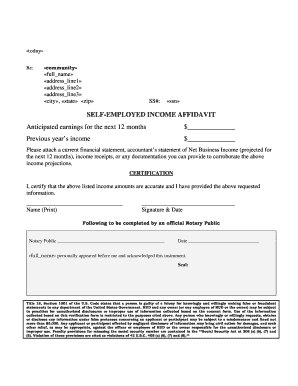

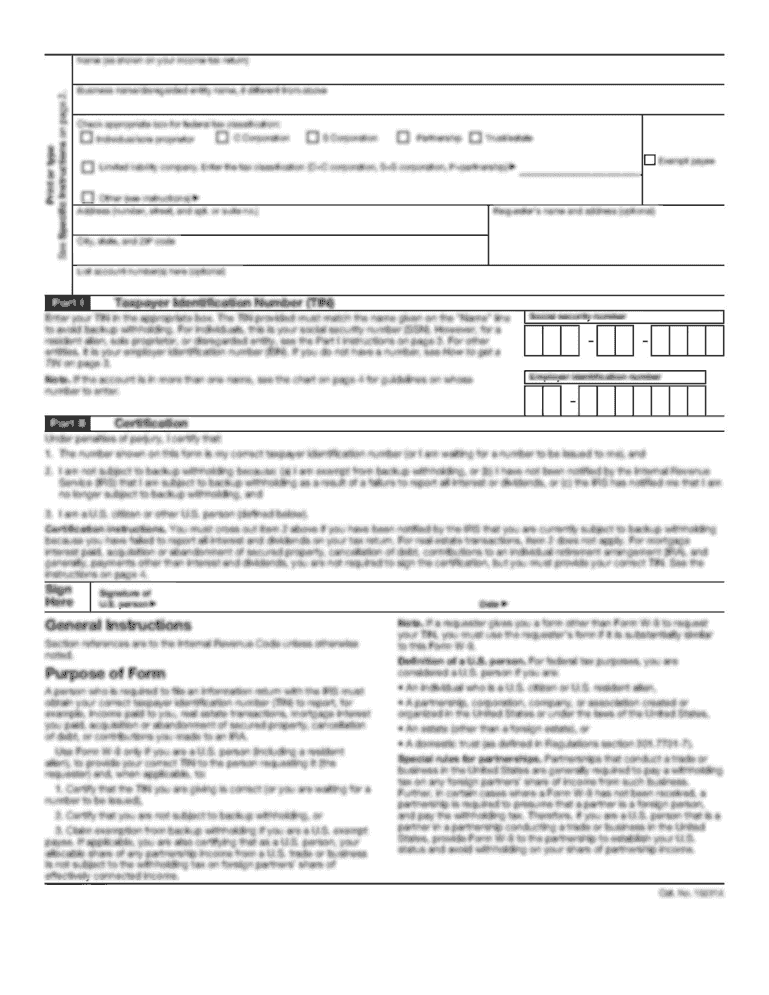

OR OHCS Self-Employment Income Verification 2017-2024 free printable template

Show details

Reemployment Income Verification

Applicant/Tenant Name:Unit #:Property Name:

This form is to be completed by the Applicant/TenantAnswer all the following:

YES NO

I am self-employed.

I am an independent

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your self employment income verification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self employment income verification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self employment income verification online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit self employment income verification form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

How to fill out self employment income verification

how to fill out self employment income verification?

01

Gather all necessary documents such as bank statements, invoices, and tax returns that demonstrate your self-employment income.

02

Fill out the required personal information section with your name, address, Social Security number, and contact information.

03

Provide details about your self-employment, including the nature of your work, the duration of your self-employment, and any relevant clients or projects.

04

accurately enter your income information, including gross earnings and any business expenses that may be deductible.

05

Attach supporting documentation, such as profit and loss statements or proof of expenses, to further verify your self-employment income.

Who needs self employment income verification?

01

Self-employed individuals who are applying for a loan or mortgage may need to provide income verification to lenders.

