Get the free check register 1-20-2017

Show details

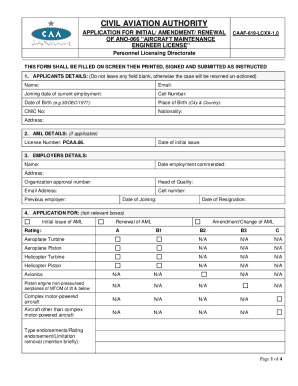

1/26/2017 VENDOR SET: BANK: DATE RANGE: 4:01 PM 99 Town of Hollywood Park * ALL BANKS 1/19/2017 Through 1/20/2017 VENDOR I.D. NAME CHECK STATUS VOID CHECK * * T O T A L S * * REGULAR CHECKS: HAND

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your check register 1-20-2017 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your check register 1-20-2017 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing check register 1-20-2017 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit check register 1-20-2017. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out check register 1-20-2017

How to fill out check register 1-20-2017:

01

Gather all the necessary information: Before you start filling out the check register for 1-20-2017, make sure you have all the relevant information at hand. This includes the checkbook, the date of the transaction, the check number, the payee's name, the purpose of the payment, and the amount spent or received.

02

Enter the date: Start by entering the date, which in this case would be 1-20-2017, at the top of the check register. This will help you keep track of the transactions that occurred on that specific day.

03

Record the check number: Write down the check number that corresponds to the transaction. Usually, check numbers are preprinted on the checks themselves, so it's just a matter of jotting it down in the register.

04

Note down the payee's name: Write down the name of the person or entity to whom the payment was made. Be specific and accurate in noting down the payee's name to avoid any confusion later on.

05

Specify the purpose of the payment: Briefly describe the purpose of the payment in the register. For example, if you paid for groceries, you can simply write "Groceries" or be more specific with "Groceries - ABC Supermarket."

06

Enter the amount spent or received: Record the amount spent or received in the appropriate column of the register. Be sure to write the amount accurately, including any cents or decimal points if applicable.

07

Calculate and update the balance: To keep track of your account balance, you need to perform the necessary calculations. Add or subtract the transaction amount from the previous balance, depending on whether it was a payment or receipt respectively. Then, update the balance column accordingly.

08

Repeat for other transactions: If there were multiple transactions on 1-20-2017, continue following the same process for each one. Repeat steps 3-7 until you've recorded all the relevant information for all the transactions that occurred on that day.

Who needs check register 1-20-2017?

01

Individuals with checking accounts: Anyone who has a checking account and engages in financial transactions during the day of 1-20-2017 would require a check register for that specific date. This ensures accurate and organized recording of their transactions.

02

Small business owners: Small business owners who use checks as a payment method will need a check register for 1-20-2017. It allows them to keep track of their expenses, reconcile their accounts, and have a clear overview of their financial activities on that given day.

03

Accountants or bookkeepers: Professionals responsible for managing the financial records of individuals or businesses may need a check register for 1-20-2017. They use it as a reference to track and update the financial information accurately in the accounting systems.

In summary, anyone who had financial transactions on the day of 1-20-2017, including individuals with checking accounts, small business owners, and accountants/bookkeepers, would need a check register to ensure accurate recording and tracking of their transactions.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is check register 1-20?

Check register 1-20 is a financial document used to record and track payments made by check within a specific time period, typically numbered from 1 to 20.

Who is required to file check register 1-20?

Any individual or organization that issues checks for payments within the designated time frame is required to fill out and maintain a check register 1-20.

How to fill out check register 1-20?

To fill out check register 1-20, one must record the check number, date issued, payee name, amount, and purpose of payment for each transaction made by check.

What is the purpose of check register 1-20?

The purpose of check register 1-20 is to provide a detailed record of all check payments made within a specified period for accounting and tracking purposes.

What information must be reported on check register 1-20?

The information that must be reported on check register 1-20 includes the check number, date issued, payee name, amount, and purpose of payment for each transaction.

When is the deadline to file check register 1-20 in 2023?

The deadline to file check register 1-20 in 2023 is typically determined by the specific accounting policies of the individual or organization, but it is usually within a few days after the end of the designated time frame.

What is the penalty for the late filing of check register 1-20?

The penalty for the late filing of check register 1-20 may vary depending on the specific circumstances, but it could result in administrative fines or other repercussions set forth by relevant financial authorities.

Where do I find check register 1-20-2017?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the check register 1-20-2017 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an eSignature for the check register 1-20-2017 in Gmail?

Create your eSignature using pdfFiller and then eSign your check register 1-20-2017 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit check register 1-20-2017 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit check register 1-20-2017.

Fill out your check register 1-20-2017 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.