Get the free 2018 TAX RATES

Show details

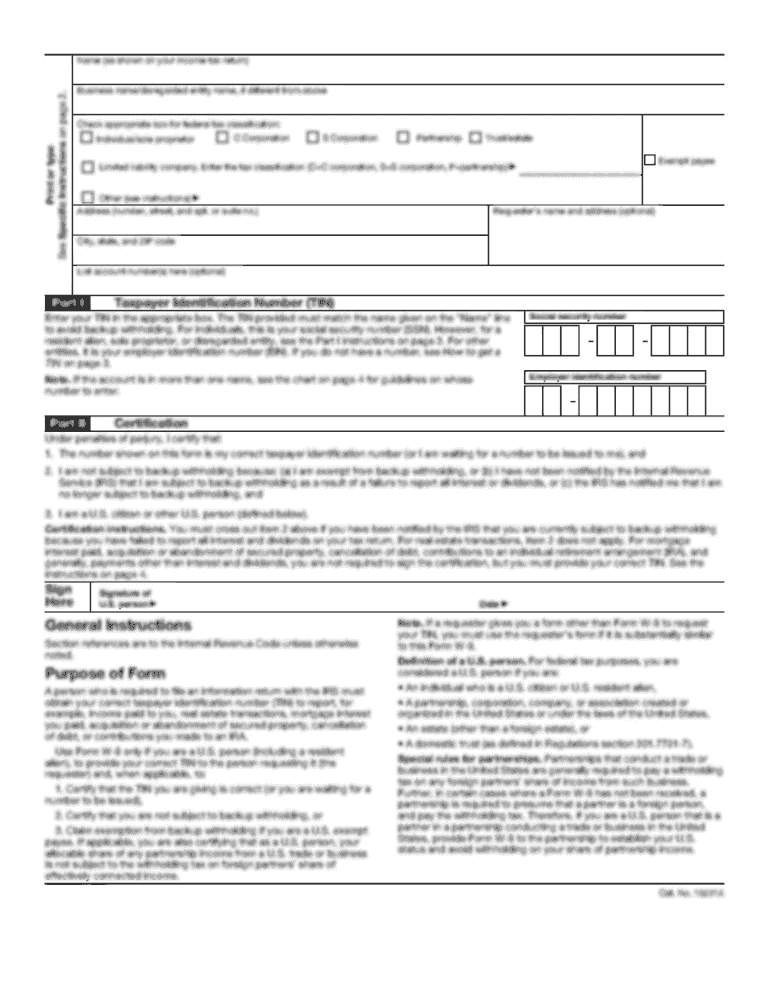

2018 TAX RATES

HighwayMunicipality

JANESVILLE

AUGUSTA

AVA

BONNEVILLE

BRIDGEWATER

CAMDEN

DEERFIELD

FLORENCE

FLOYD

FORESTRY

KIRKLAND

LEE

MARCY

MARSHALLCounty Rate

11.986629

11.052590

6.547840

10.646886

7.844683

287.091714

42.191683

39.488825

7.294667

6.957139

10.422638

204.797135

8.557869

10.254404Town

General

2.529554

3.116228

0.00

0.00

2.995437

27.535840

0.00

10.803421

0.00

0.00

3.374532

0.00

0.00

2.445733Townwide

6.238484

3.186967

0.320854

1.330285

3.523997

0.00

13.303282

7.596976

3.049244

0

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2018 tax rates form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2018 tax rates form via URL. You can also download, print, or export forms to your preferred cloud storage service.

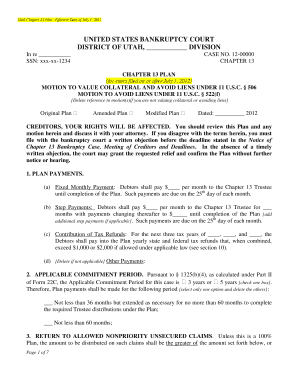

Editing 2018 tax rates online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2018 tax rates. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

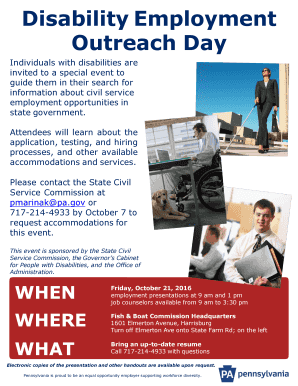

How to fill out 2018 tax rates

How to Fill Out 2018 Tax Rates:

01

Gather your financial documents: Collect all relevant documents such as W-2 forms, 1099 forms, receipts, and records of any deductions or credits you may be eligible for.

02

Understand the tax forms: Familiarize yourself with the different tax forms, including the 1040 form, which is the standard individual income tax return form. Read the instructions carefully to ensure you fill out each section correctly.

03

Input personal information: Enter your personal details, such as your name, Social Security number, and filing status, accurately in the appropriate sections of the tax form.

04

Report your income: Fill out the income section of the tax form, including wages, dividends, interest, and any other sources of income you have received during the tax year.

05

Apply deductions and credits: Deductions and credits can help reduce your taxable income and lower your tax liability. Determine which deductions and credits you qualify for and accurately enter them on the tax form.