02

Freelancers and contractors may need to prove their income when applying for rental agreements or leases.

03

Individuals who are self-employed and applying for government assistance or benefits may also need to provide income verification.

Fill form : Try Risk Free

People Also Ask about self employment income verification

What is proof that you are self-employed?

What is the self-employed income and expenses form?

How do I write an income verification letter for self-employed?

What form does a self-employed person file for expenses and income?

What is self-employed employment verification?

How do I verify self-employed income?

How do I verify employment if self-employed?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

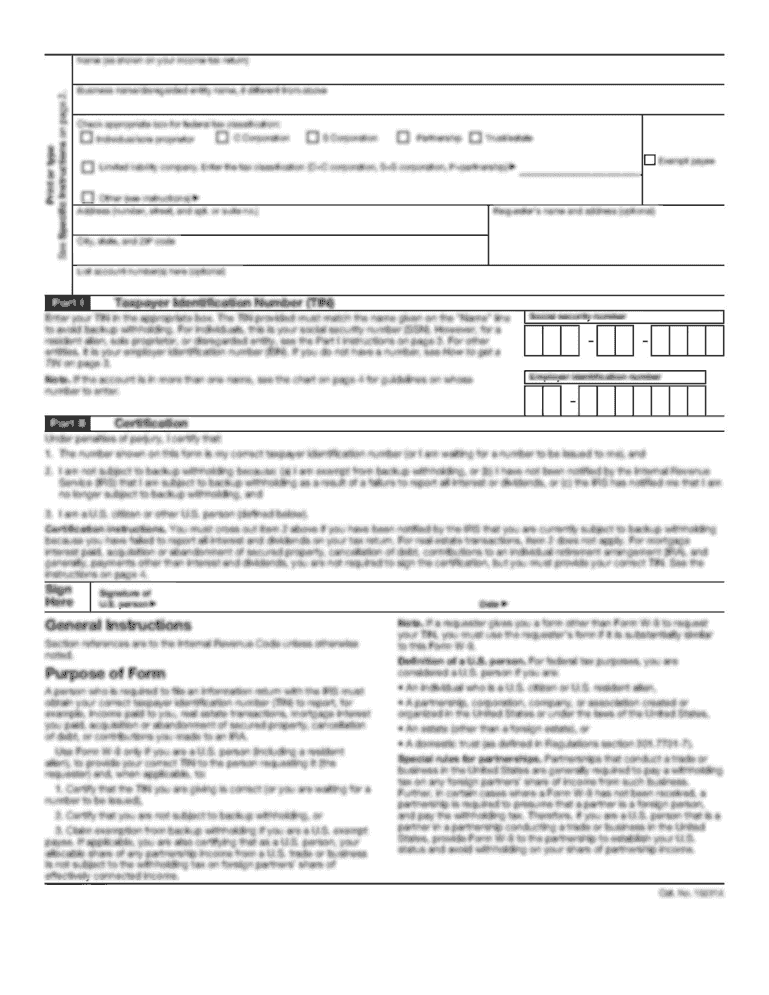

What is self employment income verification?

Self-employment income verification refers to the process of confirming and verifying the income of individuals who are self-employed. Since self-employed individuals do not have traditional pay stubs or employer-provided documentation, they are required to provide evidence of their income through various means.

This verification process often involves submitting financial documents such as tax returns, profit and loss statements, bank statements, and invoices. Lenders, creditors, or other entities may request this verification to assess the individual's ability to repay loans, determine eligibility for financial assistance programs, issue mortgages, or for other purposes.

The purpose of self-employment income verification is to ensure the accuracy and legitimacy of declared income, as well as to establish the individual's financial stability and ability to meet their financial obligations.

Who is required to file self employment income verification?

Self-employed individuals who earn certain amounts of income are required to file self-employment income verification. The specific income threshold varies by country and tax regulations. In the United States, for example, individuals who have net self-employment income of $400 or more in a year are generally required to file self-employment income verification using Schedule C or Schedule C-EZ along with their federal tax return. It is always recommended to consult with a tax professional or the relevant tax authority in your country for accurate and up-to-date information regarding your specific situation.

