Get the free Withdrawal Payee Information - District of Minnesota - mnd uscourts

Show details

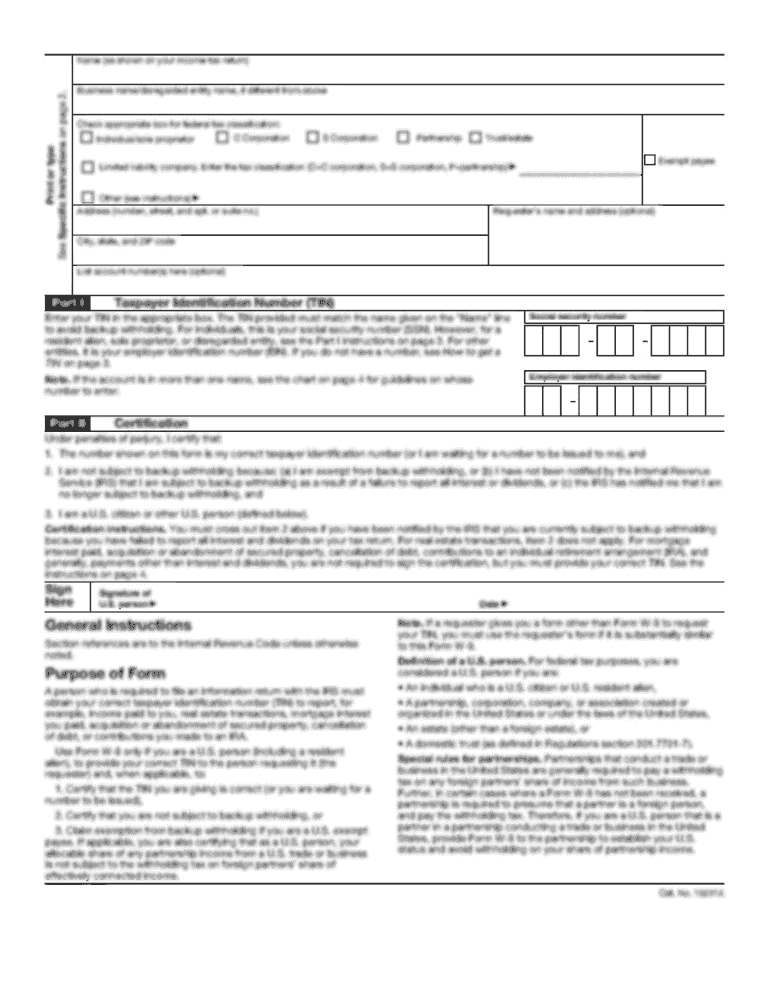

District of Minnesota. Withdrawal Payee Information. Attn: Finance Department. CONFIDENTIAL DOCUMENT. Do not file this form on the court×39’s electronic case ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your withdrawal payee information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your withdrawal payee information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing withdrawal payee information online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit withdrawal payee information. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out withdrawal payee information

01

To fill out withdrawal payee information, start by gathering the required personal details of the payee. This includes their full name, address, and contact information such as phone number or email address.

02

Next, ensure you have the relevant banking details of the payee. This typically includes the bank name, branch address, account number, and routing number. This information is necessary for the successful transfer of funds.

03

Double-check all the information you have gathered to ensure its accuracy. Mistakes in the payee's name, address, or banking details can lead to delays or failed transactions. It is crucial to be thorough and accurate to prevent any issues.

04

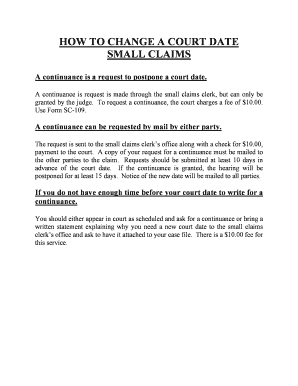

Once you have the necessary information, access the withdrawal payee form provided by the entity or institution from which you are making the withdrawal. This could be an online form or a physical document.

05

Fill in the required fields on the withdrawal payee form with the gathered payee information. Make sure to follow any specific instructions or guidelines provided.

06

Review the completed form carefully to ensure all the information is correctly entered. Verify that the payee's name, address, and banking details match what you have gathered during the earlier steps.

07

If possible, consider making a photocopy or saving a digital copy of the completed form for your records. This can serve as a reference in case any issues arise in the future.

08

Submit the filled-out withdrawal payee form as instructed by the entity or institution for processing. This could involve mailing the physical document or submitting the online form through a dedicated portal or website.

Who needs withdrawal payee information?

