Get the free Understanding Your Brokerage Account Statements

Show details

Understanding

Your Brokerage

Account StatementsUnderstanding Your Brokerage Account StatementsINTRODUCTION

How am I doing financially?

The best way to track your brokerage account activity and performance

is

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your understanding your brokerage account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding your brokerage account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing understanding your brokerage account online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit understanding your brokerage account. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out understanding your brokerage account

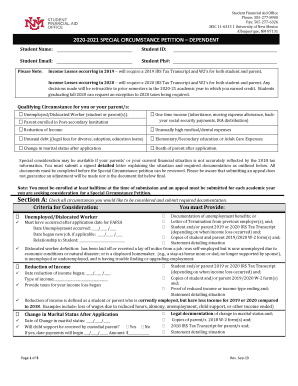

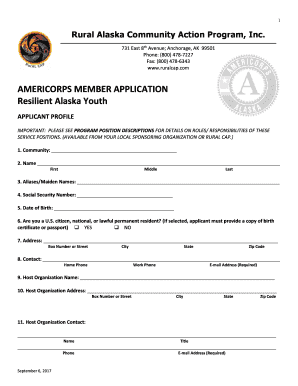

Understanding your brokerage account is essential for individuals who want to invest their money in the stock market or other financial assets. It provides necessary information on how to manage and track your investments effectively. Here's a step-by-step guide on how to fill out understanding your brokerage account:

01

Gather your personal details: Start by collecting all the required personal information needed to fill out the brokerage account application. This typically includes your full name, contact information, social security number, date of birth, and sometimes your employment details.

02

Choose the type of account: Decide whether you want an individual brokerage account or a joint account with a partner or family member. Understand the differences and benefits of each account type before making a decision.

03

Research different brokerage firms: Conduct thorough research on different brokerage firms to find one that offers the features and services that meet your investment goals. Consider factors such as trading fees, minimum deposit requirements, customer service, and investment options.

04

Fill out the application form: Once you have chosen a brokerage firm, fill out the application form accurately and provide all the required information. This may include your financial objectives, investment experience, risk tolerance, and any other relevant details the firm needs.

05

Provide identification documents: Depending on the brokerage firm and regulatory requirements, you may need to provide identification documents such as a copy of your passport or driver's license, proof of address, or other forms of identification.

06

Read and understand the terms and conditions: Carefully review the terms and conditions provided by the brokerage firm. Understand the fees, commissions, and any contractual obligations associated with managing your brokerage account.

07

Fund your account: Once your application is approved, you will need to fund your brokerage account. Follow the instructions provided by the firm to deposit funds electronically or through other accepted methods.

08

Learn about the account features: Take the time to understand all the features and tools available with your brokerage account. Explore the platform's interface, research tools, portfolio management options, and any other resources that can help you make informed investment decisions.

09

Seek professional advice if needed: If you are uncertain about any aspect of your brokerage account or investment strategies, consider seeking professional advice from a financial advisor. They can provide personalized guidance based on your financial circumstances and objectives.

In conclusion, understanding your brokerage account is crucial for anyone who wants to invest in the stock market or other financial assets. By following the step-by-step guide mentioned above, you can effectively fill out your brokerage account application and make informed investment decisions.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is understanding your brokerage account?

Understanding your brokerage account means having a clear comprehension of how your brokerage account works, including the different investment options available, the fees involved, and the risks associated with investing.

Who is required to file understanding your brokerage account?

Individuals who have a brokerage account are required to have an understanding of how it works and the investment products they have.

How to fill out understanding your brokerage account?

To fill out your brokerage account, you need to carefully review the documents provided by your broker, ask any questions you may have, and ensure you understand the terms and conditions before making any investment decisions.

What is the purpose of understanding your brokerage account?

The purpose of understanding your brokerage account is to make informed investment decisions, manage risks effectively, and ensure you are aware of the fees and charges associated with your account.

What information must be reported on understanding your brokerage account?

Information that must be reported on understanding your brokerage account includes the types of investments held, account balances, transaction history, and fees and expenses.

When is the deadline to file understanding your brokerage account in 2023?

The deadline to file understanding your brokerage account in 2023 is typically April 15th, unless an extension is granted.

What is the penalty for the late filing of understanding your brokerage account?

The penalty for late filing of understanding your brokerage account can vary, but may include fines, interest charges, and potential suspension of trading privileges.

How do I edit understanding your brokerage account in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing understanding your brokerage account and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit understanding your brokerage account on an Android device?

You can make any changes to PDF files, like understanding your brokerage account, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I fill out understanding your brokerage account on an Android device?

Complete your understanding your brokerage account and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your understanding your brokerage account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.