How to fill out self employment income verification?

To fill out a self-employment income verification, follow these steps:

1. Gather relevant documents: Collect all the necessary documents to verify your self-employment income, such as invoices, bank statements, profit and loss statements, tax returns, and any other financial records.

2. Provide personal information: Fill out personal information fields such as your full name, address, contact details, and Social Security number.

3. Indicate your business details: Include the name of your self-employed business, its location, and contact information.

4. Specify the time period: Indicate the specific time period for which you are verifying your income. This could be a particular year, quarter, or a specified period.

5. Calculate total income: Add up all your income during the specified time period, making sure to include income from all sources, such as sales, services, and other business activities.

6. Deduct business expenses: Subtract any valid business expenses from your total income. These could include costs related to supplies, equipment, marketing, licenses, and office space.

7. Calculate net income: Determine your net income by deducting all business expenses from your total income. This represents your actual income after expenses.

8. Sign and date the form: Ensure you sign and date the self-employment income verification form to authenticate the information provided.

9. Attach supporting documents: Include any necessary supporting documentation, such as bank statements, invoices, or tax returns, to validate the income claimed.

10. Submit the form: Submit the completed form and accompanying documents to the party or organization that requires the self-employment income verification. This could be an employer, lender, landlord, or government agency.

Remember to keep copies of all the documents and forms for your records. Additionally, it may be helpful to consult with a tax professional or financial advisor for accurate and detailed income verification.

What is the purpose of self employment income verification?

The purpose of self-employment income verification is to ensure that individuals accurately report and verify their self-employment income for various purposes, such as tax filings, loan applications, or other financial transactions. This verification process helps confirm the legitimacy and accuracy of the reported income, protect against fraud or misleading information, and promote transparency and fairness in financial transactions.

What information must be reported on self employment income verification?

When reporting self-employment income verification, the following information must typically be included:

1. Business Name: Provide the name of your business or self-employment endeavor. If you operate under your own name, you can state that as well.

2. Business Address: Include the physical address where your business is located.

3. Type of Business: Describe the nature of your business or occupation. For example, state whether you are a freelancer, consultant, contractor, or operate a specific type of service or product-based business.

4. Business Start Date: Indicate when you started your self-employment or business activities.

5. Average Monthly Income: Report the average monthly income you earn from your self-employment. This amount might vary each month, so an average is generally sufficient.

6. Expenses: Detail the business-related expenses you incur. This can include equipment purchases, office space rental, utilities, advertising costs, and other costs associated with running your business.

7. Method of Payment: State how you receive payments for your services or products. This could be through direct bank transfer, check, cash, or other means.

8. Tax Returns: Provide copies of your filed tax returns for the previous year(s) as proof of your self-employment income. This helps to establish the consistency and legitimacy of your earnings.

9. Bank Statements: Submit copies of your business bank statements, which show your self-employment income deposits. This further verifies the income and financial stability of your business.

Remember that the exact requirements for self-employment income verification can vary depending on the specific institution or entity requesting it. Be sure to review their guidelines or consult with a professional if you are unsure about the required documentation.

What is the penalty for the late filing of self employment income verification?

The penalty for late filing of self-employment income verification can vary depending on the country and specific regulations. In the United States, for example, the penalty for late filing of self-employment income verification (Form 1099) can range from $30 to $100 per form, depending on how late the filing is and the size of the business. Additionally, interest may be charged on any taxes owed. It is important to consult with a tax professional or refer to the specific tax regulations in your country for accurate and up-to-date information on penalties for late filings.

How do I edit self employment income verification in Chrome?

self employment income verification form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for signing my oregon self employment income in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your oregon self employment verification right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit signed affidavit verifying self employment oregon on an iOS device?

Create, modify, and share signed affidavit verifying self employment oregon form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your self employment income verification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oregon Self Employment Income is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.