01

Individuals or organizations that are authorized to make withdrawals, such as employers, financial institutions, or service providers, may require withdrawal payee information.

02

Withdrawal payee information is necessary to ensure that funds are correctly allocated and transferred to the intended recipient. It also helps in maintaining accurate financial records and preventing fraudulent activities.

03

In some cases, government institutions or agencies may also request withdrawal payee information for taxation or social benefit payment purposes.

Remember to consult the specific requirements of the entity or institution initiating the withdrawal to determine who needs withdrawal payee information in your particular situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is withdrawal payee information?

Withdrawal payee information is the details about the recipient of a withdrawal, such as the individual or entity who receives the funds.

Who is required to file withdrawal payee information?

The entity making the withdrawal is typically required to file the payee information to ensure compliance with tax and reporting regulations.

How to fill out withdrawal payee information?

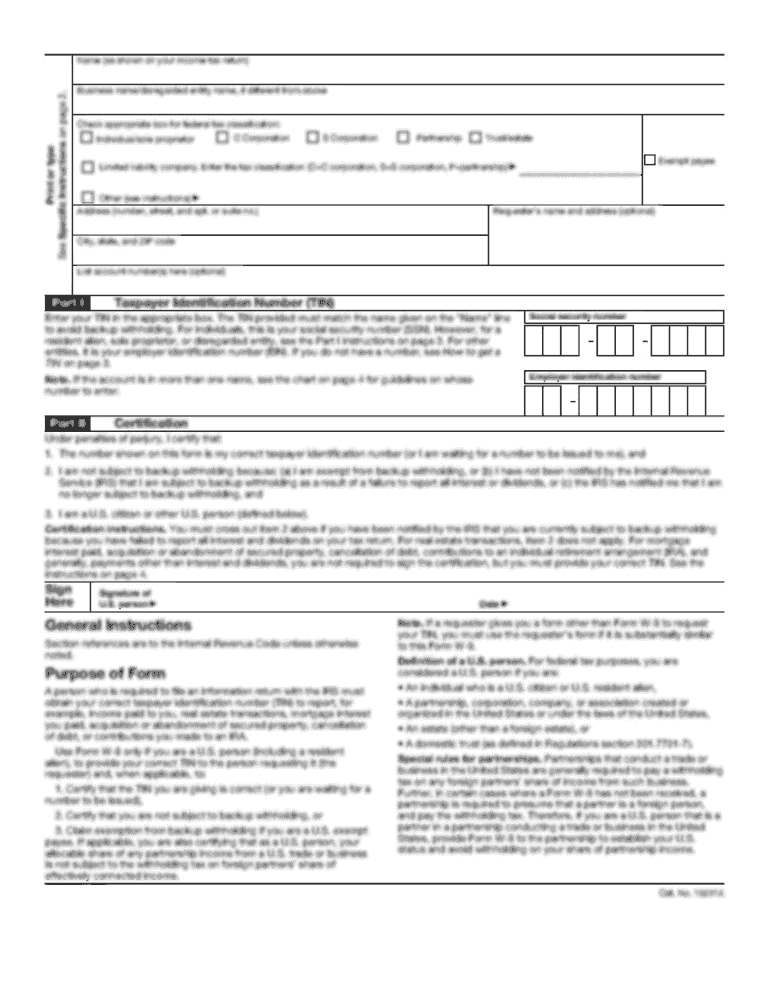

Withdrawal payee information can be filled out by providing the necessary details of the recipient, such as their name, address, and tax identification number. The specific process may vary based on the reporting requirements and regulations in place.

What is the purpose of withdrawal payee information?

The purpose of withdrawal payee information is to provide transparency and documentation of financial transactions, ensuring proper reporting for tax and regulatory purposes.

What information must be reported on withdrawal payee information?

The information reported on withdrawal payee information typically includes the recipient's name, address, tax identification number, and the amount of the withdrawal transaction.

When is the deadline to file withdrawal payee information in 2023?

The specific deadline to file withdrawal payee information in 2023 may vary based on the jurisdiction and reporting requirements. It is advisable to consult the relevant tax or regulatory authorities for the exact deadline.

What is the penalty for the late filing of withdrawal payee information?

The penalty for the late filing of withdrawal payee information can vary depending on the jurisdiction and the specific regulations in place. It is recommended to consult the relevant tax or regulatory authorities to determine the exact penalty for late filing.

How can I manage my withdrawal payee information directly from Gmail?

withdrawal payee information and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find withdrawal payee information?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the withdrawal payee information. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for the withdrawal payee information in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your withdrawal payee information.

Fill out your withdrawal payee information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.