully review the terms and conditions of the vendor finance agreement. Pay attention to the interest rate, repayment schedule, any fees or penalties, and any other conditions associated with the financing. Seek clarification from the vendor if there are any terms that are unclear.

Who needs vendor finance?

01

Small businesses: Small businesses often require vendor finance to purchase equipment, inventory, or other essential assets. Vendor financing allows them to spread the cost over time, easing the strain on their cash flow.

02

Startups: Startups may face difficulties in obtaining traditional financing due to their limited business history. Vendor finance can be a viable alternative for startups, allowing them to acquire necessary resources to kick-start their operations.

03

Businesses with fluctuating cash flow: If your business experiences seasonal or cyclical fluctuations in cash flow, vendor finance can provide the flexibility to manage expenses during slower periods. It allows you to pay for assets or inventory as you generate income.

04

Businesses with limited credit history: Vendors who offer financing often have more lenient criteria compared to traditional lenders. This makes vendor finance a suitable option for businesses with limited credit history or those rebuilding their credit.

05

Businesses in need of quick financing: Vendor finance can provide a faster alternative to traditional financing options. The application process is typically streamlined, and approval can be obtained more quickly, allowing businesses to seize opportunities or address urgent needs.

Overall, vendor finance can be beneficial for small businesses, startups, businesses with fluctuating cash flow, those with limited credit history, and those in need of quick financing solutions.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is vendor finance?

Vendor finance is a form of financing in which the vendor of a product or service provides credit to the customer.

Who is required to file vendor finance?

Any business or individual that offers vendor financing to customers is required to file vendor finance.

How to fill out vendor finance?

Vendor finance can be filled out by providing details of the vendor financing arrangement, such as the amount financed, terms of repayment, and interest rates.

What is the purpose of vendor finance?

The purpose of vendor finance is to help customers who may not have access to traditional financing options to purchase goods or services.

What information must be reported on vendor finance?

Information such as the names of the vendor and customer, amount financed, repayment terms, and interest rates must be reported on vendor finance.

When is the deadline to file vendor finance in 2023?

The deadline to file vendor finance in 2023 is usually by the end of the fiscal year or as required by the relevant tax authorities.

What is the penalty for the late filing of vendor finance?

The penalty for the late filing of vendor finance may vary depending on the jurisdiction, but it could result in fines or other consequences.

How do I make changes in vendor finance?

With pdfFiller, the editing process is straightforward. Open your vendor finance in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I make edits in vendor finance without leaving Chrome?

vendor finance can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I edit vendor finance on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign vendor finance on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your vendor finance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.