06

Calculate your tax liability: Use the tax tables or tax software to determine your tax liability based on your income, deductions, and credits. Ensure all calculations are accurate.

07

Follow instructions for payment or refund: If you owe taxes, follow the instructions provided to make the payment. If you are due a refund, provide your banking information for a direct deposit or request a check to be mailed to you.

08

Review and double-check: Before submitting your tax return, review all the information you have entered to ensure accuracy. Double-check calculations, spellings, and any additional supporting documents.

Who needs 2018 tax rates:

01

Individuals: Any individual who earned income or is required to file a federal income tax return for the tax year 2018 would need to refer to the 2018 tax rates to determine their tax liability.

02

Small business owners: Small business owners who file their taxes as sole proprietors or use pass-through entities may need to refer to the 2018 tax rates for their personal income tax filings.

03

Investors: Investors who received dividends, interest income, or capital gains during the tax year 2018 would need to consider the applicable tax rates to report and pay taxes on their investment income.

04

Retirees: Retirees who have retirement account distributions, pension income, or other sources of income would need to consult the 2018 tax rates to accurately report and calculate their tax obligations.

05

Tax professionals: Tax professionals, including accountants, tax advisors, and tax preparation services, utilize the 2018 tax rates to assist their clients in accurately filing their tax returns.

It is crucial to consult the latest tax regulations and guidelines or seek professional advice to ensure compliance with the current tax laws and regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

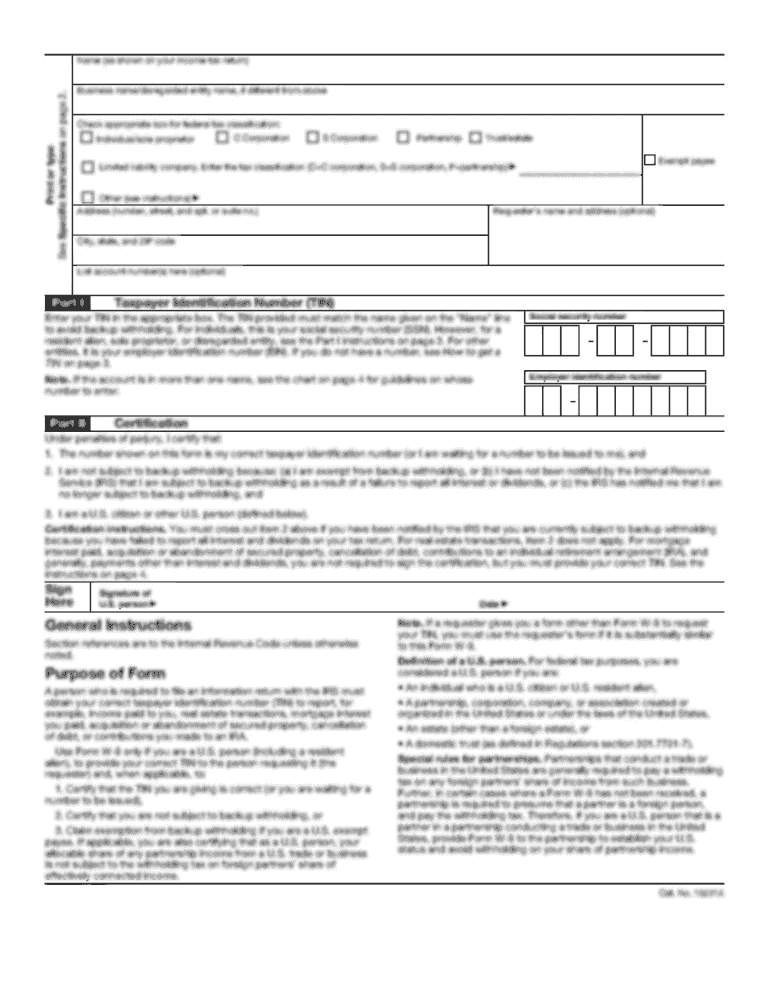

What is tax rates?

Tax rates refer to the percentage at which income or profits are taxed.

Who is required to file tax rates?

Individuals, businesses, and other entities that earn income or profits are required to file tax rates.

How to fill out tax rates?

Tax rates can be filled out by accurately reporting income, deductions, and credits on the appropriate tax forms.

What is the purpose of tax rates?

The purpose of tax rates is to generate revenue for the government to fund public services and programs.

What information must be reported on tax rates?

Income, deductions, credits, and other relevant financial information must be reported on tax rates.

When is the deadline to file tax rates in 2023?

The deadline to file tax rates in 2023 is usually April 15th, but it may be extended due to special circumstances.

What is the penalty for the late filing of tax rates?

The penalty for the late filing of tax rates is usually a percentage of the unpaid tax amount per month, up to a maximum limit.

How can I manage my 2018 tax rates directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your 2018 tax rates and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute 2018 tax rates online?

Completing and signing 2018 tax rates online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit 2018 tax rates straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing 2018 tax rates, you can start right away.

Fill out your 2018 tax rates online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.