Get the free Journal of Accountancy

Show details

Journal of Accountancy

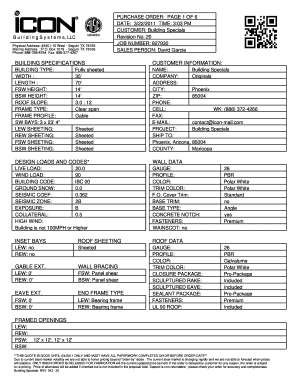

Filing season quick guide tax year 2016

Single taxpayers

If taxable

income is

over

$0But not

over

$9,275Heads of household

Tax ISAF the

amount

overPlus10%If taxable

income is

over$$00But

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your journal of accountancy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your journal of accountancy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing journal of accountancy online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit journal of accountancy. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out journal of accountancy

How to fill out a journal of accountancy:

01

Begin by gathering all relevant financial documents, such as receipts, invoices, and bank statements.

02

Determine the appropriate categories for your journal entries, such as expenses, revenue, assets, liabilities, and equity.

03

Start with the date of the transaction and provide a brief description in the "Account" column.

04

Record the specific accounts affected by the transaction in the corresponding debit or credit columns.

05

Calculate the dollar amounts for each entry and enter them in the appropriate columns.

06

Use parentheses or brackets to indicate negative values for credits or debits, respectively.

07

Remember to balance each entry by ensuring that the total debits equal the total credits.

08

Consider using accounting software or spreadsheet templates to facilitate the journaling process and simplify calculations.

09

Regularly review and reconcile your journal entries to ensure accuracy and identify any discrepancies.

10

Preserve the journal of accountancy as a permanent record for auditing and financial analysis purposes.

Who needs a journal of accountancy?

01

Small businesses: A journal of accountancy helps small business owners track and analyze their financial transactions, ensuring accurate record-keeping and facilitating tax compliance.

02

Accountants: Professionals in the accounting field rely on journals of accountancy to document and analyze financial data for their clients or employers.

03

Auditors: Auditors review journal entries to assess the accuracy and integrity of financial information, providing assurance to stakeholders and investors.

04

Financial analysts: Analysts utilize journals of accountancy to analyze financial trends, identify areas of improvement, and make sound business decisions.

05

Tax authorities: Tax officials may examine journals of accountancy to ensure proper tax reporting and identify any potential tax evasion or fraud.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is journal of accountancy?

Journal of Accountancy is a publication for finance professionals, covering topics such as accounting, auditing, financial reporting, and taxation.

Who is required to file journal of accountancy?

Finance professionals, accountants, auditors, and anyone involved in financial reporting may be required to file journal of accountancy.

How to fill out journal of accountancy?

To fill out journal of accountancy, you must record all financial transactions in chronological order using double-entry accounting principles.

What is the purpose of journal of accountancy?

The purpose of journal of accountancy is to provide a detailed record of financial transactions for an organization, which can be used for financial analysis, reporting, and decision-making.

What information must be reported on journal of accountancy?

Information such as date, description of the transaction, accounts affected, amount debited/credited, and reference number must be reported on journal of accountancy.

When is the deadline to file journal of accountancy in 2023?

The deadline to file journal of accountancy in 2023 may vary depending on the organization and regulations in place.

What is the penalty for the late filing of journal of accountancy?

The penalty for the late filing of journal of accountancy may include fines, interest charges, and potential legal consequences.

How can I get journal of accountancy?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific journal of accountancy and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I execute journal of accountancy online?

pdfFiller has made filling out and eSigning journal of accountancy easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make edits in journal of accountancy without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit journal of accountancy and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Fill out your journal of accountancy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.